Te pŪrongo 2012

Notes to the financial statements (continued)

15.

Financial instruments

Financial instrument categories

The accounting policies for financial instruments have been applied to the line items below:

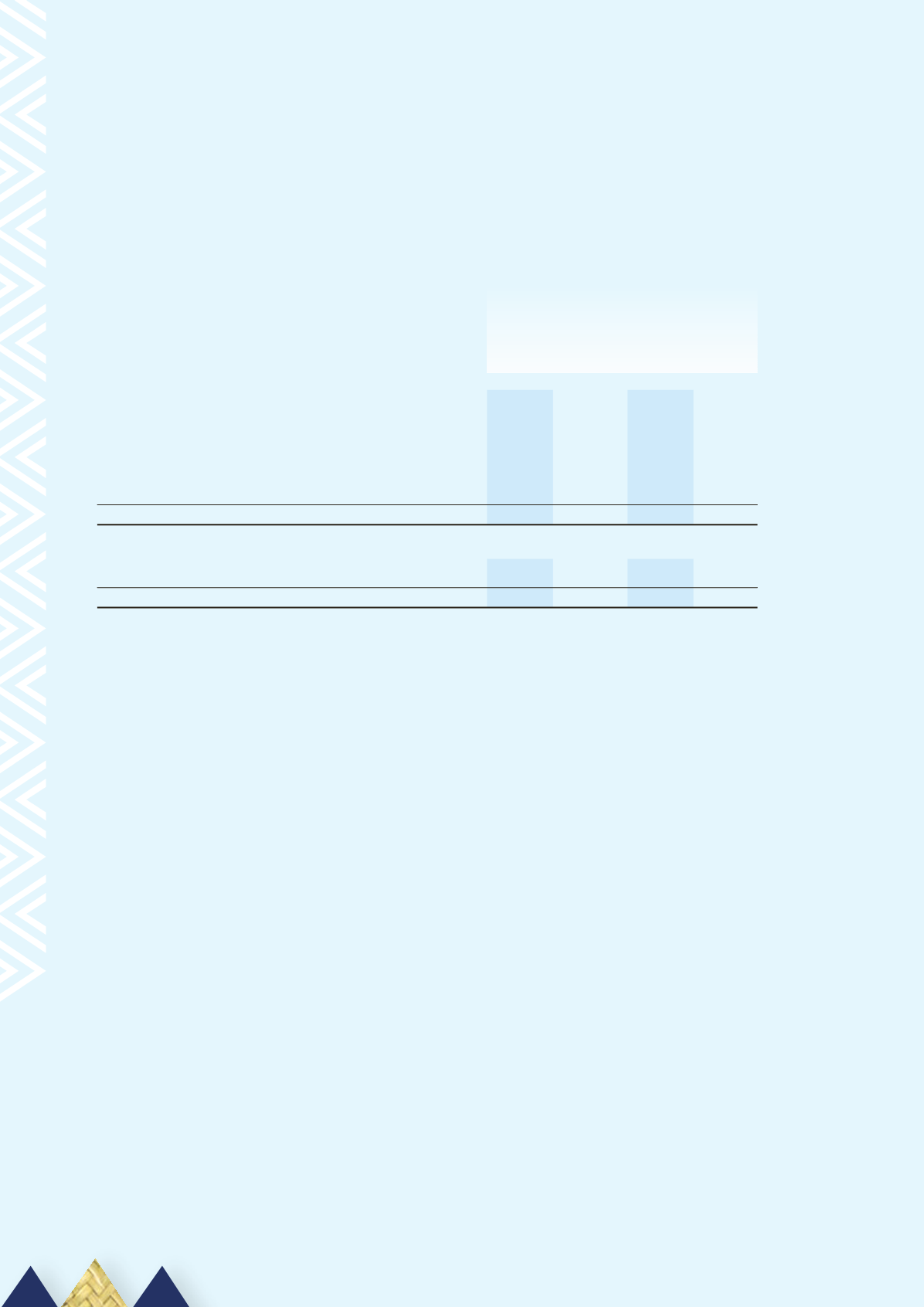

Group

Group Parent Parent

2012 2011 2012 2011

$000 $000 $000 $000

FINANCIAL ASSETS

Loans and receivables

Cash and cash equivalents

5,376 10,223

4,703

9,191

Debtors and other rereceivables

3,248

2,672

2,938

2,476

Other financial assets:

