Notes to the Financial Statements

continued

74

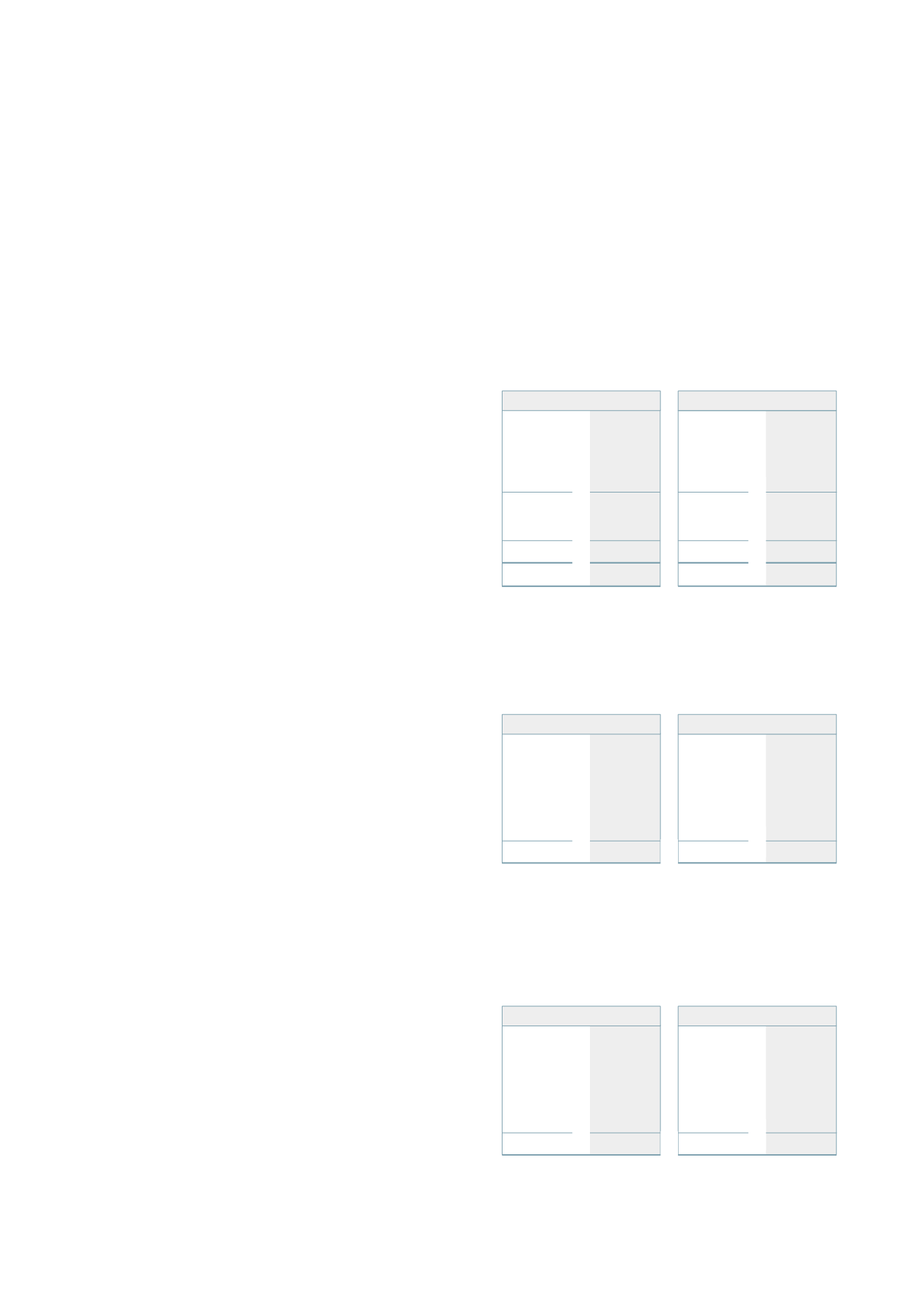

26 Leases

(a) Group and Company as lessee

Commitments for minimum lease payments/receipts in relation to non‑cancellable operating leases are

payable/receivable as follows:

2013

2012

2013

2012

$’000

$’000

$’000

$’000

Within one year

118

106

45

29

Later than one year but not later than five years

292

156

96

23

Later than five years

210

347

-

1

620

609

141

53

There are no options to purchase attached to any lease agreements.

The operating leases that exist between the Shareholder and the Company for land owned by the Shareholder

at The Base and the University of Waikato are rent free until the first rent review date which is in 2019 and

2022 respectively.

(b) Group and Company as lessor

The lease amounts due from leasees are as follows:

2013

2012

2013

2012

$’000

$’000

$’000

$’000

Within one year

32,820

31,518

1,743

2,000

Later than one year and not later than five years

96,984

104,238

6,858

8,000

Later than five years

117,269

139,239

48,401

58,942

247,073

274,995

57,002

68,942

The majority of lease agreements are renewable at the end of the lease period at market rates. There are no

options to purchase attached to any lease agreements.

