79 TE PŪRONGO 2013

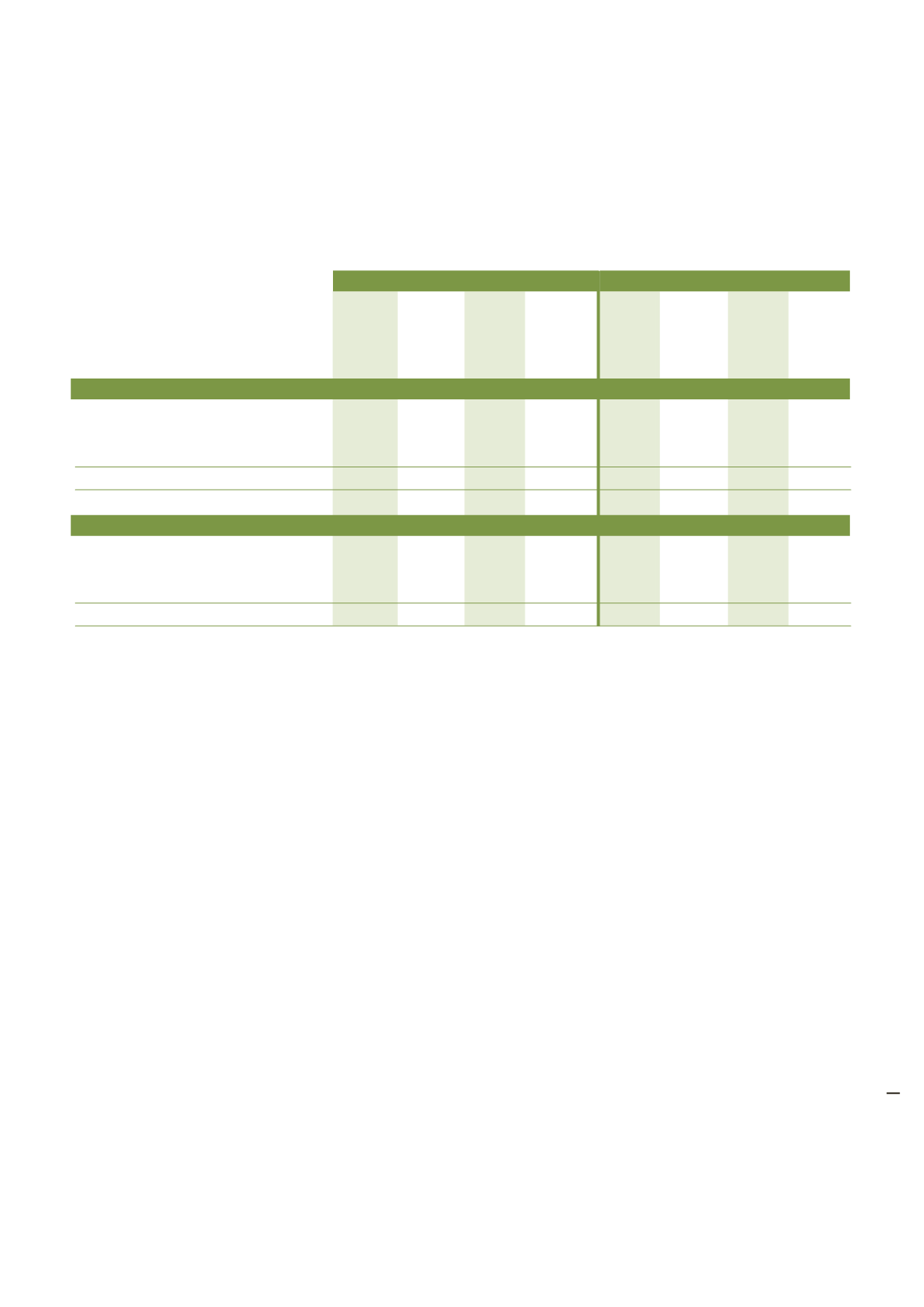

(d) Sensitivity analysis

The tables below illustrate the potential impact to the surplus or deficit and equity (excluding retained earnings) for

reasonably possible market movements with all variables held constant based on the financial instrument exposures of Te

Wānanga o Aotearoa at balance sheet date.

-100bps

+100bps

Other

Other

Surplus Equity Surplus Equity

-100bps

+100bps

Other

Other

Surplus Equity Surplus Equity

Group

Interest rate risk

Financial assets

Cash and cash equivalents

1

(30)

-

30

-

(53)

-

53

-

Total sensitivity to interest rate risk

(30)

-

30

-

(53)

