Notes to the Financial Statements

continued

60

7 Income tax

The taxable members of the Group have sufficient losses to carry forward to meet any potential income tax

liability. The taxable losses are not recorded in the financial statements due to the lack of probability that the

losses will be recovered. The approximate unrecognised tax losses carried forward are $0.9m (2012: $0.9m).

As at reporting date there is no current tax expense, tax payable or tax receivable (2012: nil).

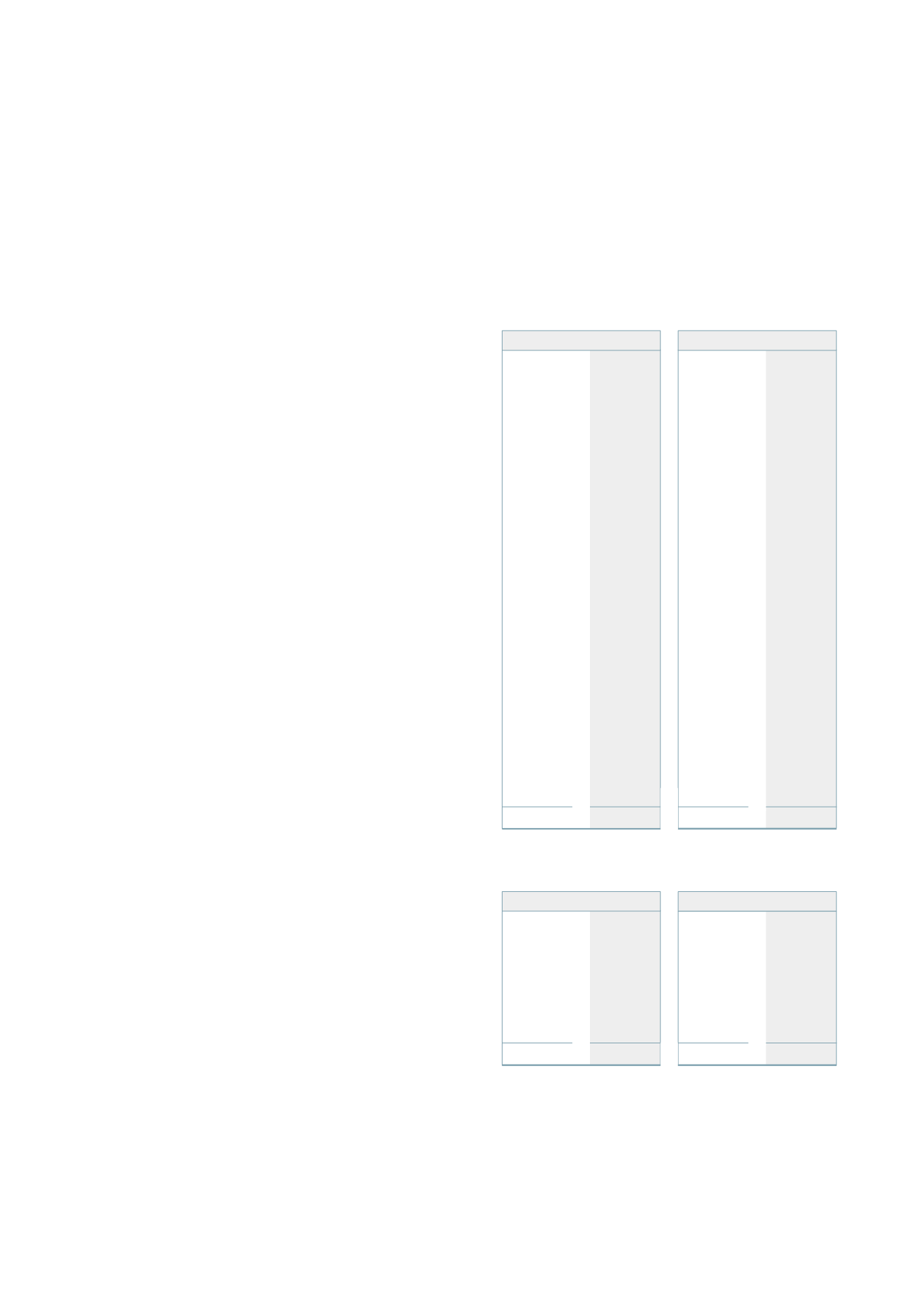

8 Other gains ‑ net

2013

2012

2013

2012

Notes

$’000

$’000

$’000

$’000

Biological assets

– fair value gains unrealised

14

1,276

497

-

-

Financial liabilities designated at fair value

through profit or loss

– increase in investment property liability

(3,730)

(4,313)

(3,730)

(4,313)

Interest rate swaps

– fair value losses unrealised

(1,140)

(3,973)

(906)

(2,927)

Investment properties

– fair value gains unrealised

19

25,686

23,624

3,590

9,255

Investment properties

– realised gain on sale

28

-

-

-

Property, plant & equipment

– impairment of land at cost

18

-

(1,400)

