Tena koutou katoa – Greetings to you all

Investing wisely

I am pleased to report that the Trust’s

investments experienced considerable

growth returning 13.24% in the financial

year. As at 31 March 2013 the Trust fund

was valued at over $285million. Established

in perpetuity, the Trust aims to grow the

value of the capital fund to keep pace with

both inflation and population growth in the

region, without taking on undue risk, so that

the fund is worth just as much for future

generations as it is for current communities.

Much progress has been made in rebuilding

the value of the capital fund, following the

falls during the global financial crisis.

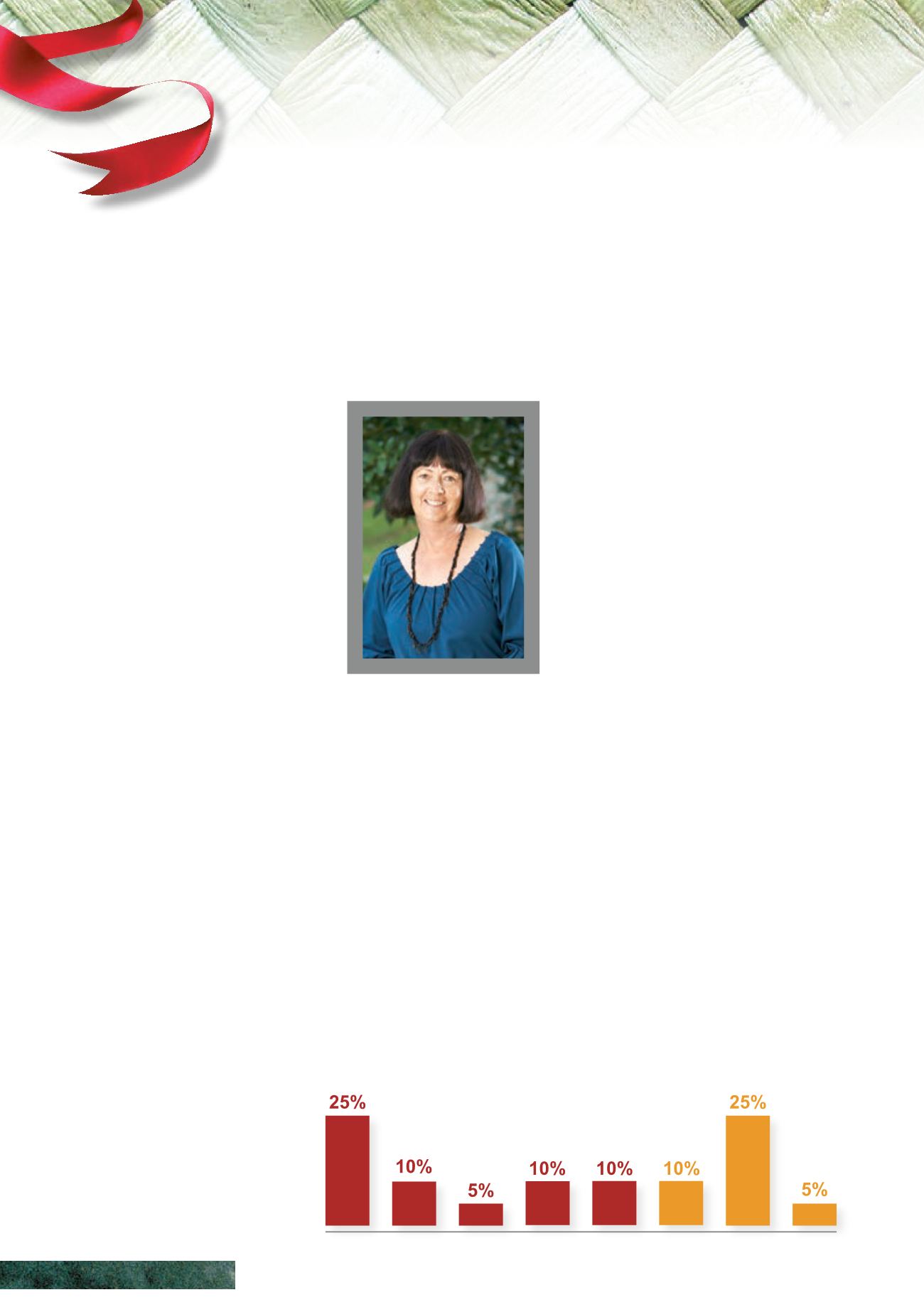

The Trust investments are spread across

a range of asset classes: global equities,

Australasian equities, private equity,

unlisted property, infrastructure, global

fixed interest, New Zealand fixed interest

and cash. The portfolio is well diversified

by asset class and fund manager, with

the allocation of assets designed to

achieve the Trust’s goals of long-term

capital growth and donating consistently to

current communities. As a signatory to the

Principles for Responsible Investment, the

Trust continues to consider ways in which

environmental, social and governance

issues may impact on both investments

and communities.

This year marks a significant milestone

for the Trust as it celebrates 25 years of

philanthropy in the greater Waikato.

Trust Waikato has a vision of

resilient and vibrant communities

throughout the region it serves.

In contributing to that vision,

the Trust aims to invest wisely

the capital fund with which

it is entrusted and to donate

effectively the proceeds of

those investments to benefit

current and future communities.

CHAIR'S

REPORT

Strategic Allocation of Financial Assets

NZ Fixed

interest

Unlisted

property

Global

equities

Australasian

equities

Private

equity

Infrastructure

NZ Cash

Global Fixed

interest

10

C H A I R ' S R E P O R T