Annual report 2012

7

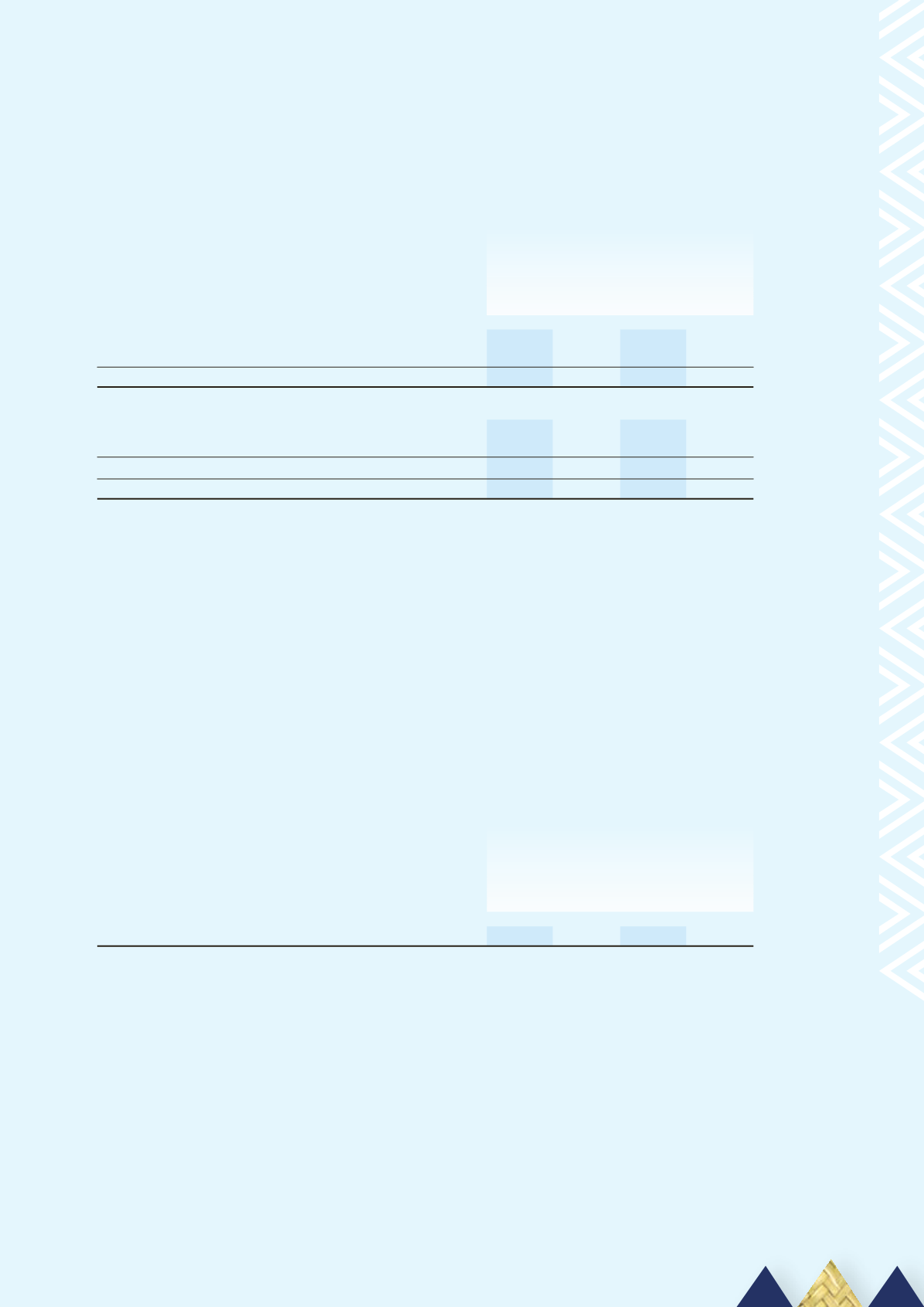

Other financial assets

Group Group Parent Parent

2012 2011 2012 2011

$’000 $’000 $’000 $’000

Current portion

Term deposits with maturities of 4-12 months

39,791 36,123 36,000 32,500

Total current portion

39,791

36,123

36,000

32,500

Non-current portion

Term deposits with maturities >12 months

13,213 13,344 13,213 13,344

Total non-current portion

13,213 13,344 13,213 13,344

Total other financial assets

53,004 49,467

49,213

45,844

Fair value

Term deposits

The fair value of non-current term deposits is $13,133,387 (2011 - $14,305,299). Fair value has been

determined by discounting future interest cash flows using a discount rate based on the market interest

rate on term deposits at balance date with principal terms to maturity that match as closely as possible

the cash flows of term deposits held.

The discount rates range between 2.53% and 2.91% (2011 - 2.46% and 3.30%).

