Tainui Group Holdings

Annual Report

2013

69

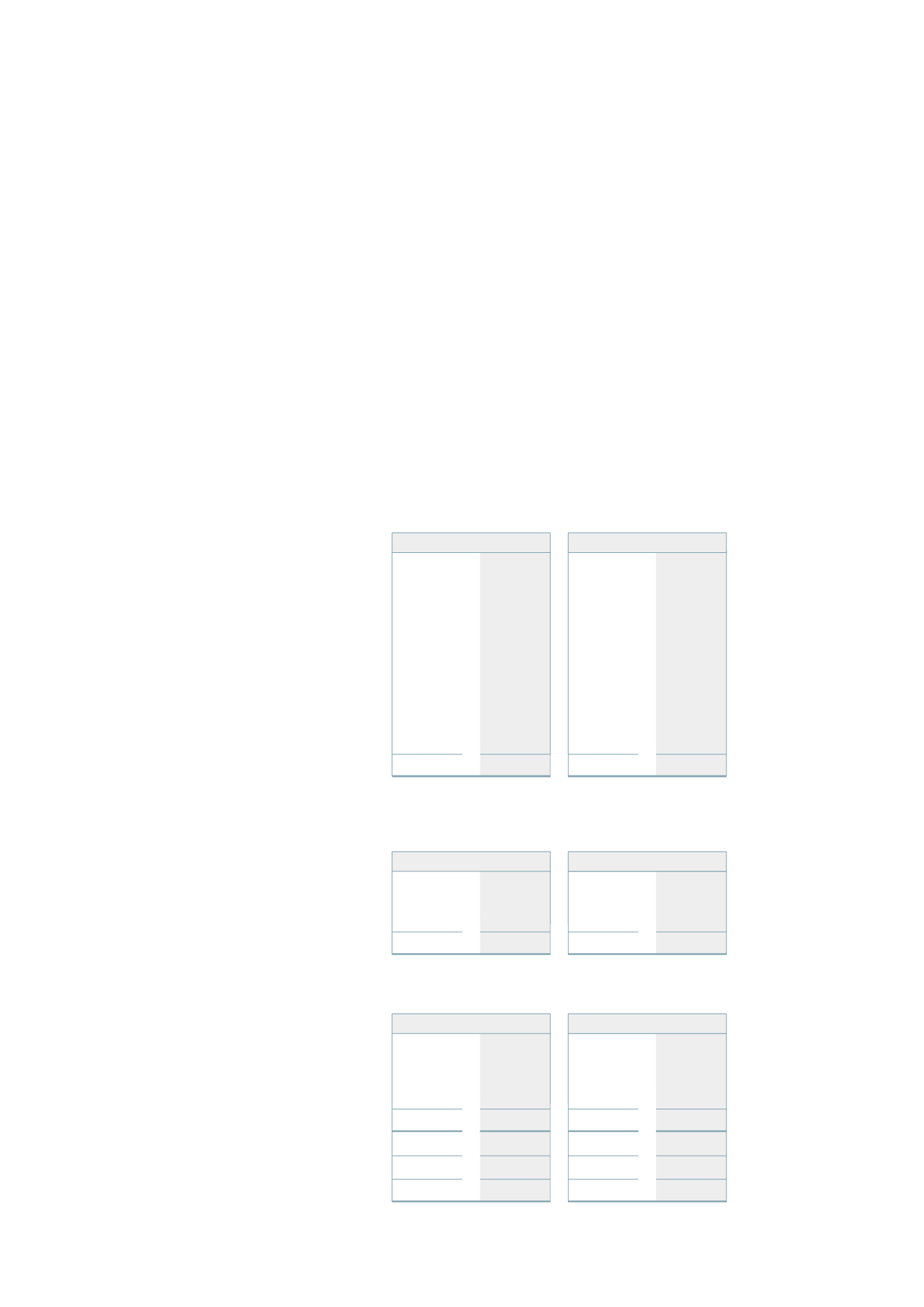

20 Trade and other payables

2013

2012

2013

2012

Note

$’000

$’000

$’000

$’000

Trade payables

810

2,092

15

1,284

Related party payables

15

7

-

4

-

Income received in advance

1,590

1,094

-

-

Accrued expenses

11,306

7,041

2,423

1,850

Employee entitlements

542

468

293

272

GST

742

346

-

-

Other payables

404

284

-

40

15,401

11,325

2,735

3,446

(31 March 2012: $107m) using a mixture of market evidence of transaction prices for similar properties, direct

comparison, capitalisation and discounted cash flow approaches.

K Sweetman from Colliers International NZ Limited valued properties at fair value of $75m on 31 March 2013

(31 March 2012: nil) using a mixture of market evidence of transaction prices for similar properties, direct

comparison, capitalisation and discounted cash flows approaches.

R. H. Martin from Property Valuations Limited valued properties at fair value of nil on 31 March 2013 (31 March

2012: $1m) using a mixture of market evidence of transaction prices for similar properties and the direct

comparison approaches.

