Notes to the Financial Statements

continued

64

17 Intangible assets

CONSOLIDATED

Computer

NZ Units

software

Quota

ETS

Total

$’000

$’000

$’000

$’000

Year ended 31 March 2012

Opening balance

227

20,340

105

20,672

Additions

36

-

-

36

Amortisation and impairment charge

(146)

-

(74)

(220)

Closing balance

117

20,340

31

20,488

At 31 March 2012

Cost

448

20,340

105

20,893

Accumulated amortisation and impairment

(331)

-

(74)

(405)

Net book value

117

20,340

31

20,488

Year Ended 31 March 2013

Opening balance

117

20,340

31

20,488

Additions

111

-

-

111

Disposals

(31)

-

-

(31)

Amortisation and impairment

(110)

-

(23)

(133)

Closing balance

87

20,340

8

20,435

At 31 March 2013

Cost

455

20,340

105

20,900

Accumulated amortisation and impairment

(368)

-

(97)

(465)

Net book value

87

20,340

8

20,435

Waikato‑Tainui Te Kauhanganui Incorporated. The Company also declared a dividend of $11.1m on 18 June 2013

(see note 29).

Tainui Corporation Limited, Tainui Development Limited and Raukura Moana Seafoods Limited declared

dividends of $161.2m, $46.9m and $8.9m respectively, for the year ended 31 March 2013 (2012: nil) to the

Company (see note 4).

The advance account movement between the Company and its subsidiaries represents cash received and

payments made by the Company on behalf of its subsidiaries as well as dividends payable by the subsidiaries.

There are operating leases in place between the Shareholder and the Company for land owned by the

Shareholder where the Group has developed and leased properties at The Base and the University of Waikato

respectively. The interest held under the operating lease has been accounted for as an investment property and

financial liability (see also notes 19 and 22 respectively).

During the financial year, Tainui Development Limited sold 42 hectares of land at Rotokauri to the joint venture

partnership, Rotokauri Development Limited for residential sub‑division. As at 31 March 2013, $1.2m is

outstanding and has since been paid (see note 11).

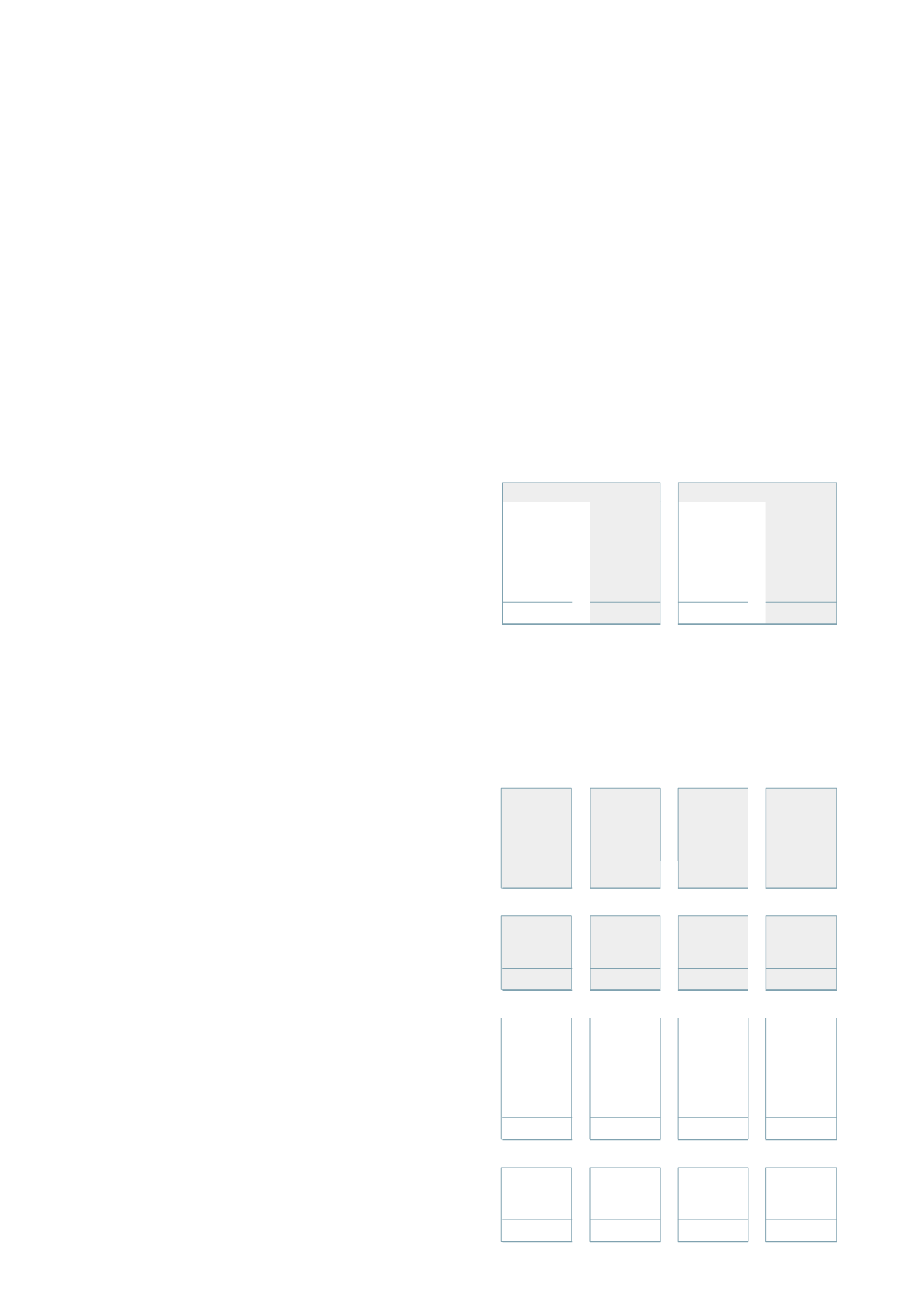

16 Other financial assets

2013

2012

2013

2012

$’000

$’000

$’000

$’000

At fair value through profit or loss:

Listed companies

2,426

-

2,426

-

Unlisted companies

7,579

5,385

7,578

5,294

10,005

5,385

10,004

5,294

Parent

Consolidated

Note 15 continued