-

-

Shares in listed companies

– fair value gains realised

-

4,050

-

4,050

Shares in listed companies

– fair value gains unrealised

964

-

964

-

Shares in unlisted companies

– fair value gains/(losses) realised

8

(53)

8

(53)

Shares in unlisted companies

– fair value gains unrealised

1,276

673

1,366

763

24,368

19,105

1,292

6,775

Consolidated

Parent

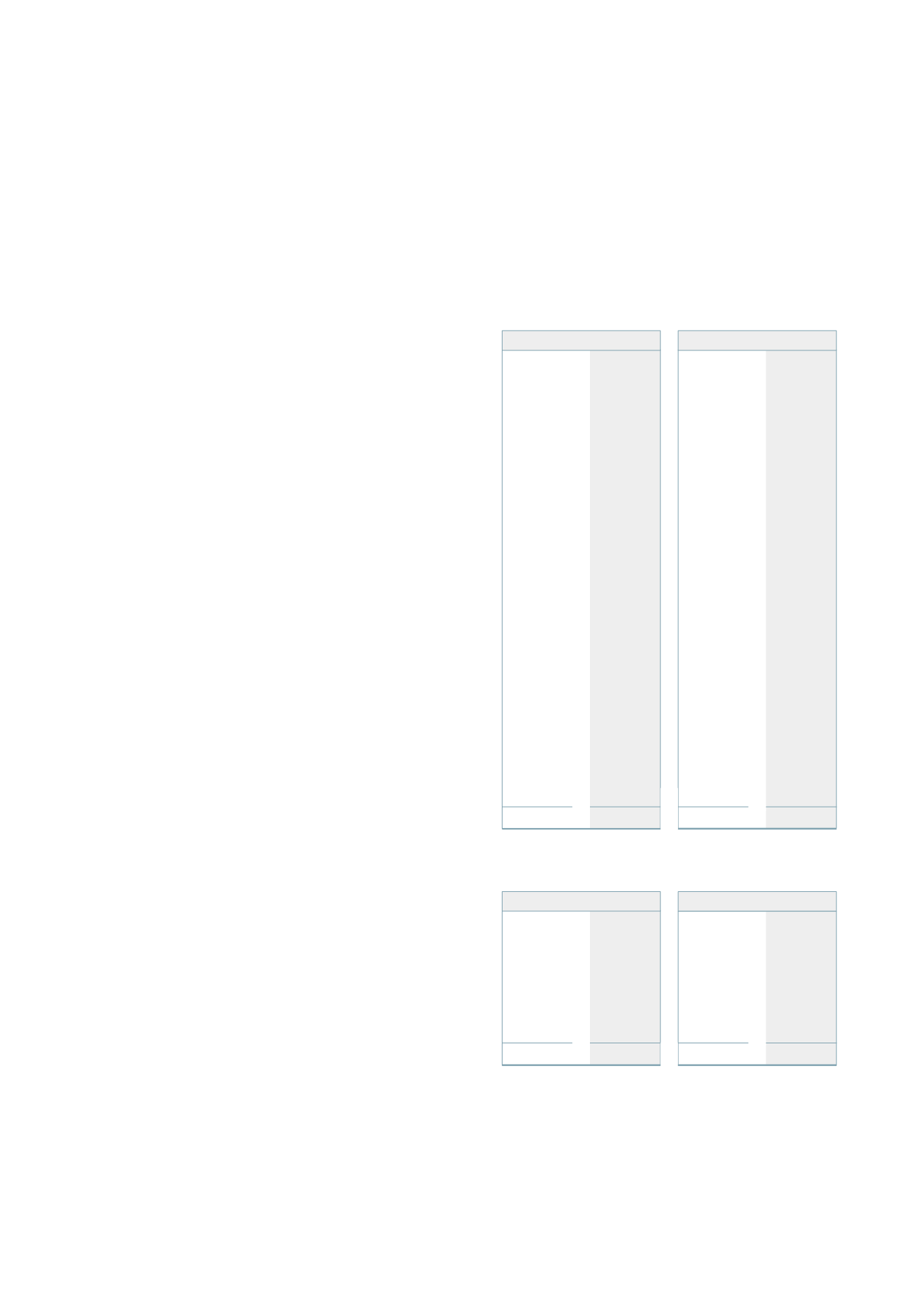

9 Contributed equity

2013

2012

2013

2012

Share no.

Share no.

$’000

$’000

Share capital

Ordinary shares

Balance at beginning of year

60,000,000 60,000,000

60,000

60,000

Issue of shares

70,000,000

-

70,000

-

Balance at end of year

130,000,000 60,000,000

130,000

60,000

All shares rank equally with one vote attached to each fully paid ordinary share. Ordinary shares do not have a

par value. On wind‑up of the Company, all proceeds will be paid to the Shareholder.

On 21 February 2013, the Parent issued a further 70,000,000 shares at $1 per share to the Shareholder,

Waikato‑Tainui Te Kauhanganui Incorporated.

Consolidated and Parent

Consolidated and Parent