Notes to the Financial Statements

continued

70

Total interest bearing liabilities for the Group is net of prepaid borrowing costs of $0.5m (2012: $0.5m).

The Company holds a multi option credit line facility agreement with Westpac New Zealand Limited for $50m

(2012: $50m) which matures on 15 March 2014. Borrowings of $30m of the available facility had been drawn at

balance date (2012: $26m).

The Company holds a multi option credit line facility agreement with Westpac New Zealand Limited for $25m

(2012: $25m) which matures on 16 June 2015. No borrowings had been drawn at balance date (2012: nil).

The Company holds a Wholesale Term Loan Facility with Westpac New Zealand Limited for $50m (2012: $50m)

which matures on 27 July 2015. Borrowings of $50m had been drawn at balance date (2012: $50m).

The Company holds a Committed Cash Advances Facility Tranche A Agreement with the Bank of New Zealand

for $75m (2012: $75m) which matures on 31 July 2016. Borrowings of $48m of this facility had been drawn at

balance date (2012: $46m).

The Company holds a Committed Cash Advances Facility Tranche B Agreement with the Bank of New Zealand

for $50m (2012: $50m) which matures on 30 November 2017. Borrowings of $32m of the available facility had

been drawn at balance date (2012: $30m).

Tainui Auckland Airport Hotel holds a Committed Cash Advance Facility with ASB Bank Limited for $33m

(2012: $33m) which matures 27 May 2014. Borrowings of $26m of the available facility had been drawn at

balance date (2012: $28m). The ASB Bank has a first and exclusive security agreement over the assets and

undertakings of Tainui Auckland Airport Hotel LP and Tainui Auckland Airport Hotel GP Limited.

The Company and guaranteeing subsidiaries (Tainui Corporation Limited, Tainui Development Limited, TGH

No.1 Limited, Raukura Moana Seafoods Limited, The Base Limited and Te Rapa 2002 Limited) have granted to

Westpac New Zealand Limited and Bank of New Zealand a charge in and over all present and future assets and

present and future rights and interest in any asset as security for the finance facilities.

