Notes to the Financial Statements

continued

82

Maori Authority Credit Account, which are the tax credits available to pass onto its Shareholder (2012: $0.2m).

These future accounts recoverable are unrecognised at 31 March 2013 (2012: nil).

2.7 GST

The Company is not registered for GST. Revenue and expenses are reported gross of GST (if any).

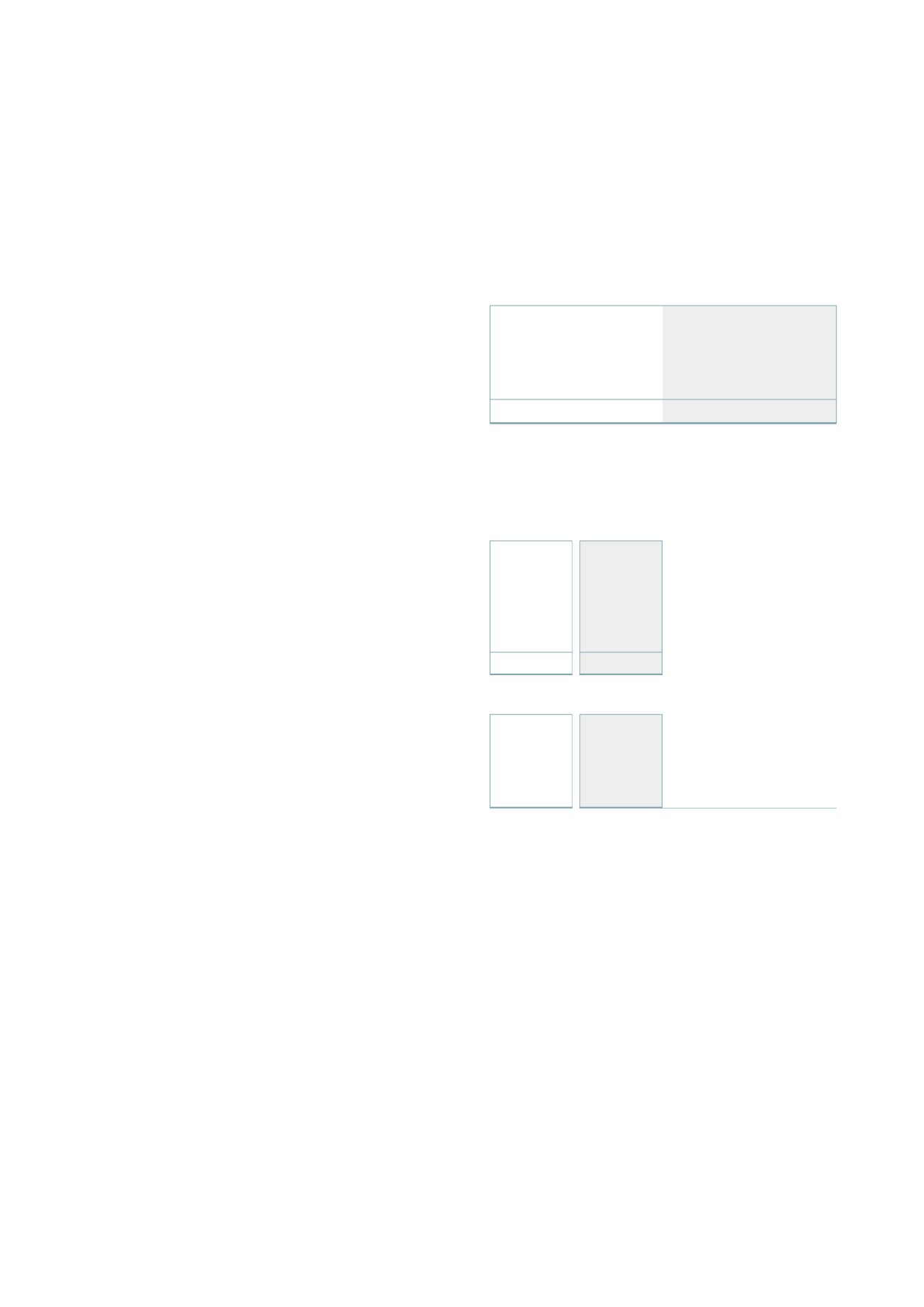

3 Contributed equity

2013

2012

No.

$’000

No.

$’000

Ordinary shares

Balance at beginning of year

100

-

100

-

Balance at end of year

100

-

1

00

-

All fully paid ordinary shares carry one vote per share and carry the right to dividends. Ordinary shares do not

have a par value. On wind-up of the company, all proceeds will be paid to the Sharehoder.

