Notes to the Financial Statements

continued

62

The livestock consists of mixed age sheep, cattle and cows, which are held for dairy and dry stock farming.

M Gaustad from PGG Wrightson determined the fair value of sheep, cattle and cows at 31 March 2013 (2012:

C Heggie from PGG Wrightson). Both valuers provided valuations based on reference to market evidence of

current market prices less point‑of‑sale costs. At balance date there were 2,486 sheep, 471 cattle and 197

cows (2012: 2,864 sheep, 428 cattle and 161 cows).

The trees are comprised of a 374 hectare Pinus Radiata (2012: 374 hectares) forest planted from 1996 to

1997, 150 hectares Pinus Radiata (2012: 150 hectares) forest planted from 2001 to 2002 and 270 hectares of

Californian Coast Redwoods (2012: 270 hectares) planted from 2005 to 2007. It is expected that the rotation

age for the Pinus Radiata crop will be 27 years and 30 years for the Californian Coast Redwoods, at which time

the crop will be harvested. The 374 hectares and 150 hectares of Pinus Radiata was valued using the Crop

Expectation Value method at a 7.0% post‑tax discount rate to determine fair value, less point‑of‑sale costs. The

270 hectares of Californian Coast Redwoods was valued using current replacement cost method used for young

trees at a 7.0% compounded rate. The non‑current biological assets are held for investment. All non‑current

biological assets were valued by P Silcock from NZ Forestry Limited (2012: R H Webster from NZ Forestry

Limited valued 374 and 270 hectares and Alan Bell valued 150 hectares).

All valuers are independent registered valuers not related to the Company or Group. All valuers hold recognised

and relevant professional qualifications and have recent experience in the categories of biological assets they

have valued.

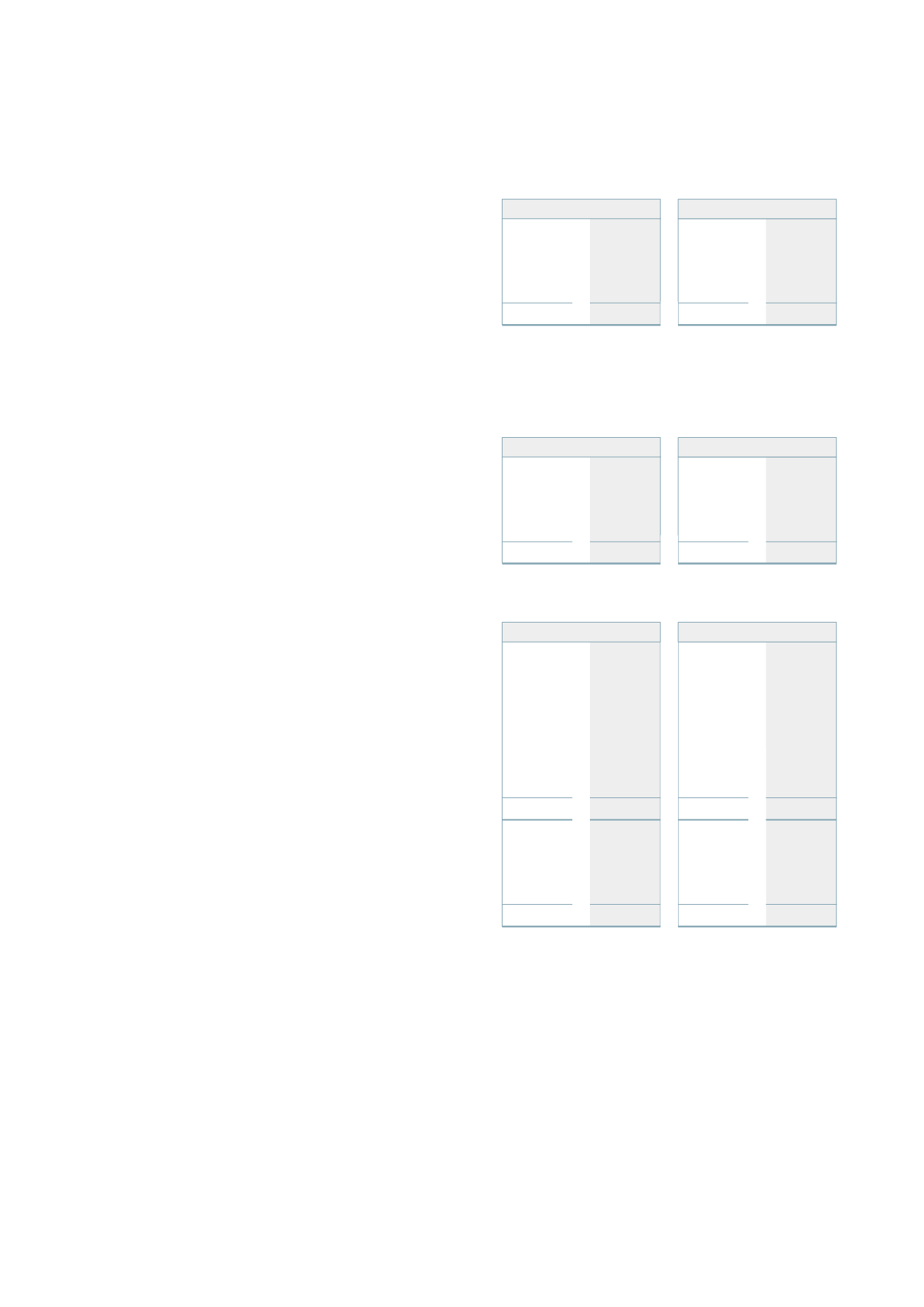

14 Biological assets

2013

2012

2013

2012

Notes

$’000

$’000

$’000

$’000

Current – livestock

Balance at beginning of year

1,082

843

1,082

843

Additions

200

160

200

160

Decreases due to sales

(566)