Term deposits

53,004 49,467 49,213 45,844

Total loans and receivables

61,628

62,362

56,854

57,511

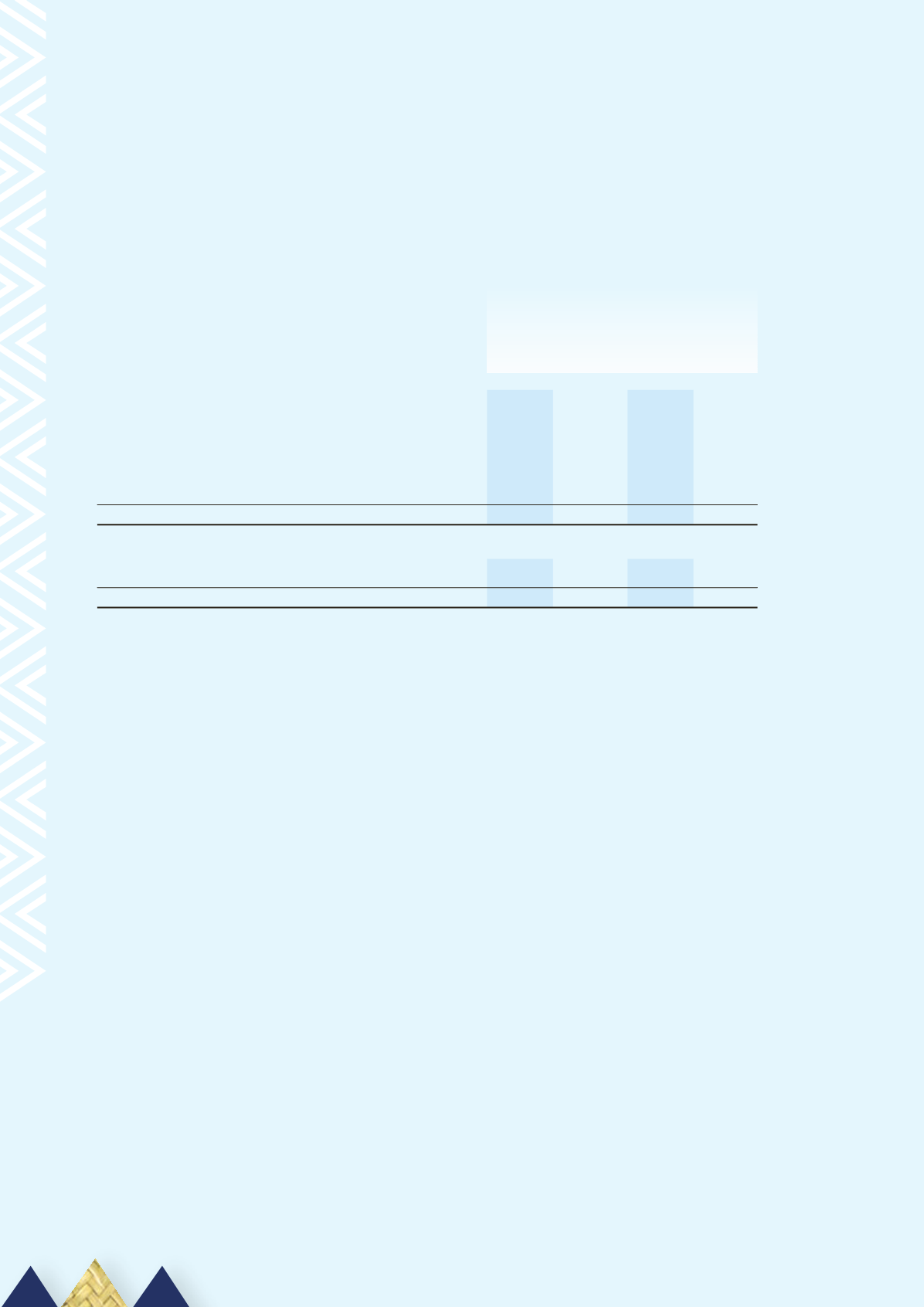

FINANCIAL LIABILITIES at amortised cost

Creditors and other payables

10,562 10,932 16,387 18,230

Total financial liabilities at amortised cost

10,562

10,932

16,387

18,230

Financial value hierarchy disclosures

For those instruments recognised at fair value on the statement of financial position, fair values are

determined according to the following hierarchy:

• Quoted market price - Financial instruments with quoted prices for identical instruments in active

markets;

• Valuation technique using observable inputs - Financial instruments with quoted prices for similar

instruments in active markets or quoted prices for identical or similar instruments in inactive markets

and financial instruments valued using models where all significant inputs are observable; and

• Valuation techniques with significant non-observable inputs - Financial instruments valued using

models where one or more significant inputs are not observable.

102