2 S umm a r y o f s i g n i f i c a n t a c c o u n t i n g p o l i c i e s ( c on t i n u e d )

2.24 Current and deferred income tax

The Inland Revenue Department approved the Trust as charitable for the purposes of the Income Tax Act 1994.

However some entities within the Group are taxable. In the instances where an entity is taxable, current tax is calculated by using

tax rates and tax laws that have been enacted or substantively enacted by the reporting date. Accordingly no tax is payable by the

Trust. See note 30 for details of entities that have charitable status.

Deferred income tax liabilities are provided on taxable temporary differences arising from investments in subsidiaries except for

deferred income tax liability where the timing of the reversal of the temporary difference is controlled by the Group and it is

probable that the temporary difference will not reverse in the foreseeable future.

Deferred tax in respect of property, plant and equipment had been assessed in 2014 on the basis of the asset value being realised

through sale. This has been reversed in 2015 (see note 7)

2.25 Statement of cash flows

The statement of cash flows are prepared exclusive of GST. For the purposes of the statement of cash flows, cash and cash

equivalents include cash in banks and investments in money market instruments, net of outstanding bank overdrafts.

Operating activities include all transactions and other events that are not investing or financing activities.

Investing activities are those activities relating to the acquisition and disposal of current and non-current investments and any

other non-current assets.

Financing activities are those activities relating to changes in the equity and debt capital structure of the Trust and Group and

those activities relating to the cost of servicing the Trust’s and Group’s equity capital.

2.26 Goods and services tax (GST)

The profit and loss component of the statement of comprehensive income has been prepared so that all components are stated

exclusive of GST. All items in the statement of financial position are stated net of GST, with the exception of receivables and

payables, which include GST invoiced.

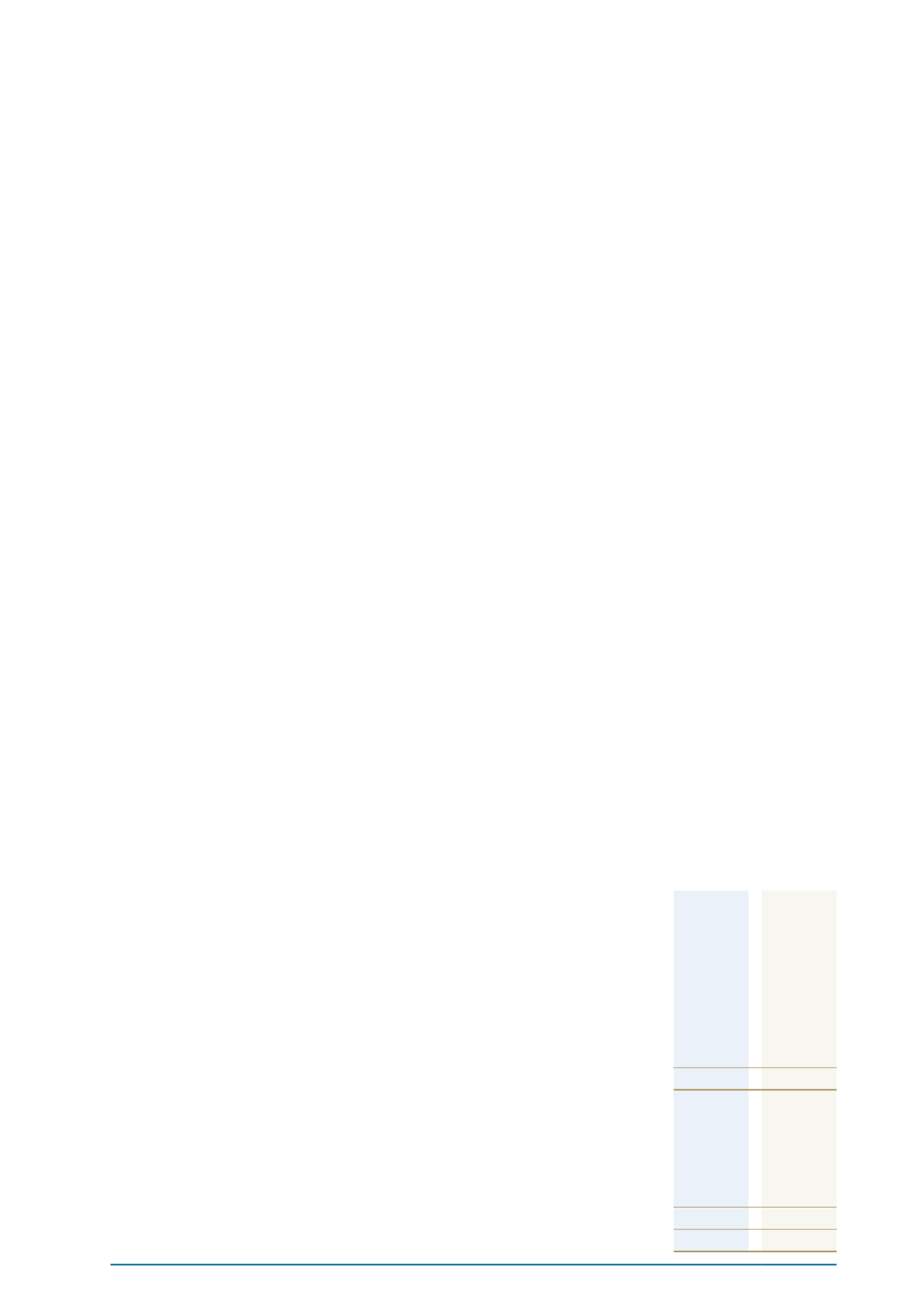

3 T o t a l i n c om e

Consolidated

Notes

2015

$’000

2014

$’000

Revenue

Rental income

35,247

35,469

Amortisation of capitalised lease incentives

(340)

(297)

Hotel income

37,928

27,946

Fishing income

1,611

1,241

Dairy income

889

1,408

Other revenue

7,104

3,941

Revenue from rendering of services

143

124

82,582

69,832

Other income

Dividends from listed investments

415

32

Dividends from unlisted investments

481

1

Other operating gains – livestock

12

539

545

Other gains

-

3,049

1,435

3,627

Total income

84,017

73,459

waikato raupatu lands trust

notes to the financial statements

f o r t h e y e a r e n d e d 3 1 m a r c h 2 0 1 5

64