Tainui Group Holdings

Annual Report

2013

75

27 Contingent liabilities and gains

The Parent and Group had contingent liabilities at 31 March 2013 in respect of:

The Shareholder has first priority security of $15m over the present and future undertakings, property, assets,

revenues and capital of Raukura Moana Seafoods Limited, Tainui Corporation Limited, Tainui Development

Limited and Tainui Group Holdings Limited. Each company jointly and severally, unconditionally and irrevocably

guarantees to the Shareholder all secured monies.

The Directors believe that the expectation of a liability arising due to the guarantees and mortgages in place is

remote.

29 Events subsequent to the reporting period

On 20 May 2013, Raukura Moana Seafoods Limited entered into a joint venture agreement with Sealord Group

Limited to manage the fishing activities. The agreement is subject to Overseas Investment Office approval

which is yet to be issued. The joint venture will have no material impact on the financial statements.

The Company declared a dividend of $11.1m on 18 June 2013 (2012: $10.1m).

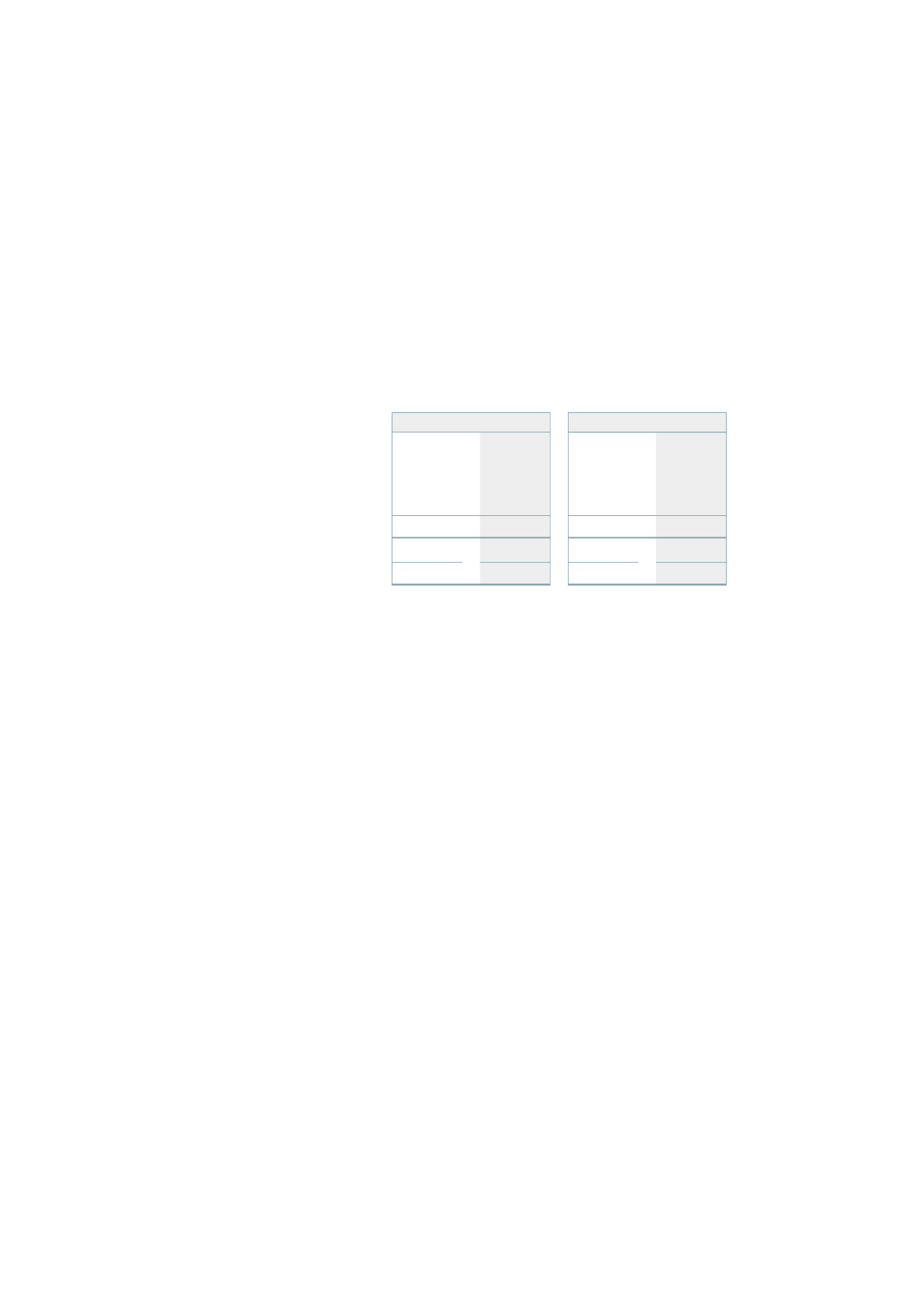

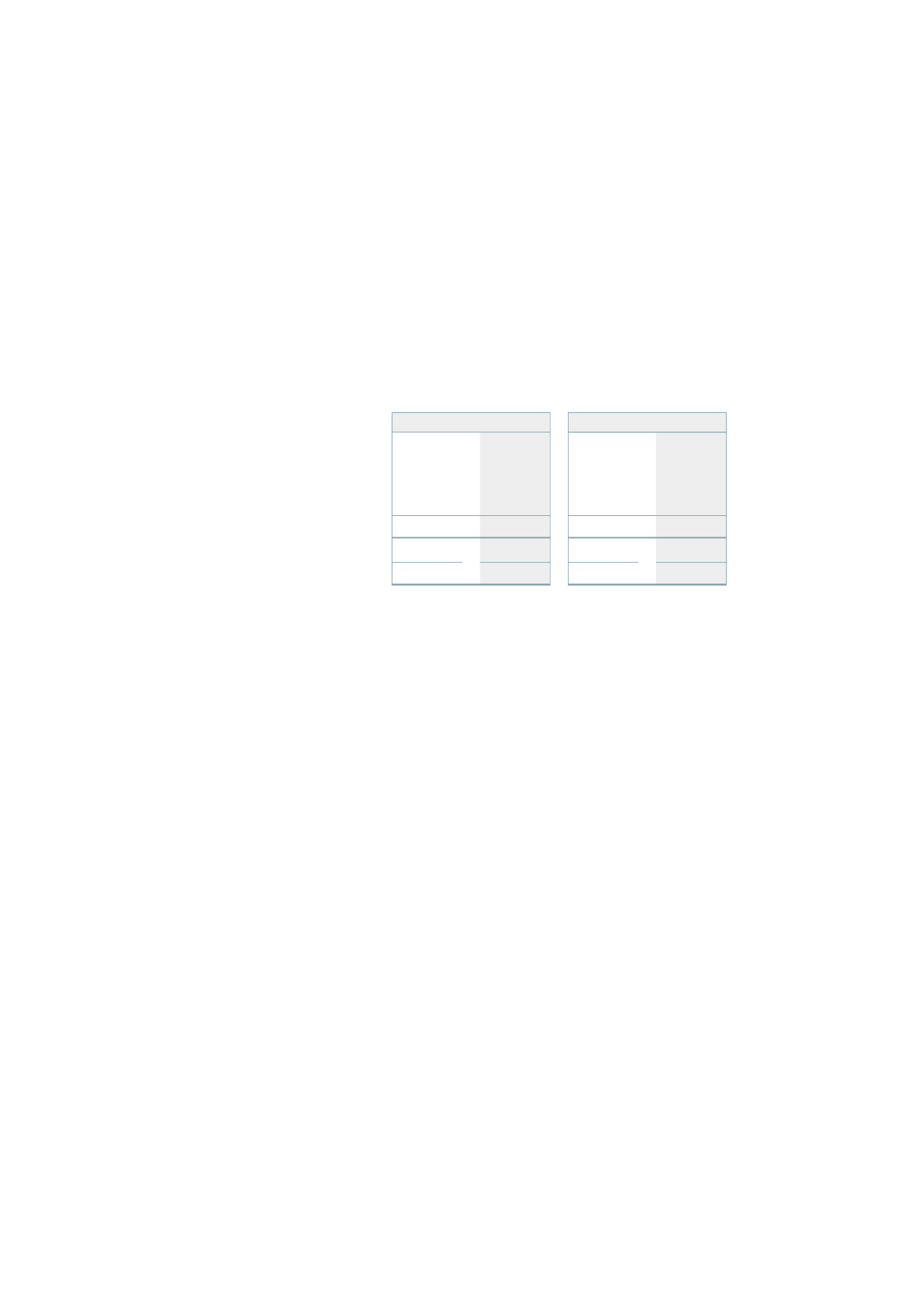

28 Capital commitments

Capital expenditure contracted for at the reporting date but not recognised as liabilities is as follows:

2013

2012

2013

2012

$’000

$’000

$’000

$’000

Property, plant and equipment

-

2,157

-

-

Other financial assets

583

1,440

-

-

583

3,597

-

-

Investment properties

-

2,298

-

-

-

2,298

-

-

Parent

Consolidated