T R U S T W A I K A T O

A N N U A L R E P O R T 2 0 1 2 / 2 0 1 3

F I N A N C I A l S T A T E M E N T S

37

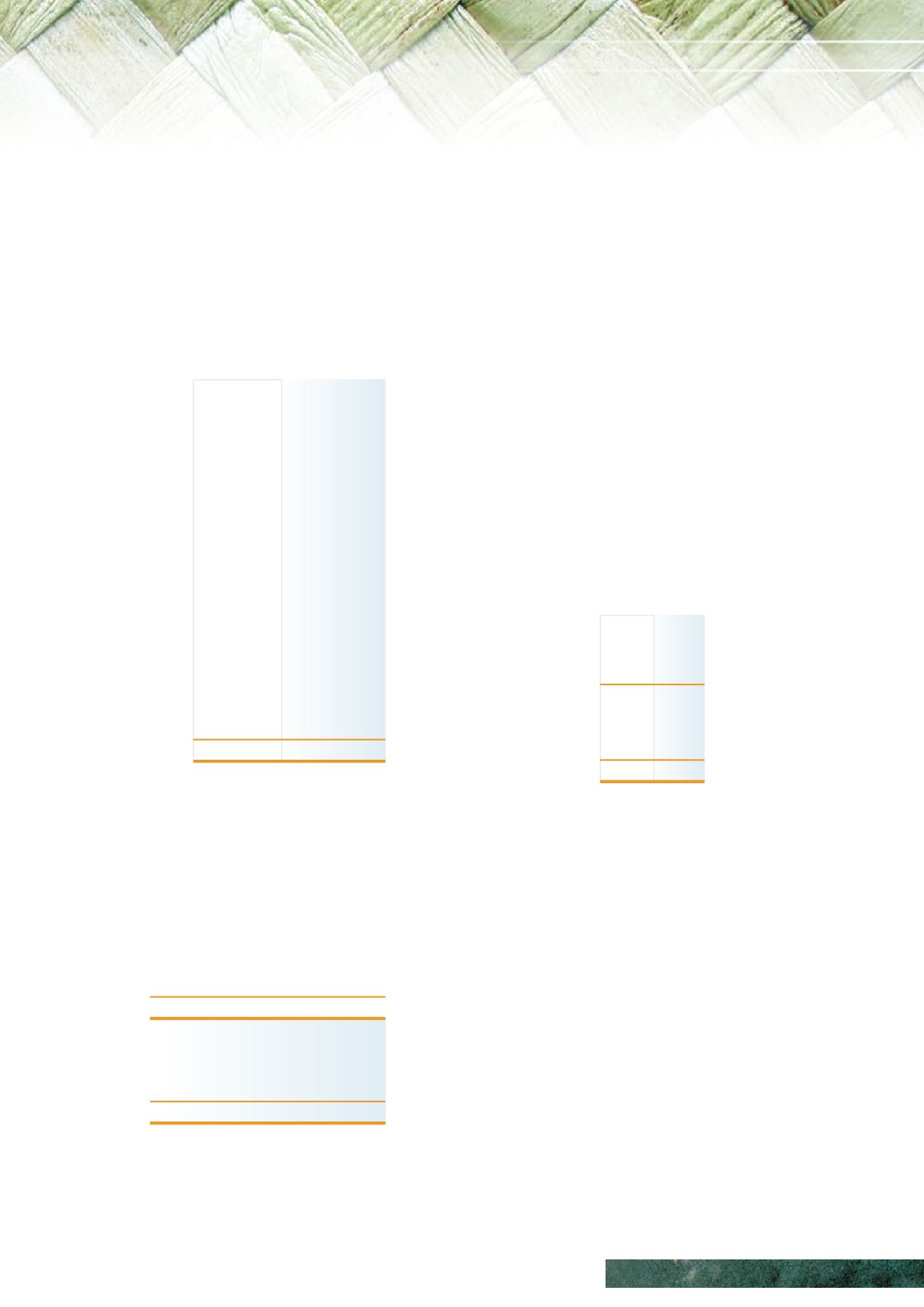

11 INVESTMENTS

The Trust uses the services of an investment

advisor to pursue an investment policy considered

appropriate for the Trust. The Trust selects fund

managers according to their style and specialist skills

including the ability to protect capital in negative

or down markets. In the year to 31 March 2013

the Trust confirmed the following strategic asset

allocations and investments at fair value.