(614)

(566)

(614)

Changes in fair value

4

119

693

119

693

Balance at end of year

835

1,082

835

1,082

Non‑current – trees

Balance at beginning of year

3,191

2,694

-

-

Changes in fair value

8

1,276

497

-

-

Balance at end of year

4,467

3,191

-

-

Parent

Consolidated

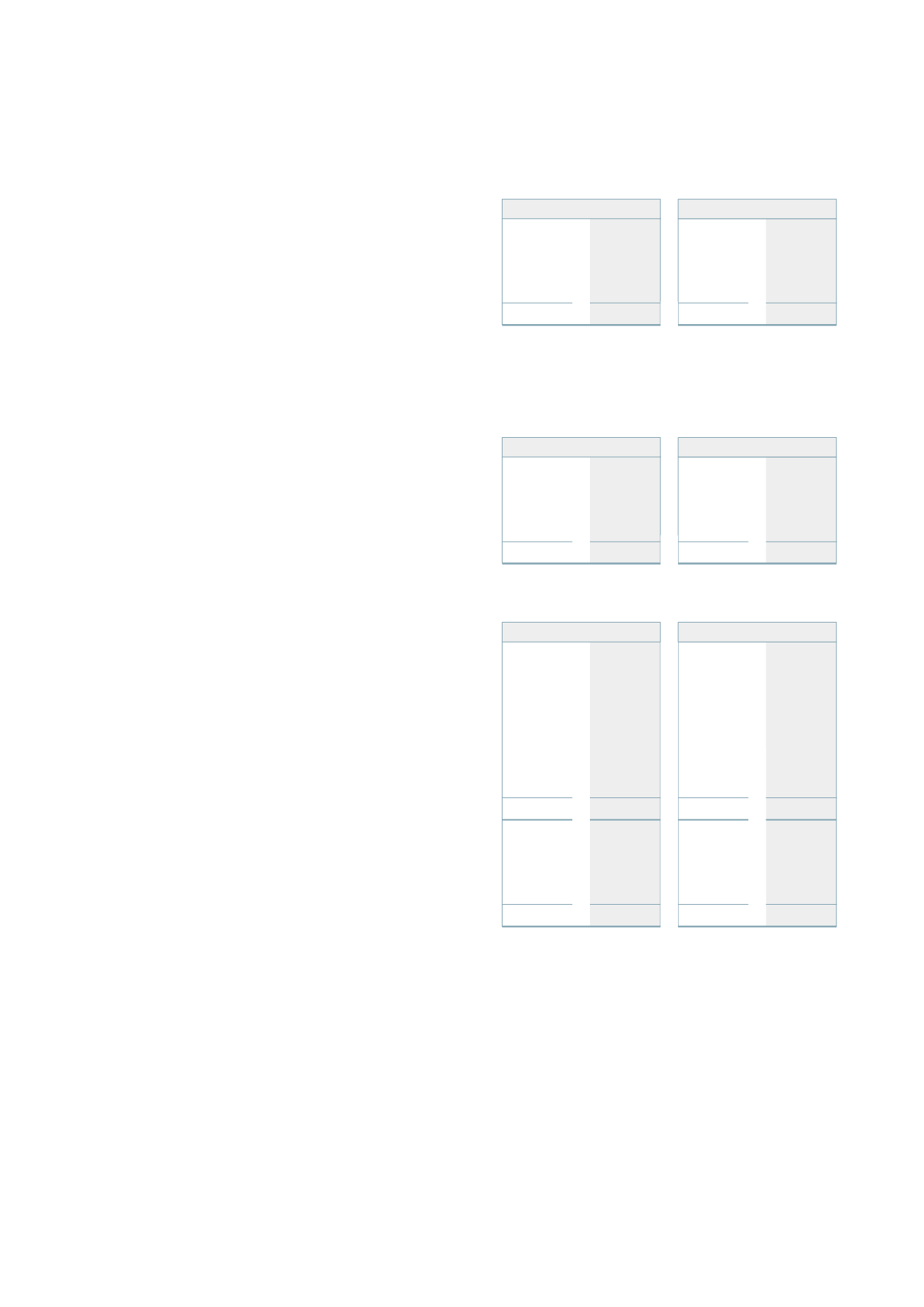

12 Inventories

2013

2012

2013

2012

Notes

$’000

$’000

$’000

$’000

Land – sections for sale

3,905

4,159

-

-

Other inventories at cost – food and beverage

36

43

-

-

3,941

4,202

-

-

The Bank of New Zealand currently holds a registered first mortgage over property situated at Huntington/

Gordonton Road, Hamilton. This property is part of the Callum Brae Tainui joint venture.

13 Trade and other receivables (non‑current)

2013

2012

2013

2012

Notes

$’000

$’000

$’000

$’000

Other receivables

458

466

-

-

Lease fitout contribution

1,159

821

-

-

1,617

1,287

-

-

Parent

Consolidated

Parent

Consolidated