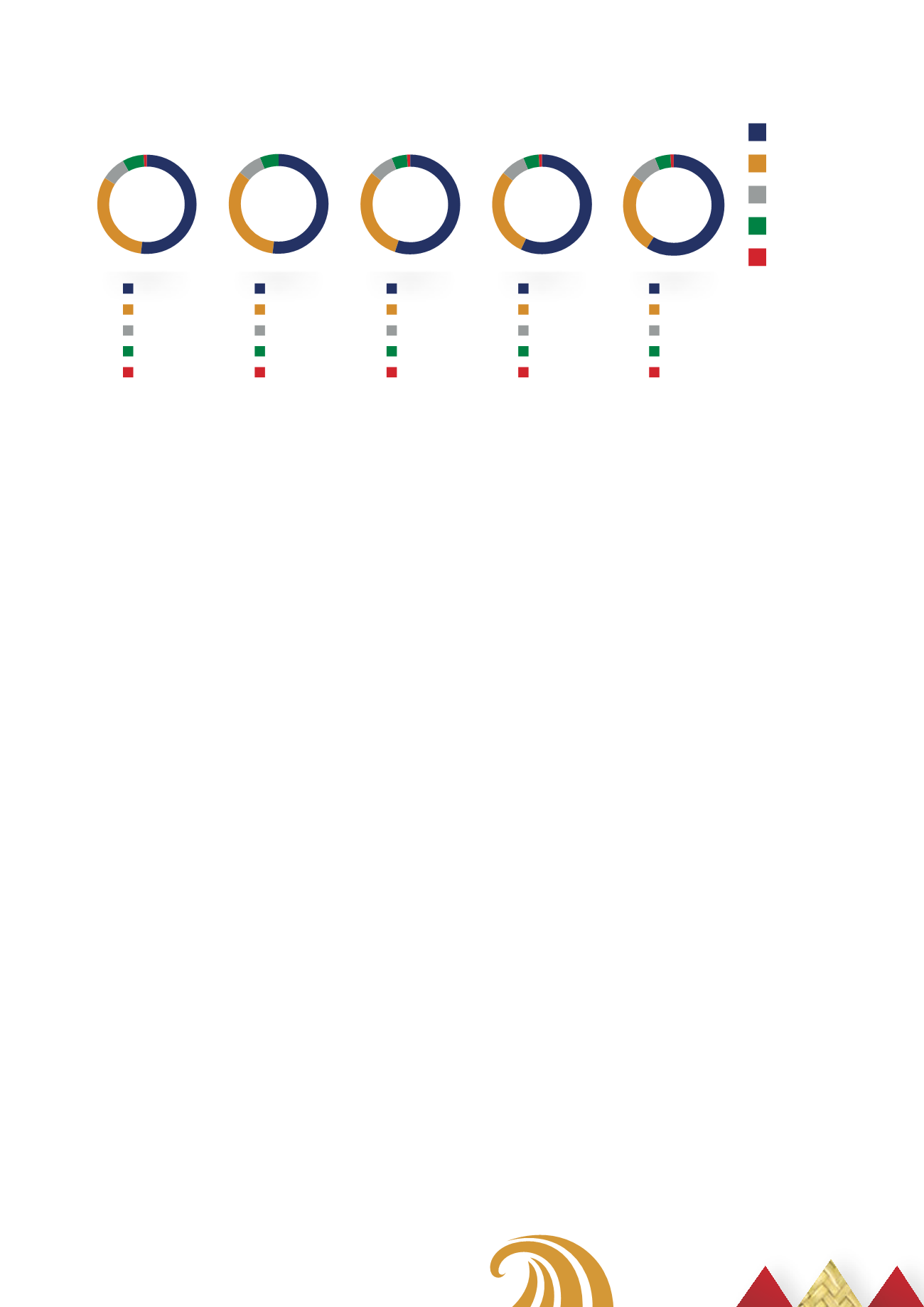

Source

Resources/

Administration

Depreciation

Property Costs

Impairment

of Assets

Personnel Costs

Expenditure

The table below shows the profile of our expenditure for the past five years.

Personnel costs continue to increase relative to other expenditure types. This is due to a number of factors, with the most significant

contributors being general cost of living increases and employing staff with higher qualifications.

Resource and administration costs have continued to decrease as a result of management’s focus on entering procurement contracts

that provide the organisation with better value for money and keep variable costs under tight control.

Property costs have remained fairly stable for the past five years. This results from an ongoing commitment to ensuring that the

organisation maximises utilisation of existing space. Changes in our property portfolio between owned and leased sites have also

contributed to this result.

Even with a planned purchase of a leased site, depreciation costs have steadily decreased and stabilised over the past five years.

This is a result of only minor changes occurring in the property portfolio and the current capitalisation threshold for plant, property

and equipment.

Comprehensive Income

As a result of a revaluation exercise undertaken on all land and buildings owned by the organisation, Te Wānanga o Aotearoa

recognised a decrease in property revaluations of $2.9 million in 2012. The primary contributor to the decline in property values

was a building that was assessed as earthquake prone. This resulted in total comprehensive income for 2012 being $5 million.

Financial Position

Cash, cash equivalents and other financial assets in 2012 exceeded budget by $7.3 million. Te Wānanga o Aotearoa was $8.2 million

down on cash and $15.7 million up on short term deposits when compared with budget. This variance results from a higher than

anticipated surplus and opening cash position for the year.

The organisation had a positive working capital balance at the end of the year of $34.1 million. This is an increase of $0.3 million on

the 2011 result.

Overall, non-current assets increased by $4.9 million due to the purchase of plant, property and equipment, particularly the

acquisition of the Raroera site in Hamilton. This result was partly offset by the loss on property revaluations.

Eight programmes were developed and capitalised during the year along with the purchase of software at a total cost of $1.4

million. As a result of amortisation and impairment there was little movement over the year in intangible assets.

Net assets as at year end are now $138.8 million – an increase of $4.9 million on 2011.

Cash Flow

The strong closing cash position for the year shows the result of a focused approach to maximising our earnings from surplus cash.

During 2012, Te Wānanga o Aotearoa achieved interest revenue of $3.3 million, $0.2 million below the amount received in 2011.

This result was achieved by investing in investment-rated trading banks for varying terms within our credit risk criteria. The average

interest rate for cash and current financial assets in 2012 was 5.00%. This is an increase of 0.90% from the 2011 result.

During 2012, cash and cash equivalents (both short and long term) decreased from $60 million to $58 million. The net surplus for

the year was $7.9 million; however, when non-cash items are removed, the net operating inflow of cash to the organisation was

$14.0 million.

Te Wānanga o Aotearoa had a net cash outflow of $19 million on investing activities. This expenditure relates mainly to property,

plant and equipment, and programme development. Te Wānanga o Aotearoa developed and capitalised eight programmes in

2012, compared with twelve in 2011. The concentration in 2012, as was the case in previous years, on property, plant and

equipment has seen the completion of major improvements on many of our large sites and an acquisition of the Raroera site

in Hamilton.

te manu

...ka rere

2012

59%

26%

9%

5%

1%

2011

57%

29%

8%

5%

1%

2010

55%

31%

8%

5%

1%

2009

52%

34%

8%

6%

-

2008

52%

32%

8%

7%

1%

Annual report 2012

67