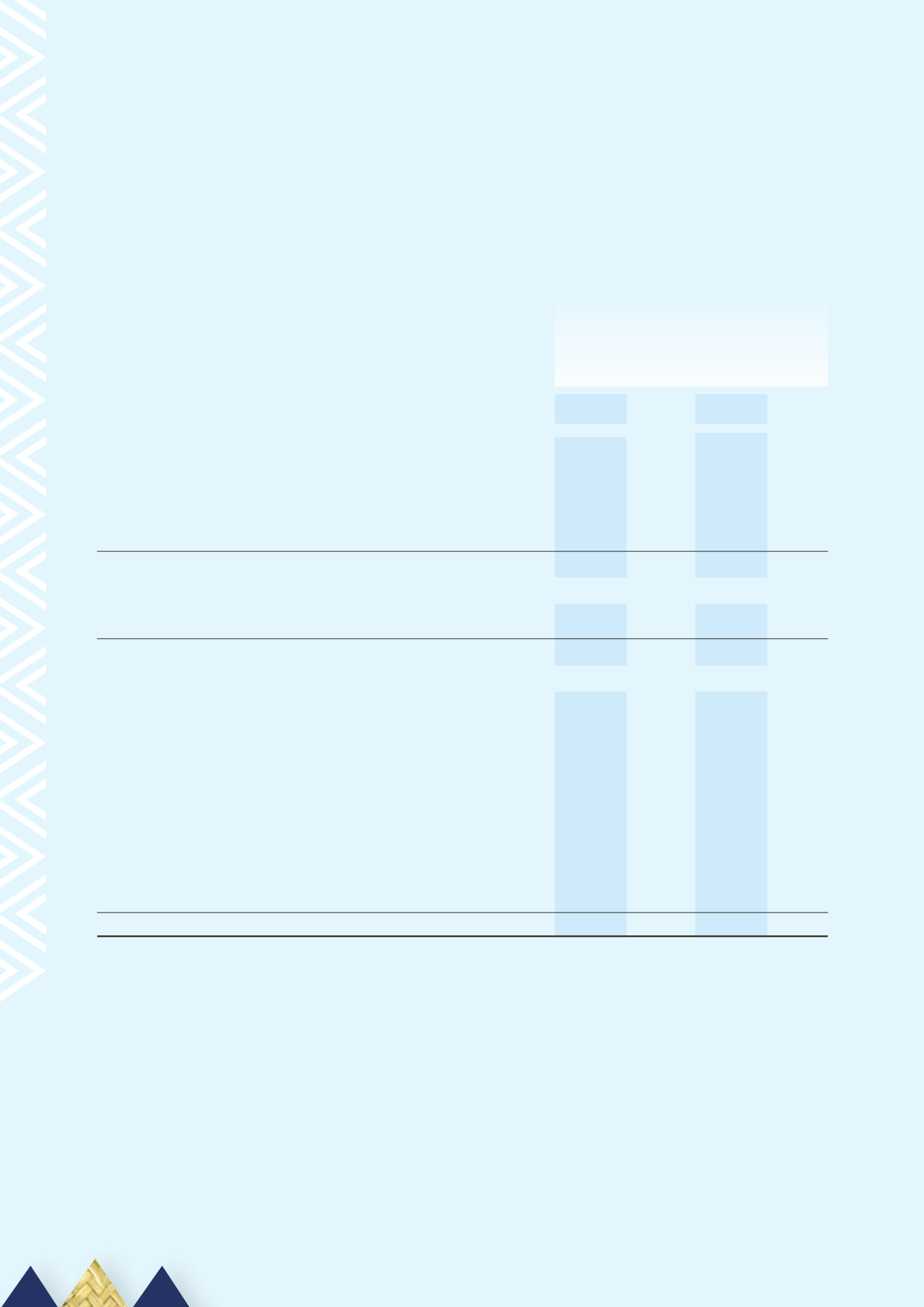

Te pŪrongo 2012

Statement of cash flows (continued)

For the year ended 31 December 2012

Reconciliation from the net surplus to the net cash flows from operating activities

Group Group Parent

Parent

2012 2011 2012

2011

$’000 $’000 $’000 $’000

Surplus/(deficit) from the statement of comprehensive income

7,947

7,286

9,091

8,456

Add/(less) non-cash items

Depreciation and amortisation expense

7,660

7,795

6,647

7,038

Found property, plant and equipment

(959)

-

(959)

-

Net (gain) on lease make good provision

195

-

117

-

Asset impairment

691

829

690

829

Total non-cash items

7,587

8,624

6,495

7,867

Add/(less) items classified as investing or financing activities

Net (gain) on disposal of property, plant and equipment

(98)

(279)

(86)

(291)

Total items classified as investing or financing activities

(98)

(279)

(86)

(291)

Add/(less) movements in working capital items

(Increase)/decrease in inventories

28

(202)

141

(82)

(Increase)/decrease in trade and other receivables

(555)

(1,672)

(512)

110

(Increase)/decrease in prepayments

-

88

(41)

153

(Increase)/decrease in interest accrued

(21)

(293)

50

(286)

Increase/(decrease) in trade and other payables

(198)

4,171 (1,671)

11

Increase/(decrease) in revenue received in advance

(172)

(598)

(172)

(571)

Increase/(decrease) in tauira fees

(53)

(196)

(111)

(196)

Increase/(decrease) in provision for employee entitlements

(490)

(37)

(544)

(105)

Net movement in working capital

(1,461)

1,261 (2,860)

(966)

Net cash flow from operating activities

13,975

16,892

12,640

15,066

The accompanying notes form part of these financial statements.

78