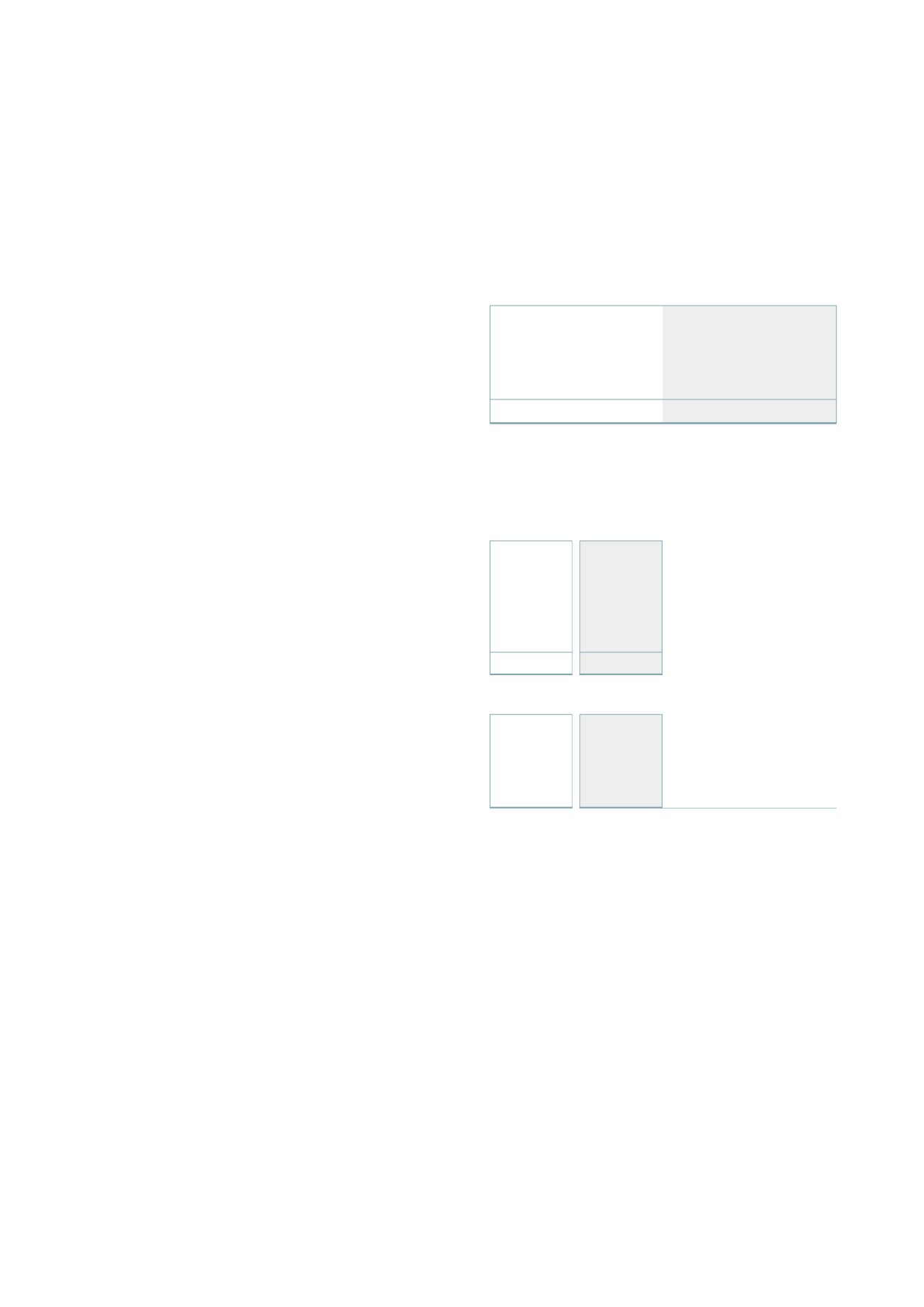

4 Retained earnings

Movement in retained earnings were as follows:

2013

2012

$’000

$’000

Balance at beginning of year

13,848

13,349

Net profit for the year

370

499

Dividend

(910)

-

Balance at end of year

13,308

13,848

5 Other financial assets

2013

2012

$’000

$’000

At fair value through profit or loss

Shares in unlisted company

– AFL income shares

12,935

12,935

The shares comprise of 6,851 income shares in AFL. These income shares received on 31 March 2008 have no

voting rights attached and can be traded amongst iwi.

The fair value of AFL income shares is based on a calculation of the equity value of AFL as determined at 31 March

2013. The calculation of equity value considers the average EBIT over the period from 2010 to 2012 and uses

a market multiple to determine the enterprise value and deductng net debt to derive the equity value of each

income share held at 31 March.

6 Related parties

Transactions between related entities include advances to and from other entities owned by the Shareholder. All

amounts are repayable upon demand and are interest free. There is no impairment of any related party balances.

The advance account movement of $0.5m represents cash received and payments made on behalf of the

Company by Tainui Group Holdings Limited (2012: $0.5m).

7 Contingent liabilities

The Company has no contingent liabilities at balance date (2012: nil).

8 Capital commitments

The Company has no capital commitment at balance date (2012: nil).

9 Events subsequent to the reporting period

The Company declared a dividend of $0.4m on 18 June 2013 (2012: $0.9m)

Note 2.6 continued