Annual report 2012

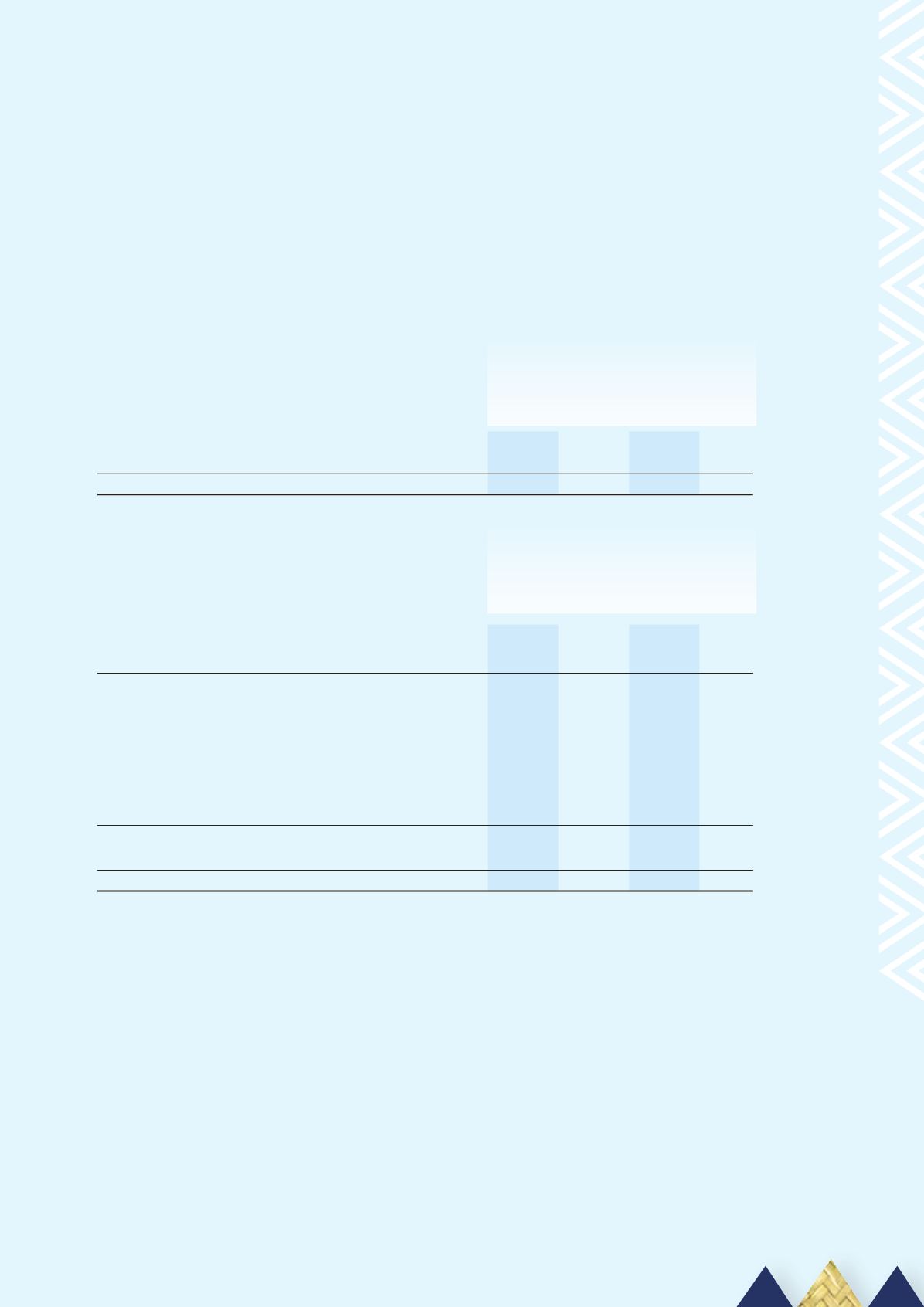

5 Cash and cash equivalents (continued)

Reconciliation of cash for the purpose of the cash flow statement

For the purpose of the cash flow statement, cash and cash equivalents comprise the following as at

