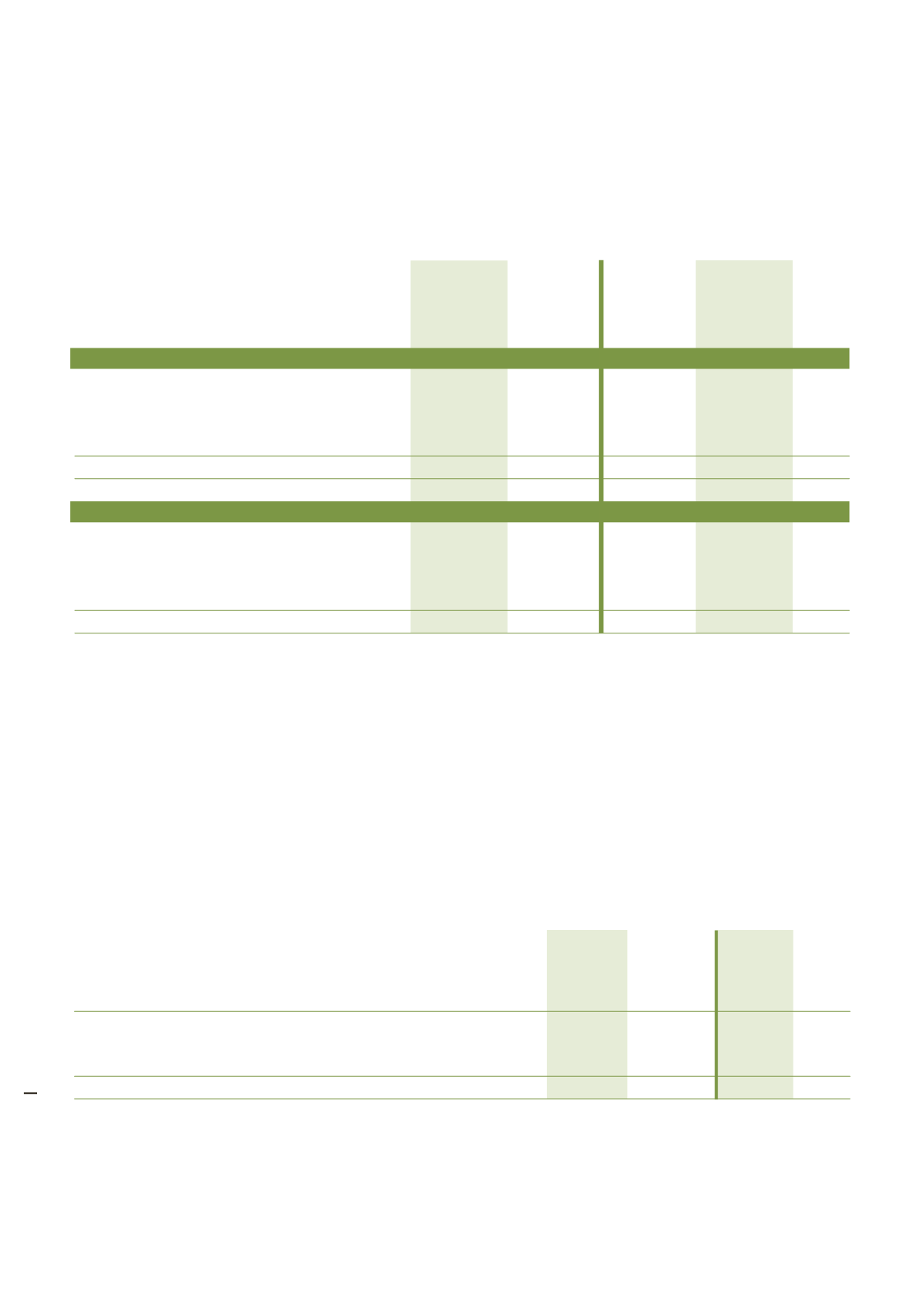

62 TE PŪRONGO 2013

2013

2012

Gross Impairment

Net

Gross Impairment

Net

$’000

$’000 $’000

$’000

$’000 $’000

Group

Not past due

1,551

-

1,551

2,499

-

2,499

Past due 1-60 days

444

-

444

229

-

229

Past due 61-120 days

269

-

269

110

-

110

Past due > 120 days

912

-

912

443

(33)

410

Total

3,176

-

3,176

3,281

(33)

3,248

Parent

Not past due

1,517

-

1,517

2,309

-

2,309

Past due 1-60 days

444

-

444

163

-

163

Past due 61-120 days

186

-

186

23

-

23

Past due > 120 days

912

-

912

476

(33)

443

Total

3,059

-

3,059

2,971

(33)

2,938

All receivables greater than 30 days in age are considered to be past due.

