Te pŪrongo 2012

Notes to the financial statements (continued)

15 Financial instruments (continued)

(c)

Liquidity risk

Management of liquidity risk

Liquidity risk is the risk that Te Wānanga o Aotearoa will encounter difficulty raising liquid funds to meet

commitments as they fall due. Prudent liquidity risk management implies maintaining sufficient cash, the availability

of funding through an adequate amount of committed credit facilities and the ability to close out market positions.

Te Wānanga o Aotearoa aims to maintain flexibility in funding by keeping committed credit lines available.

Te Wānanga o Aotearoa has an overdraft facility of $1 million in place. ($1 million 2011).

There are no restrictions on the use of this facility.

Te Wānanga o Aotearoa manages liquidity risk by continuously monitoring forecast and actual cash

flow requirements.

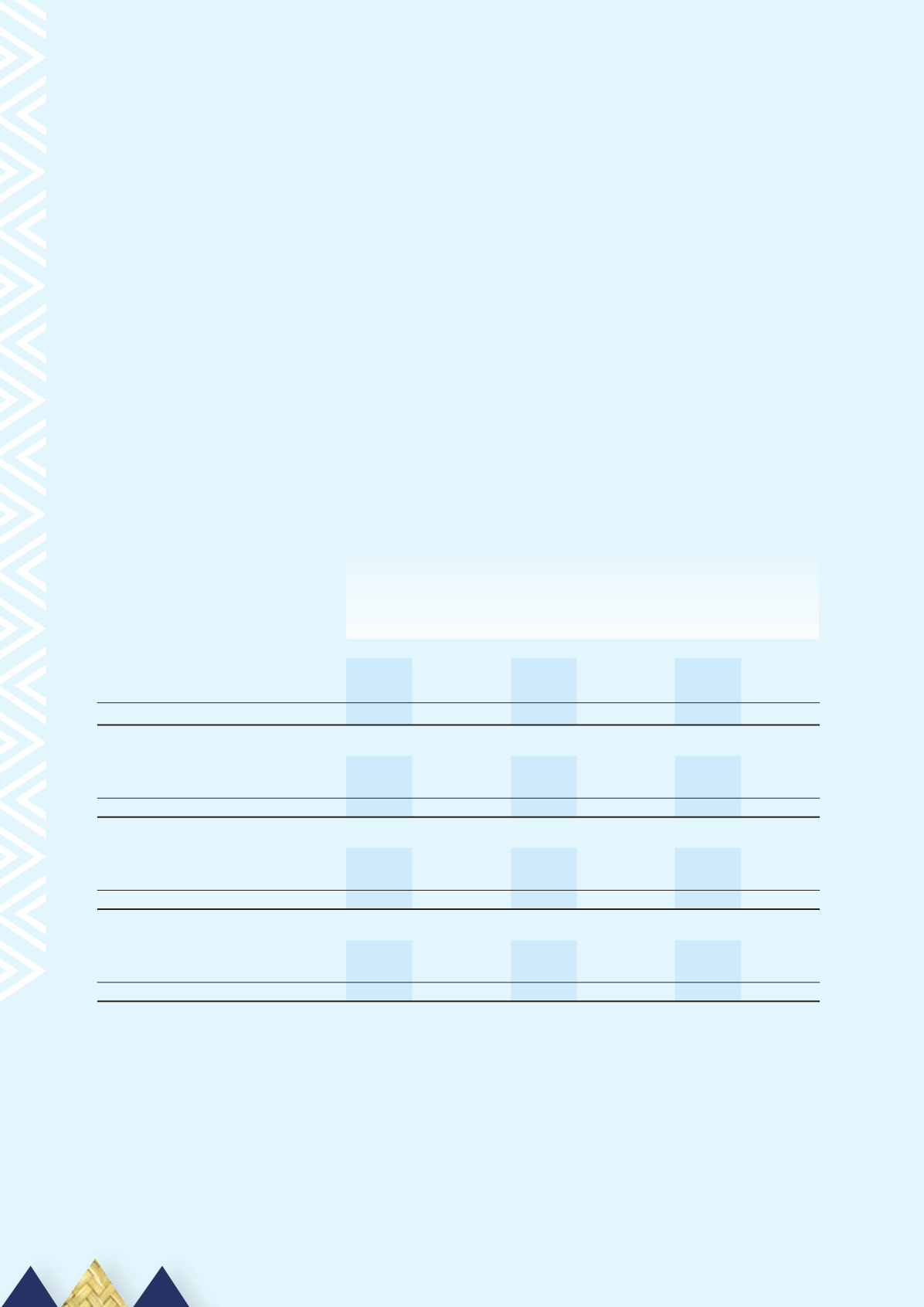

Contractual maturity analysis of financial liabilities

The table below shows an analysis of Te Wānanga o Aotearoa financial liabilities grouped according to maturity,

based on the remaining period at the balance date to the contractual maturity date. The amounts disclosed are the

contractual undiscounted cash flows.

Carrying Contractual Less than 1-2 years 2-5 years More than

amount cash flows

1 year

5 years

$’000

$’000 $’000 $’000

$’000 $’000

Group 2012

C

reditors and other payables

10,562

10,562

10,562

-

-

-

Accrued pay

390

390

390

-

-

-

Total

10,952

10,952

10,952

-

-

-

Parent 2012

Creditors and other payables

16,387

16,387

16,387

-

-

-

Accrued pay

222

222

222

-

-

-

Total

16,609

16,609

16,609

-

-

-

Group 2011

Creditors and other payables

10,932

10,932

10,932

-

-

-

Accrued pay

2,057

2,057

2,057

-

-

-

Total

12,989

12,989

12,989

-

-

-

Parent 2011

Creditors and other payables

18,230

18,230

18,230

-

-

-

Accrued pay

1,773

1,773

1,773

-

-

-

Total

20,003

20,003

20,003

-

-

-

104