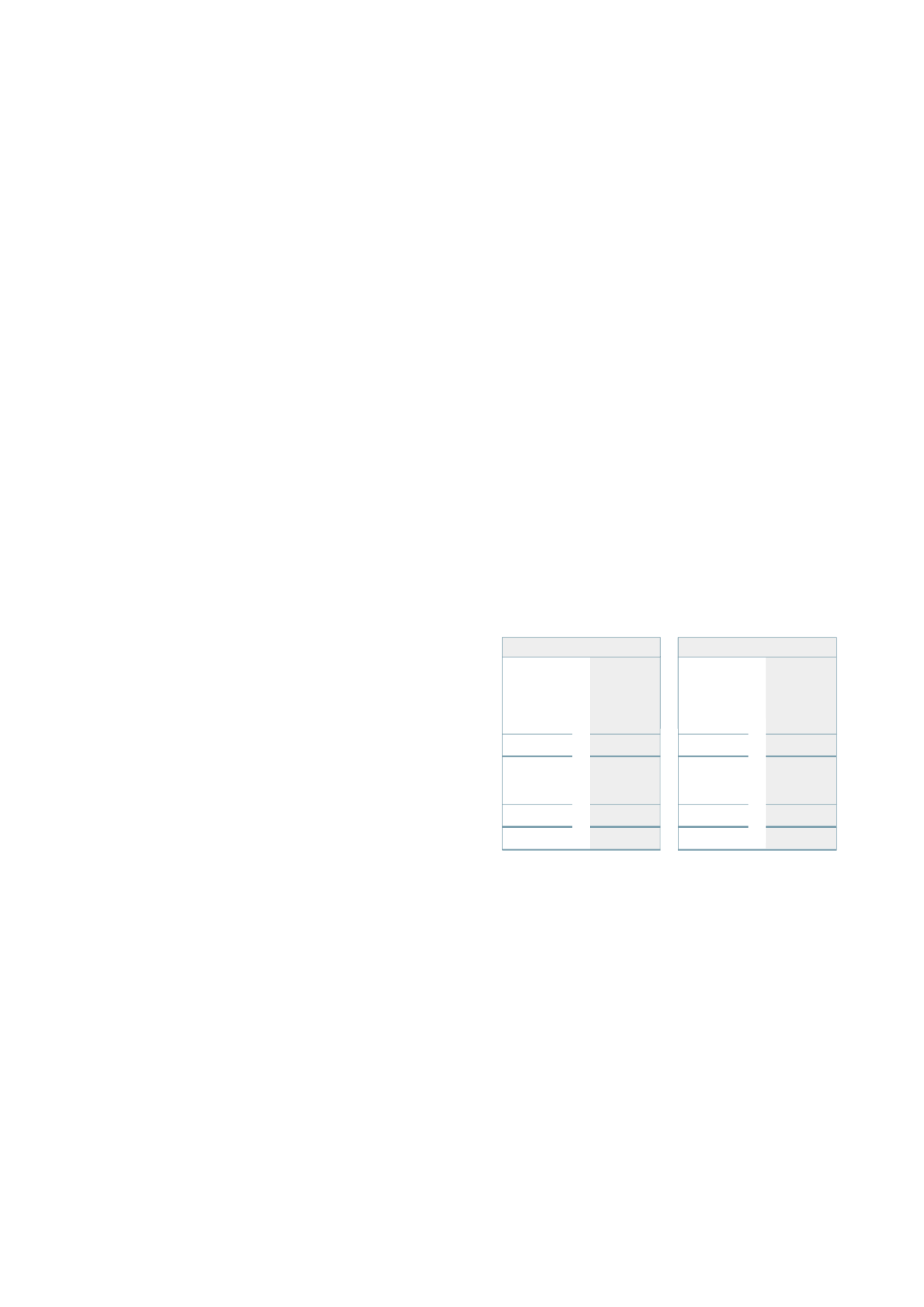

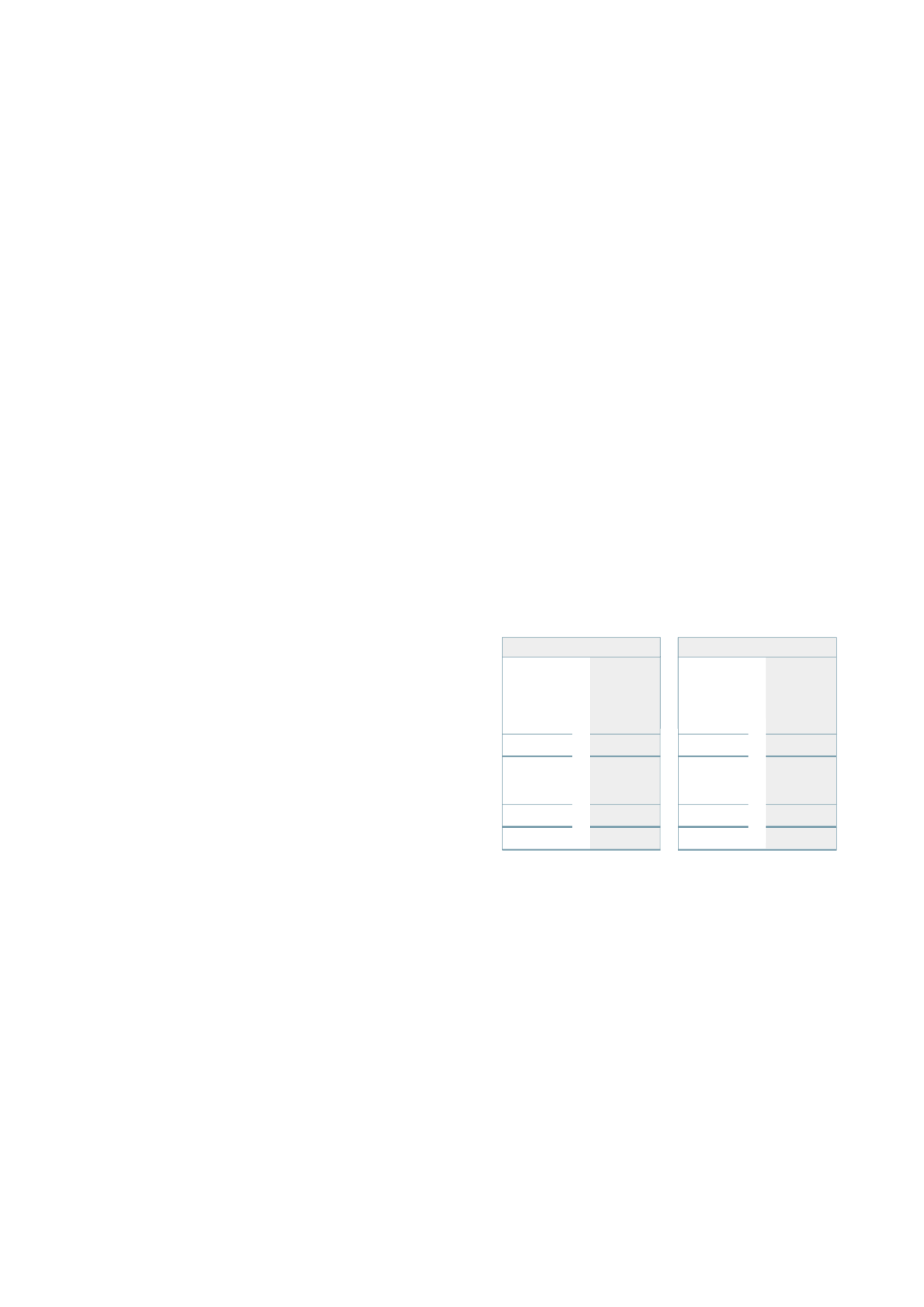

23 Other financial liabilities

2013

2012

2013

2012

$’000

$’000

$’000

$’000

At fair value through profit or loss

Interest rate swaps

162

-

162

-

Total current other financial liabilities

162

-

162

-

Interest rate swaps

12,740

11,763

11,460

10,717

Investment property liability

32,010

28,280

32,010

28,280

Total non‑current other financial liabilities

44,750

40,043

43,470

38,997

44,912

40,043

43,632

38,997

The notional amount of interest rate swaps is $150m (Parent: $135m) with maturity dates that range from 1‑9

years (Parent: 1‑8 years), (2012: $150m for the Group and $135m for the Parent, maturing between 1‑10 years).

The Base and University of Waikato land is owned by the Shareholder. There is an operating lease in place

between the Shareholder and the Group. The interest held under the operating lease has been recognised as a

financial liability and investment property (see note 15 and note 19).

Parent

Consolidated

Note 22 continued