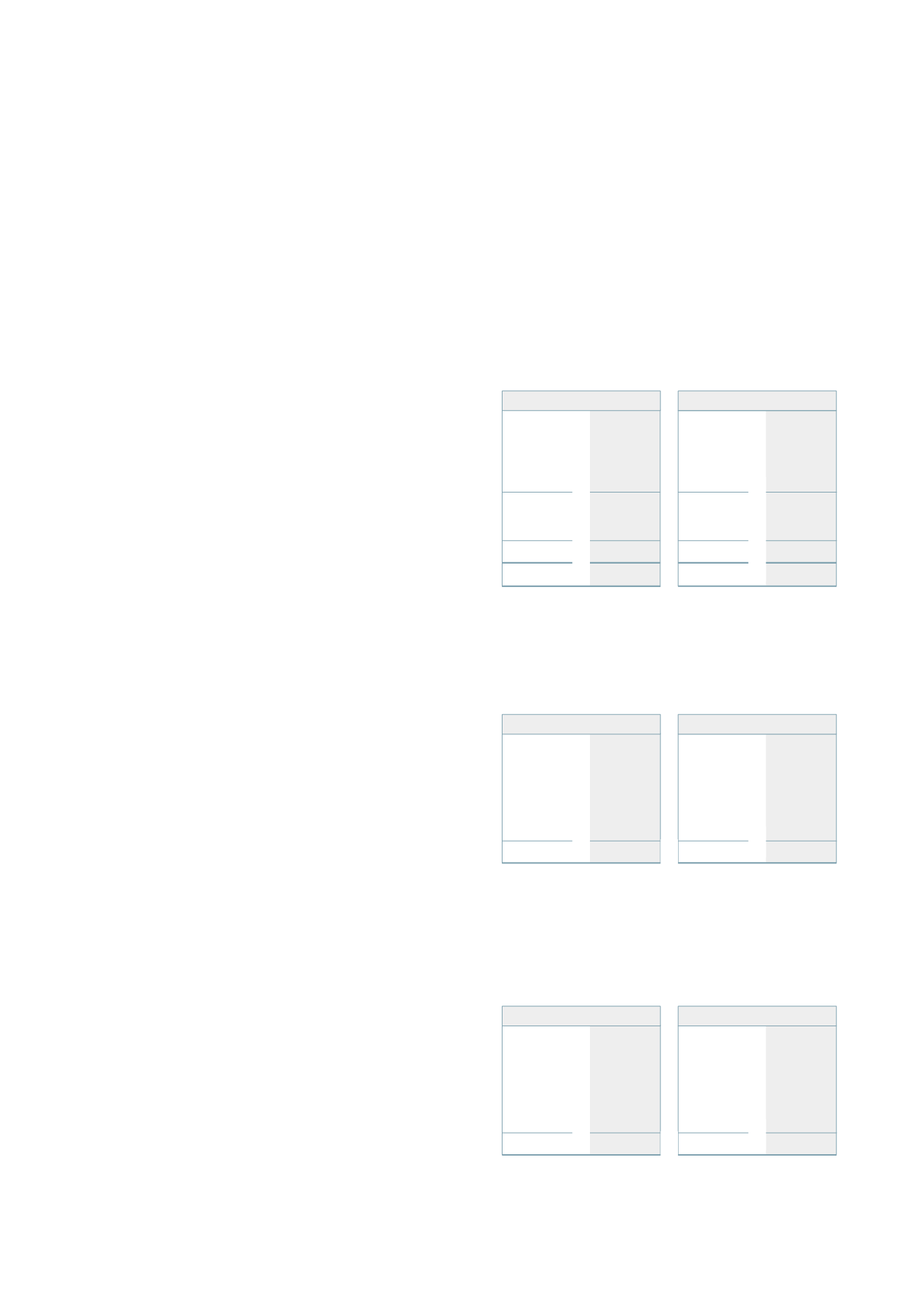

25.2 Capital risk management

The Group’s capital is its equity plus debt, which is comprised of contributed capital, retained earnings and

other reserves. Equity is represented by net assets. The Group manages its revenues, expenses, assets and

liabilities, investments and general financial dealings prudently. The Group’s equity is largely managed as a

by‑product of managing revenues, expenses, assets, liabilities, investments and general financial dealings. The

objective of managing the Group’s equity is to ensure the Group effectively achieves its objectives and purpose,

whilst remaining a going concern in order to provide returns for the Shareholder and to maintain an optimal

capital structure to reduce the cost of capital. In order to maintain or adjust the capital structure, the Group may

adjust the amount of dividend paid to the Shareholder, return capital to the Shareholder, issue new shares or sell

assets to reduce debt. The Group has not breached any bank covenants as required by the Bank of New Zealand

and Westpac New Zealand Ltd during the reporting period (2012: no breach). There are no externally imposed

capital requirements at balance date (2012: nil).

2013

2012

2013

2012

Note

$’000

$’000

$’000

$’000

Total borrowings

22 186,671

179,622

160,286

151,437

Less: cash and cash equivalents

(7,603)

(6,257)

(5,032)

(2,054)

Net debt

179,068

173,365

155,254

149,383

Total equity

476,911

373,883

343,483

78,459

Total capital

655,979

547,248

498,737

227,842

Gearing ratio

27%

32%

31%

66%

Parent

Consolidated

Parent

Consolidated

Parent

Consolidated