2 4 F i n a n c i a l r i s k m a n a g e m e n t ( c on t i n u e d )

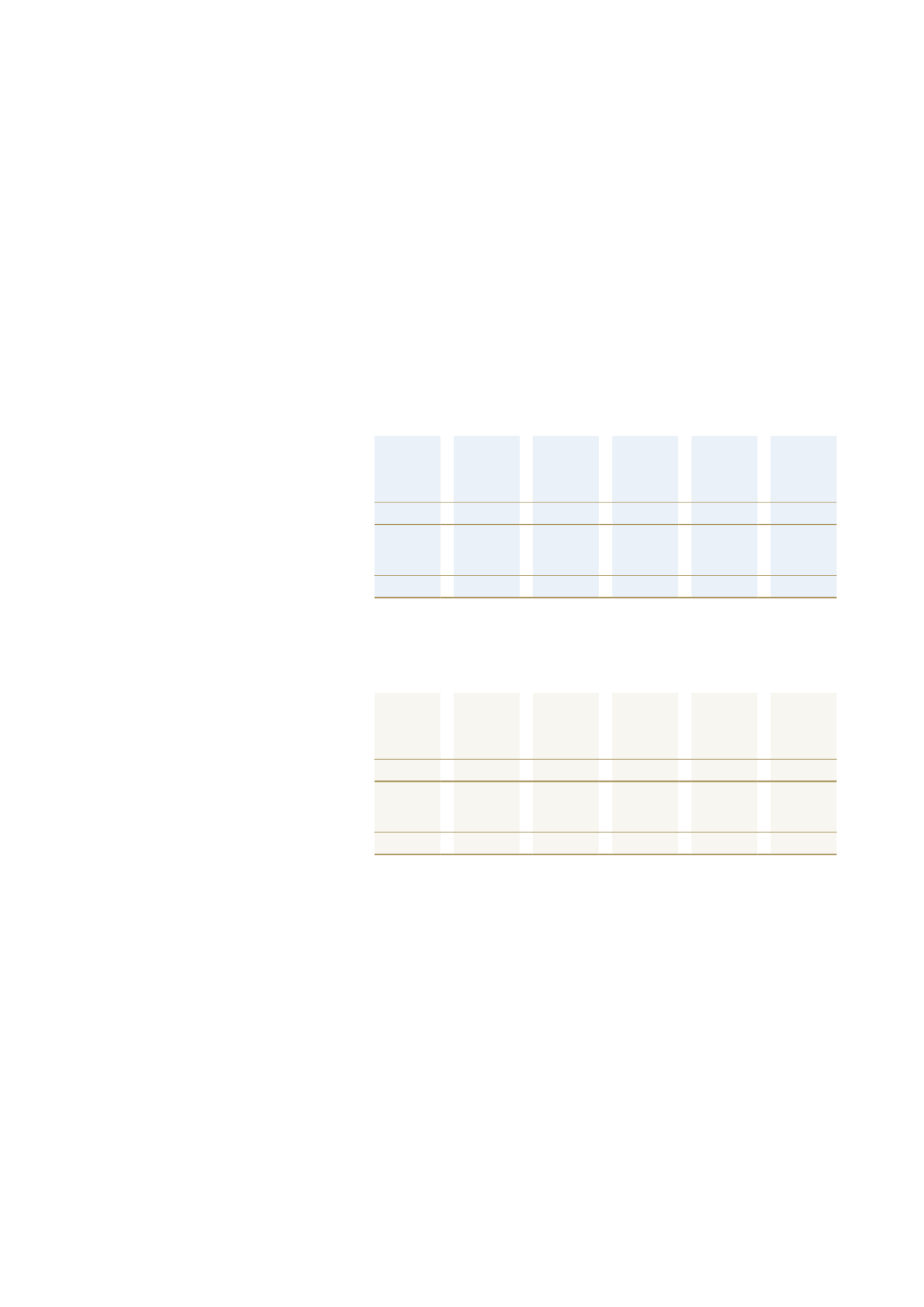

The table below analyses the Group’s financial liabilities that will be settled based on the remaining period at balance date to the

contractual maturity date. The amounts disclosed are the contractual undiscounted cash flows.

Maturities of financial liabilities

The tables below analyse the Group financial liabilities, net settled derivative financial instruments into relevant maturity

groupings based on the remaining period at the reporting date to the contractual maturity date. The amounts disclosed in the

table are the contractual undiscounted cash flows.

Consolidated – At 31 March 2015

Notes

Less than

1 year

$’000

Between 1

and 2 years

$’000

Between 2

and 5 years

$’000

Over 5

years

$’000

Total

contractual

cash flows

$’000

Carrying

Amount

liabilities

$’000

Non-derivatives

Trade and other payables

20

10,594

-

-

-

10,594

10,594

Borrowings

22

17,005

12,393

294,702

-

324,100

268,133

Total non-derivatives

27,599

12,393

294,702

-

334,694

278,727

Derivatives

Derivative financial instrument (outflows)

2,362

1,857

3,355

341

7,915

7,686

Total derivatives

23

2,362

1,857

3,355

341

7,915

7,686

Consolidated – At 31 March 2014

Notes

Less than

1 year

$’000

Between 1

and 2 years

$’000

Between 2

and 5 years

$’000

Over 5

years

$’000

Total

contractual

cash flows

$’000

Carrying

Amount

liabilities

$’000

Non-derivatives

Trade and other payables

20

22,763

-

-

-

22,763

22,763

Borrowings

22

8,678

58,554

172,810

-

240,042

211,755

Total non-derivatives

31,441

58,554

172,810

-

262,805

234,518

Derivatives

Derivative financial instrument (outflows)

2,012

2,052

2,474

390

6,928

5,048

Total derivatives

23 2,012

2,052

2,474

390

6,928

5,048

(d) Fair value estimation

The fair value of financial instruments traded in active markets is based on quoted market prices at balance date. The quoted

market price used for financial assets held by the Group is the current bid price, with the exception of investment in subsidiaries

and joint ventures.

Investment in subsidiaries and joint ventures do not have a quoted market price in an active market and the fair value cannot be

reliably measured.

The carrying value less impairment provision of trade receivables and payables are assumed to approximate their fair values due

to their short term nature. The fair value of financial liabilities for disclosure purposes is estimated by discounting the future

contractual cash flows at the current market interest rate that is available to the Group for similar financial instruments.

There are no financial liabilities with a carrying value different to their fair value.

waikato raupatu lands trust

notes to the financial statements

f o r t h e y e a r e n d e d 3 1 m a r c h 2 0 1 5

82