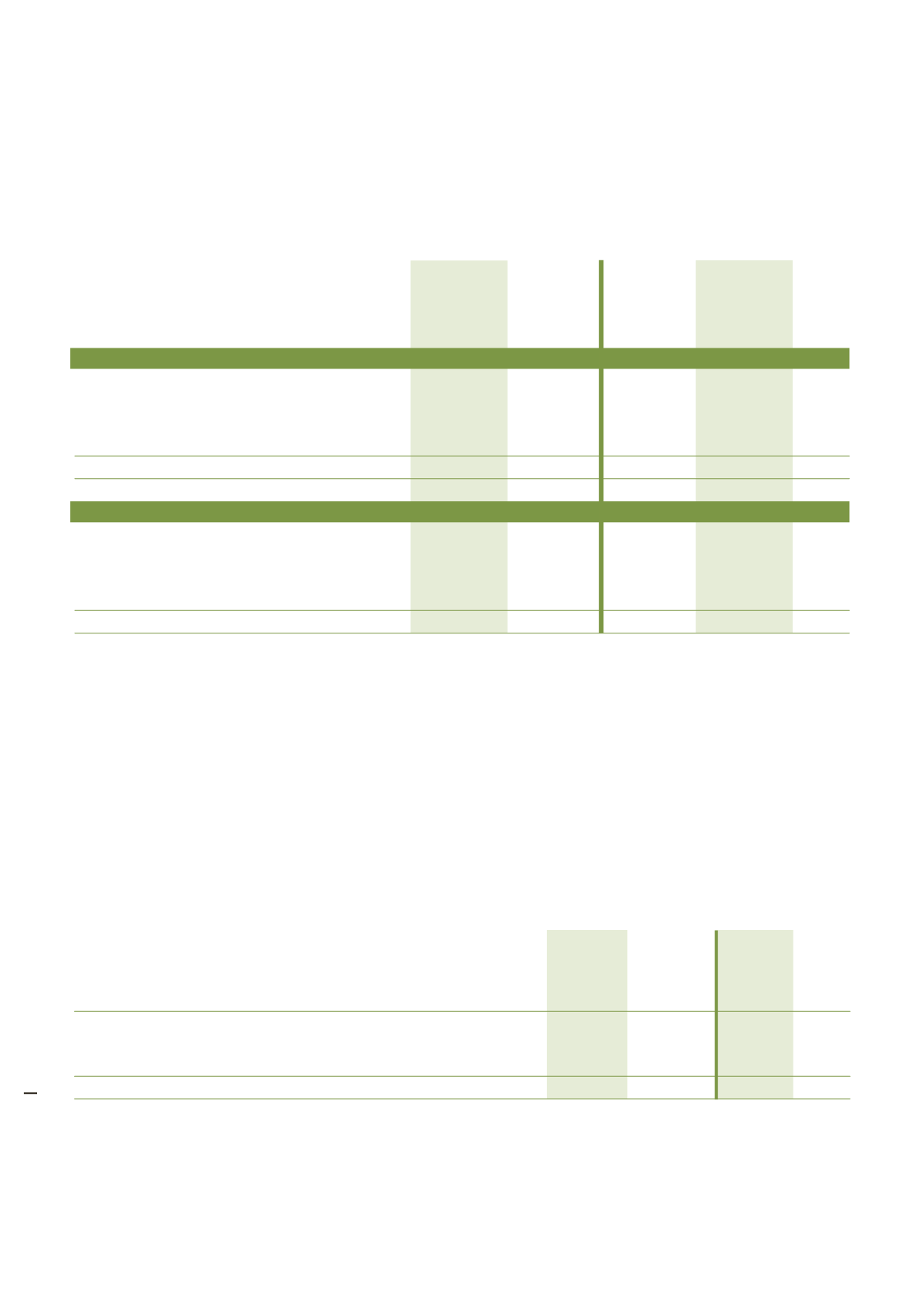

The impairment provision has been calculated based on expected losses for Te Wānanga o Aotearoa and the pool of

receivables. Expected losses have been determined based on an analysis of losses for Te Wānanga o Aotearoa in previous

periods and a review of specific receivables.

Other impaired receivables have been determined to be impaired because of the significant financial difficulties being

experienced by the debtor.

Movements in the provision for impairment of receivables are as follows:

Group

Group Parent

Parent

2013

2012

2013 2012

$’000

$’000

$’000 $’000

At 1 January

33

20

33

20

Additional provisions made during the year

95

169

95

169

Receivables written off during the period

(128)

(156)

(128)

(156)

At 31 December

-

33

-

33

6.Tauira and other receivables (continued)

Impairment

The ageing profile of receivables at year end is detailed below:

Notes to the financial statements (continued)