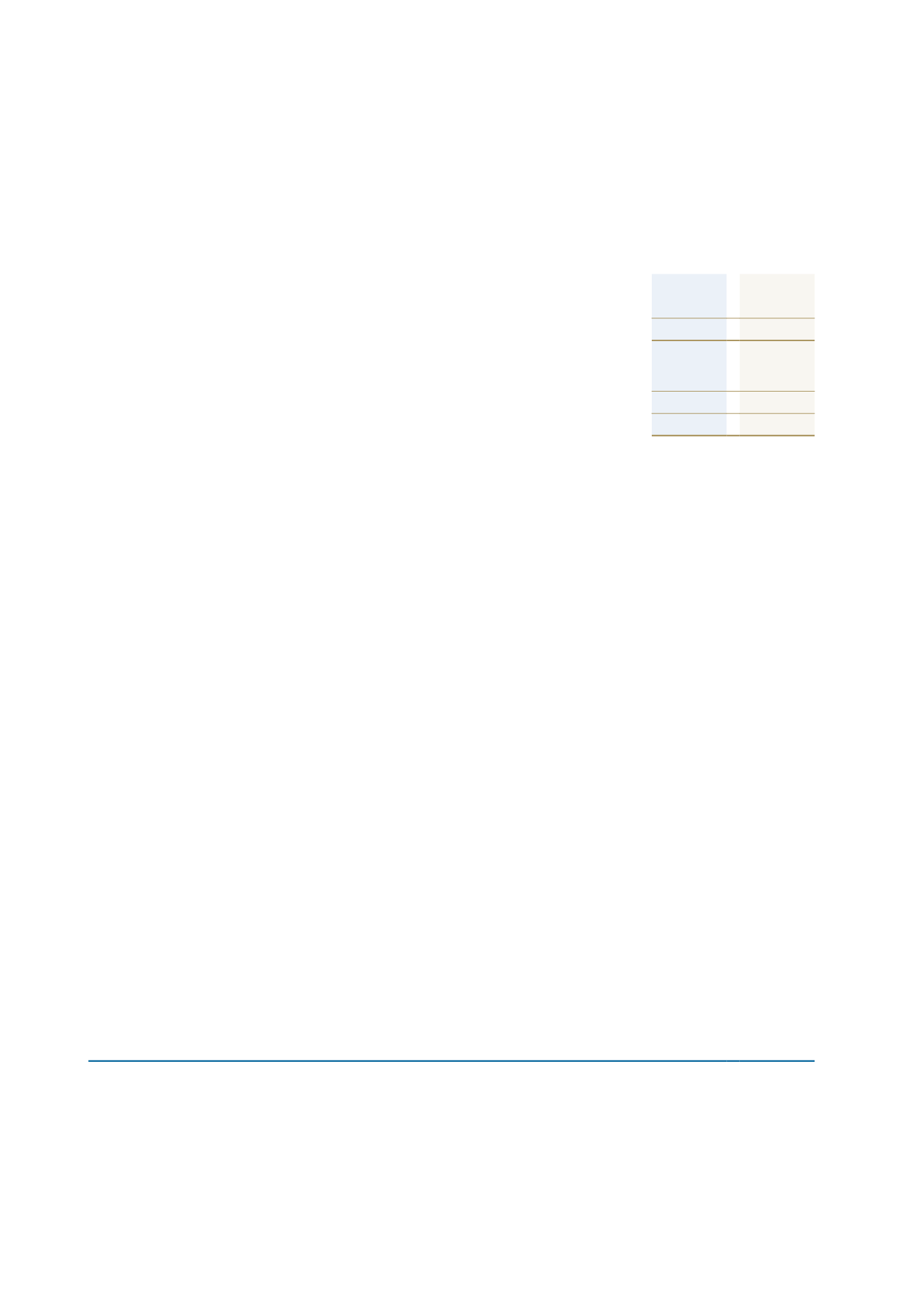

2 2 I n t e r e s t b e a r i n g l i a b i l i t i e s

Consolidated

2015

$’000

2014

$’000

Secured

Bank loans

4,460

-

Total current interest bearing borrowings

4,460

-

Secured

Bank loans

263,634

211,422

Total non-current interest bearing liabilities

263,634

211,422

Total interest bearing liabilities

268,094

211,422

During the year the Group (excluding the hotels) restructured its arrangements with all banks to align the debt facilities with

relevant subsidiary entities that have contributed towards the debt. This has resulted in a cost effective structure which has led to

a number of assets being released from unnecessary security (see also note 24.2).

Total interest bearing liabilities for the Group is net of prepaid borrowing costs of $0.03m (2014: $0.3m).

Tainui Group Holdings has a multi option credit facility agreement with Westpac New Zealand for $25m which matures on 31

December 2015 (2014: nil). Borrowings of $4.5m of the available facility had been drawn at balance date (2014: nil). As part of the

facility arrangement, Tainui Group Holdings has agreed to a negative pledge with Westpac New Zealand. In essence, this means

Tainui Group Holdings will not enter into any transaction or agreement that will increase Tainui Group Holdings indebtedness

without Westpac New Zealand’s prior consent.

The Base Limited has debt facilities of $210m (2014: nil). The facilities include a multi option credit line facility agreement with

Westpac New Zealand for $70.0m (2014: nil), a committed cash advance facility with Bank of New Zealand for $70m (2014:

nil) and term loan facility agreement with ANZ for $70m (2014: nil). All three facilities mature on 18 January 2020. Borrowings

of $194.7m of the available facilities had been drawn at balance date (2014: nil). ANZ, the Bank of New Zealand and Westpac

New Zealand have an equal charge over the present and future acquired assets of The Base Limited as security for the finance

facilities (2014: no charge). Tainui Development Limited has established a committed cash advance facility with Bank of

New Zealand for $25m which matures on 24 December 2017 (2014: nil). Borrowings of $24.7m had been drawn at balance date

(2014: nil). The Bank of New Zealand has a charge over the present and future acquired assets of Tainui Development Limited as

security for this finance facility (2014: no charge).

Tainui Auckland Airport Hotel holds a Committed Cash Advance Facility with Westpac New Zealand for $28m (2014: ASB Bank

- $33m) which matures 31 March 2019. Borrowings of $20.9m of the available facility had been drawn at balance date (2014:

$22.9m). Westpac New Zealand has a first and exclusive security agreement over the assets and undertakings of Tainui Auckland

Airport Hotel LP and Tainui Auckland Airport Hotel GP Limited.

Hamilton Riverview Hotel Limited holds a term loan with the Bank of New Zealand for $24m which matures 27 May 2019.

Borrowings of $23.3m (2014: $7m) of the available facility had been drawn at balance date. The Bank of New Zealand holds a first

and preferential security interest over all property owned by Hamilton Riverview Hotel Limited.

79

waikato-tainui

annual report 2015