R. Peters from Seagar & Partners valued properties at fair value of nil on 31 March 2013 (31 March 2012:

$2m) using a mixture of market evidence of transaction prices for similar properties and the direct comparison

approaches.

All valuers are independent registered valuers not related to the Company or Group. All valuers hold recognised

and relevant professional qualifications and have recent experience in the locations and categories of the

investment property they have valued.

The Group also incurred work in progress, which is held at cost, as at 31 March 2013 of $3m (2012: $6m) in

relation to the property located at The Base, Parent nil (2012: nil).

Parent

Consolidated

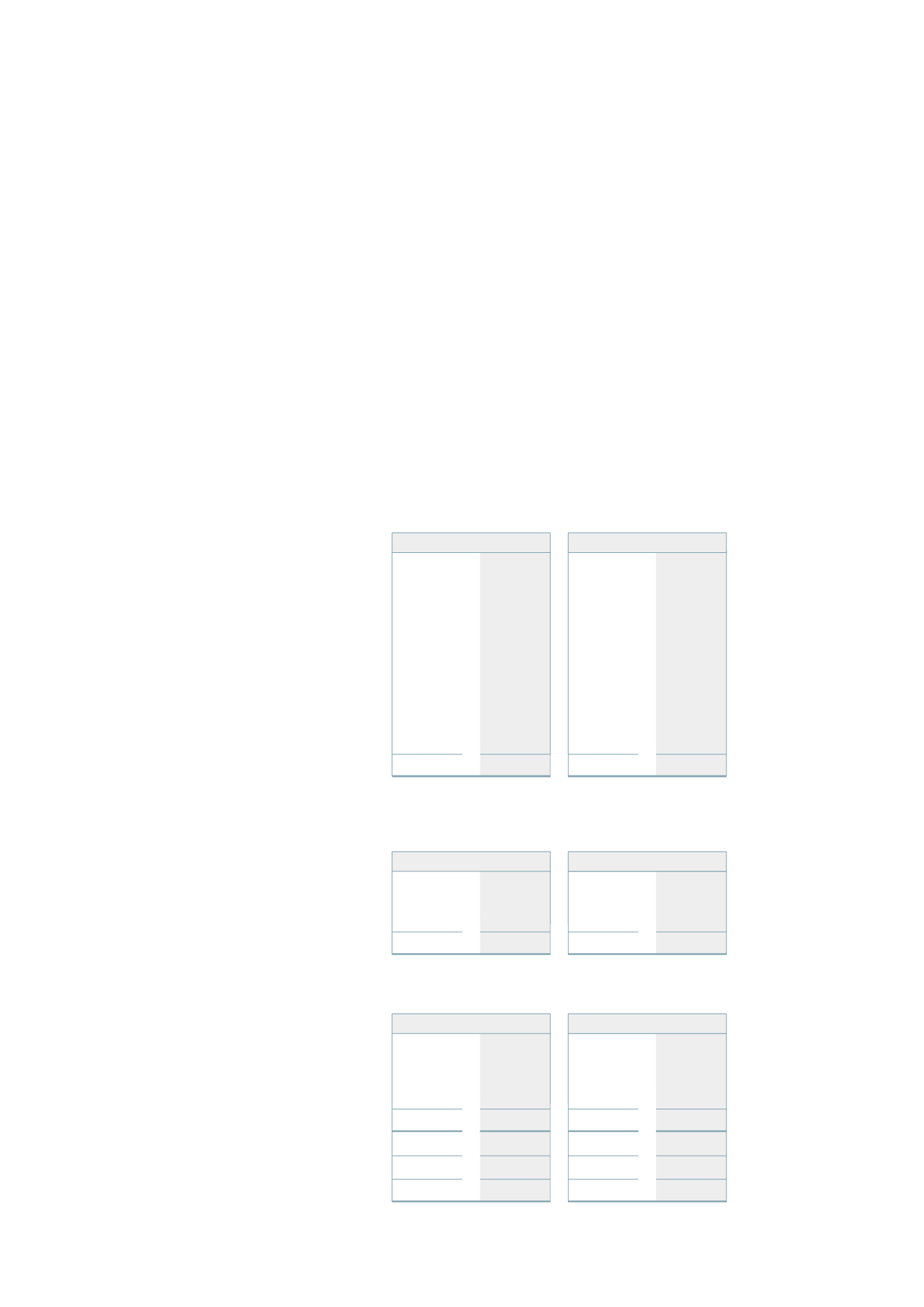

22 Interest bearing liabilities

2013

2012

2013

2012

$’000

$’000

$’000

$’000

Secured

Bank loans

30,336

30,228

30,336

30,228

Total current interest bearing borrowings

30,336

30,228

30,336

30,228

Bank loans

156,335

149,394

129,950

121,209

Total non‑current interest bearing liabilities

156,335

149,394

129,950

121,209

Total interest bearing liabilities

186,671

179,622

160,286

151,437

21 Trade and other payables (non‑current)

2013

2012

2013

2012

$’000

$’000

$’000

$’000

Income received in advance

1,131

-

-

-

1,131

-

-

-

Parent

Consolidated

Parent

Consolidated