31 December.

Group Group Parent Parent

2012 2011 2012 2011

$’000 $’000 $’000 $’000

Cash at bank and in hand

3,376

5,123

2,703

4,191

Term deposits with maturities less than 3 months

2,000

6,723

2,000

5,000

Total cash and cash equivalents

5,376

11,846

4,703

9,191

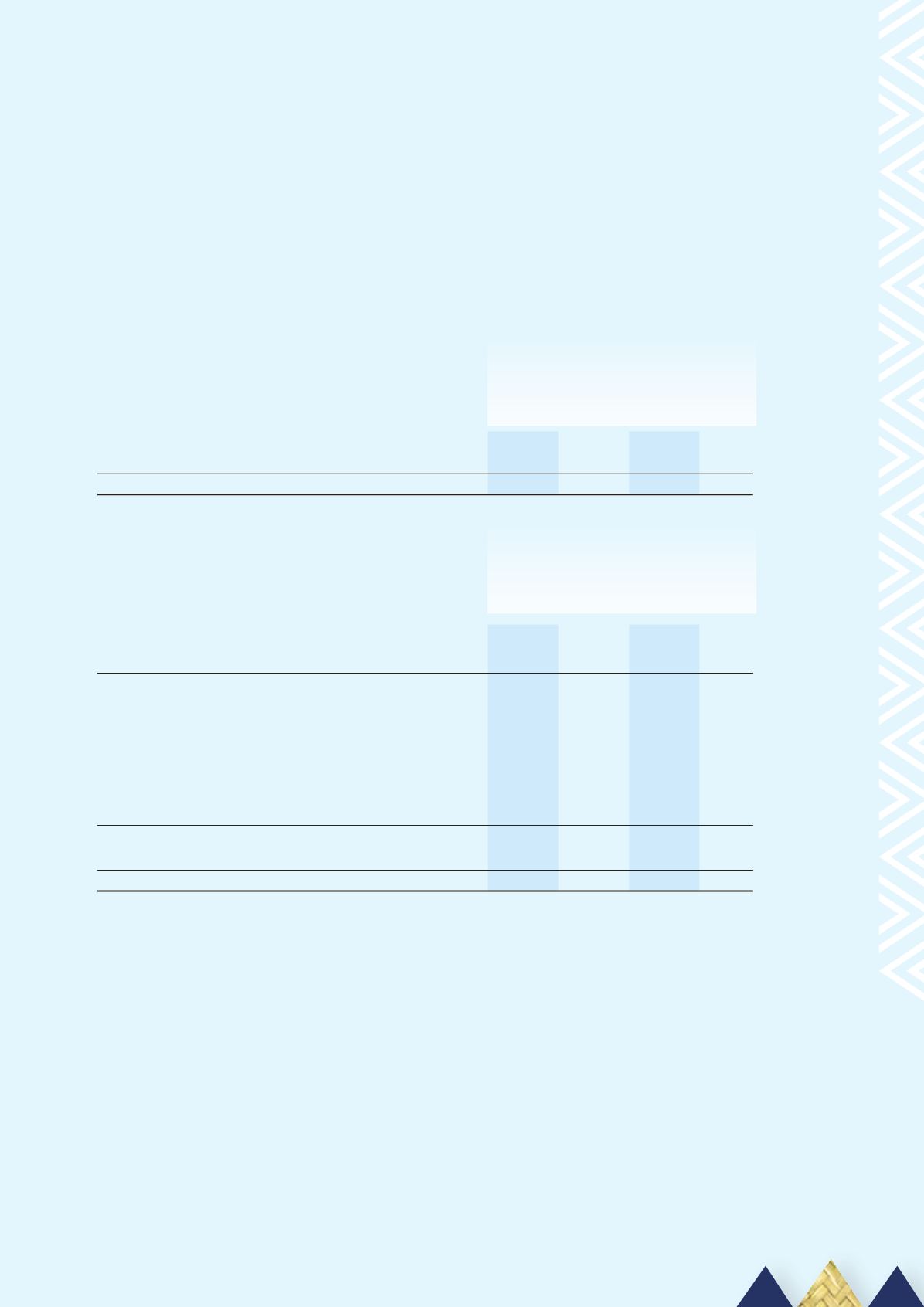

6 Debtors and other receivables

Group Group Parent Parent

2012 2011 2012 2011

$’000 $’000 $’000 $’000

Tauira receivables

Tauira fee receivables

662

522

662

522

Less provision for impairment

(16)

(7)

(16)

(7)

Net Tauira fee receivables

646

515

646

515

Other receivables

Trade receivables

550

228

550

228

Accrued interest

1,808

1,787

1,683

1,733

Related party receivables

Subsidiary (note 19)

-

-

24

13

Other related parties (note 19)

261

155

52

-

Gross debtors and other receivables

2,619

2,170

2,309

1,974

Less provision for impairment

(17)

(13)

(17)

(13)

Total debtors and other receivables

3,248

2,672

2,938

2,476

Fair Value

Other debtors are non-interest bearing and receipt is normally on 30-day terms. Therefore the carrying

value of other debtors approximates their fair value.

Tauira debtors are non-interest bearing and receipt is normally on enrolment and no later than

graduation. Therefore the carrying value of Tauira debtors approximates their fair value.

89