Impairments

There were no impairment provisions for other financial assets. None of the assets are either past due

or impaired.

8

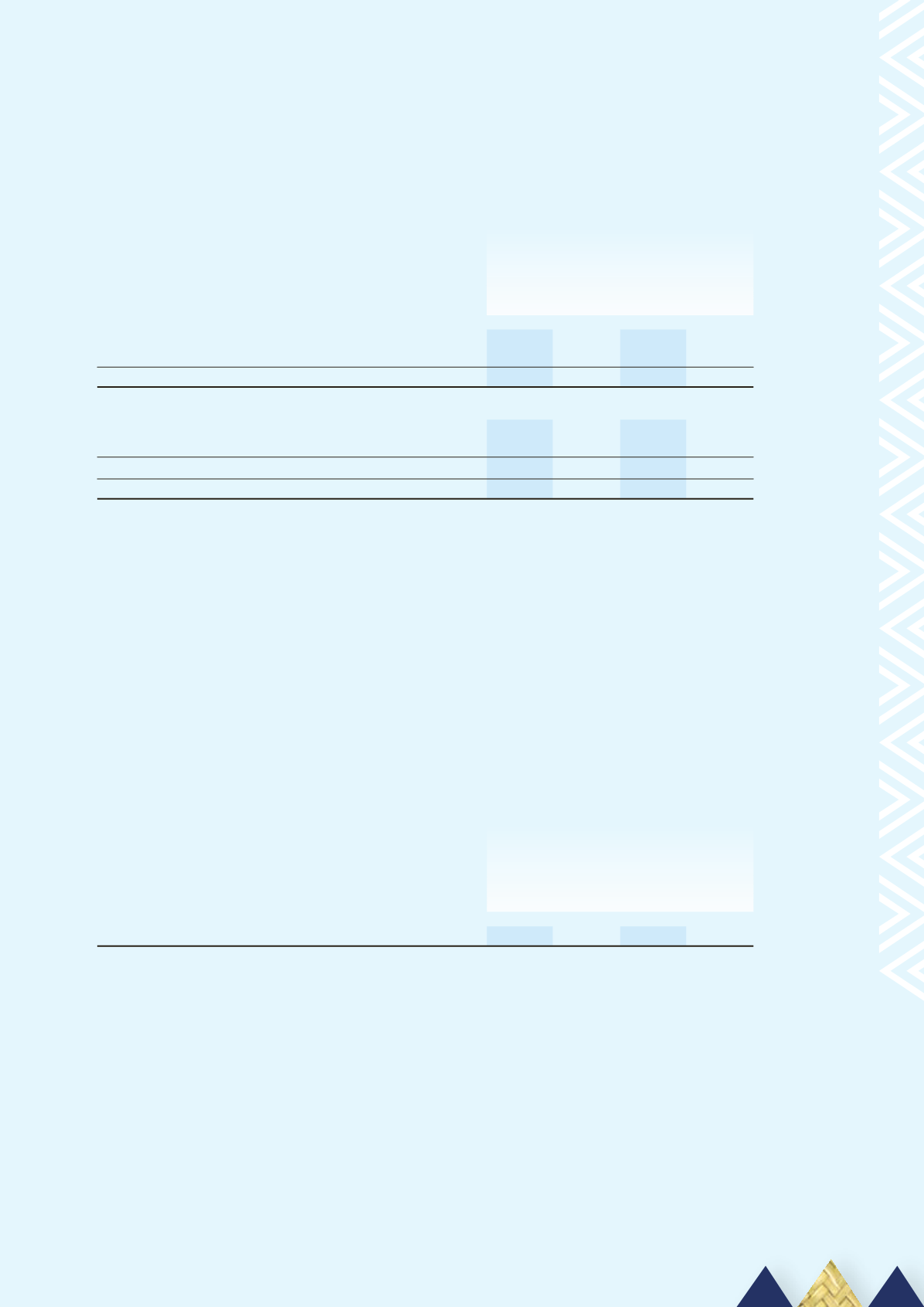

Inventory

Group Group Parent Parent

2012 2011 2012 2011

$’000 $’000 $’000 $’000

Inventories held for distribution

2,068

2,096

964

1,105

The carrying amount of inventories for distribution are measured at cost as at 31 December 2012 and

therefore, the carrying amount at current replacement cost is NIL (2011 - NIL).

Inventories are made up of consumables and inventories held for distribution to campuses. Consumables

are materials or supplies which will be consumed in conjunction with the delivery of services and

predominantly comprise books and resources used in the teaching of courses to tauira.

During the year, a write-off of inventories occurred due to a change in resources and technologies

required in a number of programmes. This write-off amounted to $86,269 in 2012 (2011 - $129,167).

There have been no reversals of write-offs (2011 - NIL).

No inventories are pledged as security for liabilities.

91