-

53

-

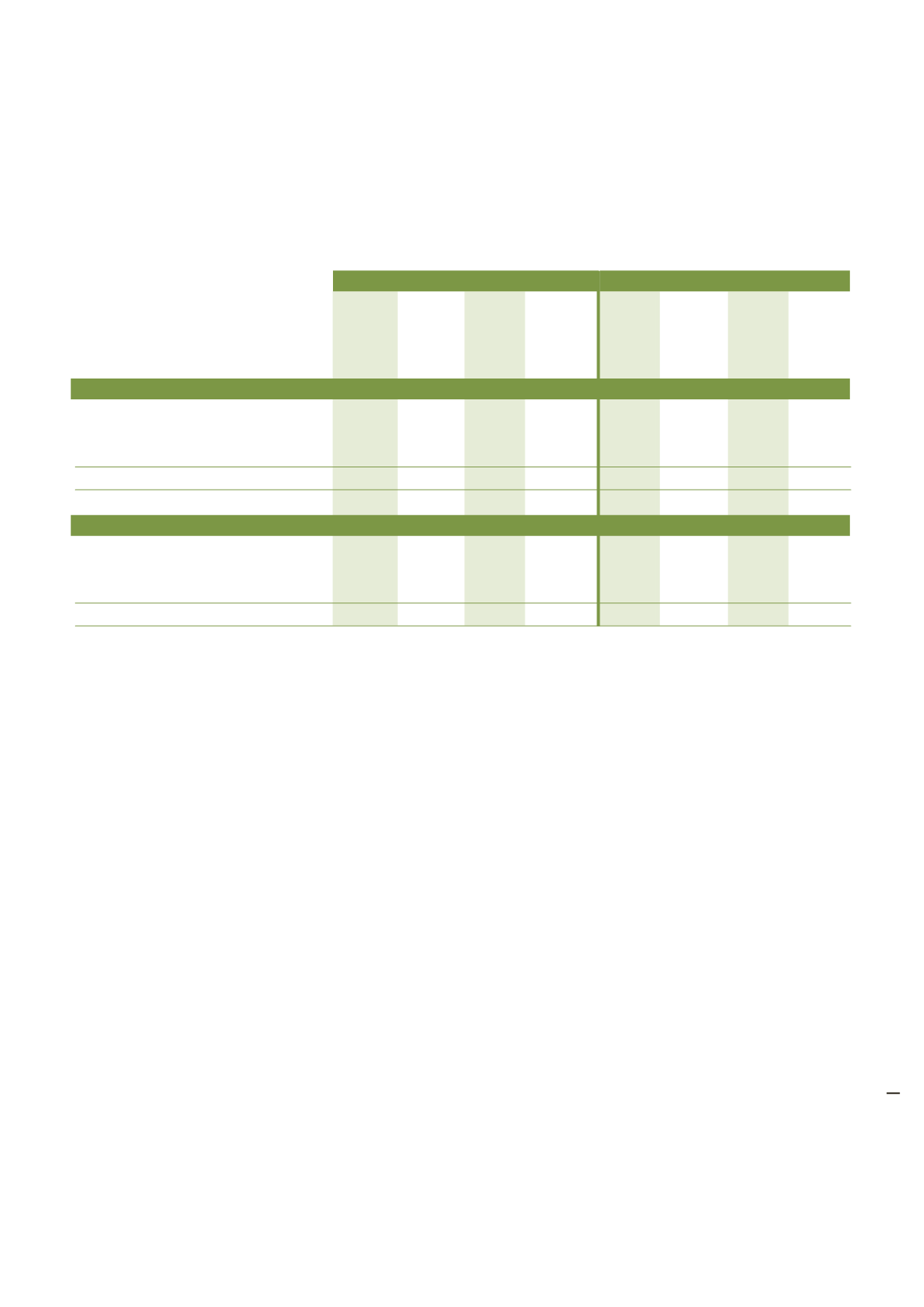

Parent

Interest rate risk

Financial assets

Cash and cash equivalents

1

(19)

-

19

-

(47)

-

47

-

Total sensitivity to interest rate risk

(19)

-

19

-

(47)

-

47

-

1. Explanation of interest rate risk sensitivity

The interest rate sensitivity is based on a reasonable possible movement in interest rates, with all other variables held

constant, measured as a basis points (bps) movement. For example a decrease in 100 bps is equivalent to a decrease in

interest rates of 1.0%.

(e) Capital Management

The capital of Te Wānanga o Aotearoa is its equity, which comprises of retained earnings and the property revaluation

reserve. Equity is represented by net assets.

Te Wānanga o Aotearoa is subject to the financial management and accountability provisions of the Education Act 1989,

which includes restrictions in relation to: disposing of assets or interests in assets, ability to mortgage or otherwise charge

assets or interests in assets, granting leases of land or buildings or parts of buildings and borrowings.

Te Wānanga o Aotearoa manages its revenues, expenses, assets, liabilities, investments, and general financial dealings

prudently and in a manner that promotes the current and future interests of the community. The equity of Te Wānanga o

Aotearoa’s is largely managed as a by-product of managing revenues, expenses, assets, liabilities and general financial

dealings.

The objective of managing the equity of Te Wānanga o Aotearoa is to ensure that it effectively and efficiently achieves the

goals and objectives for which it has been established, while remaining a going concern.

Note

2013 $000

2012 $000