2013

2013

2012

2012

Strategic NZ$’000

Strategic NZ$’000

Asset

Asset

Allocation

Allocation

%

%

Growth Assets

Global Equities

25 73,463

25 67,515

Australasian Equities

10 48,298

15 40,551

Private Equity

5

334

-

-

Unlisted Property

10 27,395

10 26,242

Infrastructure

10 22,371

10 20,417

Income Assets

New Zealand

Fixed Interest

10 26,972

10 25,882

Global Fixed Interest

25 68,505

25 64,287

New Zealand Cash

5 15,347

5 12,591

Investments at

Fair Value

100% 282,685

100% 257,485

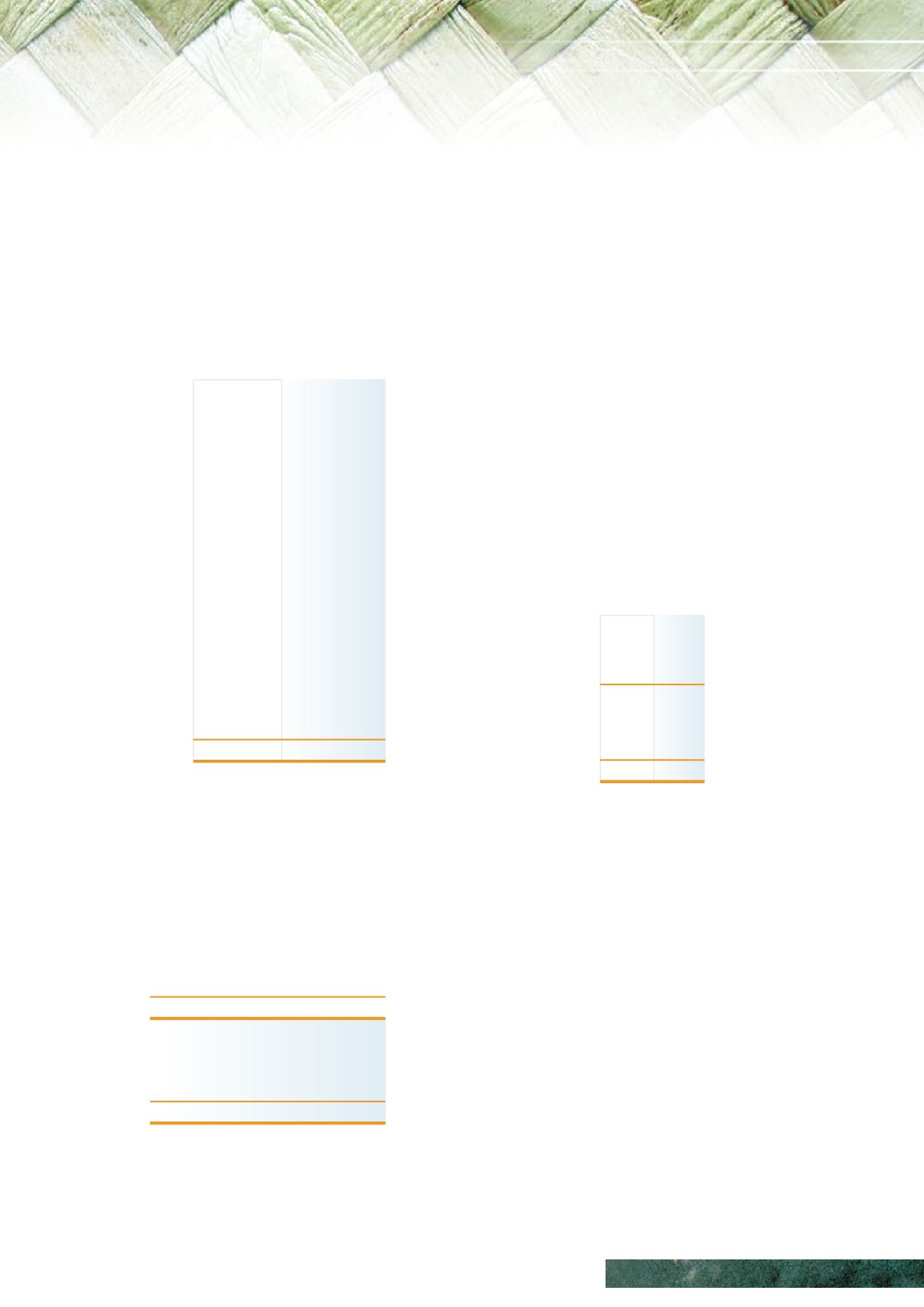

12 COMMITMENTS: INVESTMENTS

The Trust has made commitments to invest in certain

managed funds, which will call upon the committed

funds as the fund managers identify suitable

investment vehicles. These investments will be

funded by realising other investments currently held

by the Trust.

2013

Contribution Commitment Contribution

Commitment

to date

Balance within 1 year

NZ$’000

NZ$’000

NZ$’000

NZ$’000

Committed

Investments

23,000

2,925

20,075

450

2012

Contribution

Commitment

Contribution

Commitment

to date

Balance within 1 year

NZ$’000

NZ$’000

NZ$’000

NZ$’000

Committed

Investments 8,000

1,822

6,178

-

13 TE KETE PUTEA LIMITED

PARTNERSHIP (2012: DATABASE

LOAN)

The investment in Te Kete Putea Limited Partnership

(TKPLP) represents the Trust share of an integrated

donations and financial management system owned

collectively between 11 Community Trusts.

The Trust initially met its funding proportion for the

project by way of a loan to ASBCT, which agreed

to undertake the work on the project and incur the

project commitments. The Trust granted an indemnity

in favour of ASBCT in respect of such commitments.

This loan, shown in the Trust Balance Sheet as at

31 March 2012, was unsecured and interest free. On

the formation of TKPLP, the loan from the Trust was

extinguished by application by ASBCT towards the

Trust capital contribution to TKPLP. TKPLP acquired

the assets on 15 March 2013.

2013

2012

NZ$’000

NZ$’000

Total Comprehensive

Income for the year

23,963

6,808

Adjust for Non-Cash Items:

56

(31)

Impact of Changes in

Net Assets and Liabilities:

(23,938)

(6,193)

Net Cash Inflow

From Operating Activities

81

584

14 RECONCILIATION OF SURPLUS

FOR THE YEAR TO NET CASH

FLOWS FROM OPERATING

ACTIVITIES