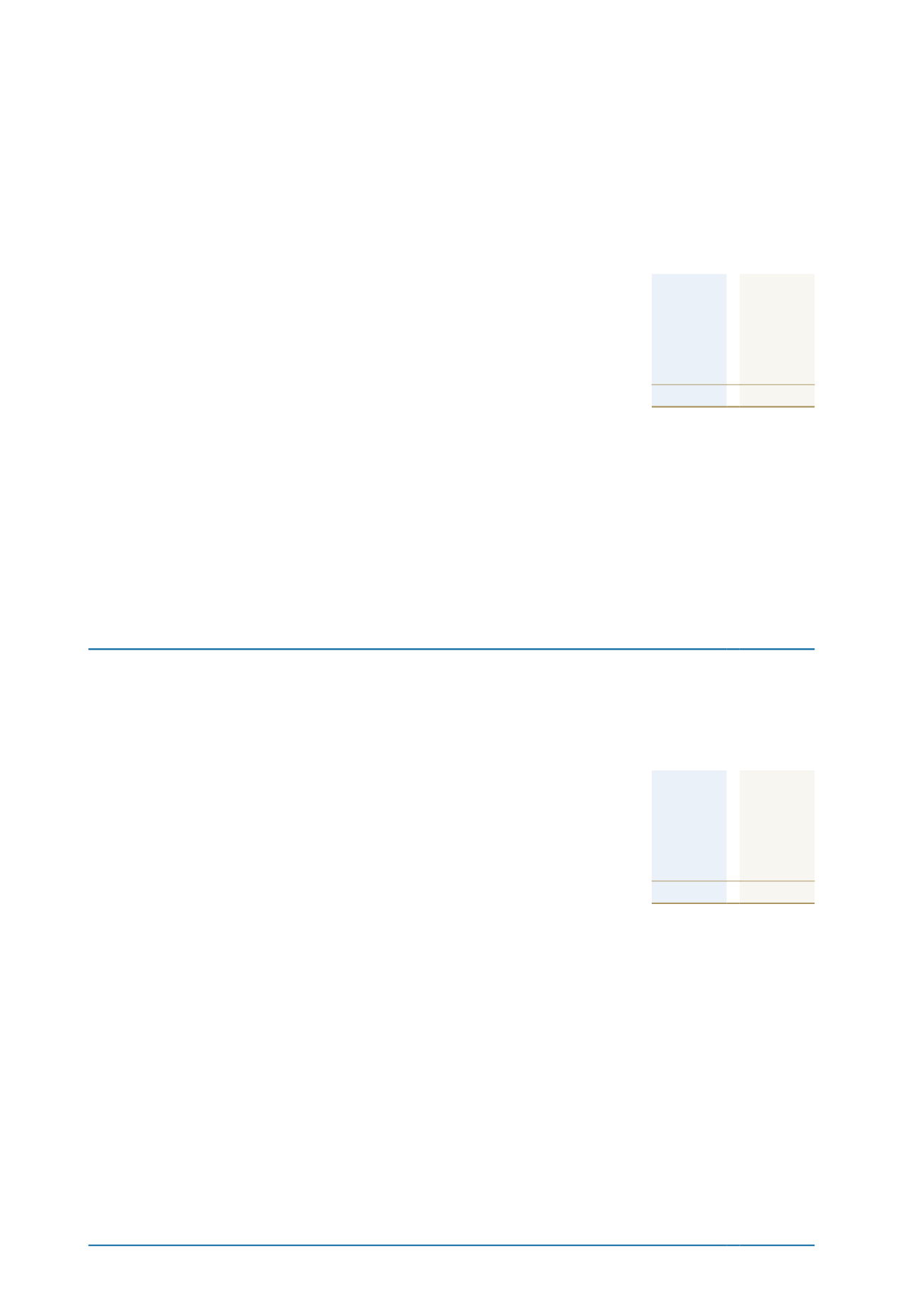

1 4 Ot h e r r e c e i v a b l e s ( non - c u r r e n t )

Consolidated

2015

$’000

2014

$’000

Relativity settlement receivable

76,401

19,000

Co-management settlement receivable

9,546

9,455

Other receivables

264

607

Provision for doubtful receivable

(264)

(450)

Lease fitout contribution

1,216

1,158

87,163

29,770

Relativity is the mechanism under which further settlement is recognised (see note 1 for details and note 2.3 (a) and 2.10 on

accounting policy for relativity settlement). A relativity settlement receivable of $76m has been recognised at 31 March 2015

(2014: $19m) based on the Group’s accounting policy. The receivable is not to be settled until 2017.

The Co-management settlement receivable is comprised of the Waikato Raupatu River Trust Co-management settlement

receivable. The Co-Management settlement receivable has been valued based on a discounted cash flow method using the

annual swap rates for the relative term. The swap rates applied range from 3.56% to 3.75% (2014: 3.63% to 5.08%). The Co-

Management funding settlement provided that an annuity of $1m be provided for 27 years effective from 2010. During the 2014

year, $11m was received for the Co-management debtor, which included the annuity of $1m plus an advance of $10m, reducing

the settlement period by 10 years.

1 5 Ot h e r f i n a n c i a l a s s e t s

Consolidated

2015

$’000

2014

$’000

Categorised as at fair value through profit or loss:

Call option agreement – property

-

647

Listed companies

12,881

1,957

Unlisted companies

14,238

10,883

Unlisted company – AFL income shares

10,521

10,521

37,640

24,008

(a) Listed companies

The fair value of shares in listed companies is the investment in Genesis Energy Limited and Fonterra Co-operative Group Limited.

(b) Unlisted companies

The fair value of shares in unlisted companies is represented by the investment in Pioneer Capital Partners LP. The investment

in Pioneer Capital Partners LP is based on the fair value of the Group’s investment. The fair value of the Group’s investment is

valued using common valuation methods such as discounted cash flow and comparable trading multiple methods as set out in the

International Private Equity and Venture Capital Valuation Guidelines.

(c) Unlisted companies – Aotearoa Fisheries Limited (AFL) income shares

The fair value of the AFL income shares is based a valuation undertaken by Toroa Strategy Limited. The valuation methodology

uses a mixture of historical performance, multiple earnings over a four year period, dividend streams and liquidity. Toroa Strategy

Limited is not related to the Group and holds recognised and relevant professional qualifications having had recent experience and

knowledge in the assets they have valued.

73

waikato-tainui

annual report 2015