2 7 Con t i n g e n c i e s

(a) Contingent assets

The Trust had contingent assets at 31 March 2015 in respect of:

There is a contingent asset at balance date in respect of the Relativity Settlement mechanism (refer to Note 1, 2.10 and 14). The

mechanism was triggered in 2012 and the amount of $70m was received in December 2013 upon the first claim being made

under the relativity clause. Further to this in the year ended 31 March 2015 an amount of $12.5m was received as a result of the

arbitration process which followed the first claim.

The Trust is still in an ongoing dispute in relation to the first claim made in 2012. The dispute relates to interpretations of specific

clauses in Deed of Settlement and valuation of Total Redress Amounts. The final amount of the disputed receivable is contingent

on agreement being reached and cannot be reliably measured.

(b) Contingent liabilities

Guarantees

The Group had contingent liabilities at 31 March 2015 in respect of:

Raukura Whare Limited has agreed to underwrite certain Housing Corporation of New Zealand mortgages. Raukura Whare Limited

is liable for any mortgages which default if total claims exceed $23.3m. The life of the loan is 20 years. Te Arataura believe that

the expectation of defaulting mortgages exceeding $23.3m is remote.

The Trust has first priority security of $15m over the present and future undertakings, property, assets, revenues and capital of

Raukura Moana Seafoods Limited, TGH Fixed Income Limited, TGH Property Limited and Tainui Group Holdings Limited. Each

company jointly and severally, unconditionally and irrevocably guarantees to the Trust all secured monies.

Te Arataura believe that the expectation of a liability arising due to the guarantees and mortgages in place is remote.

2 8 Comm i t m e n t s

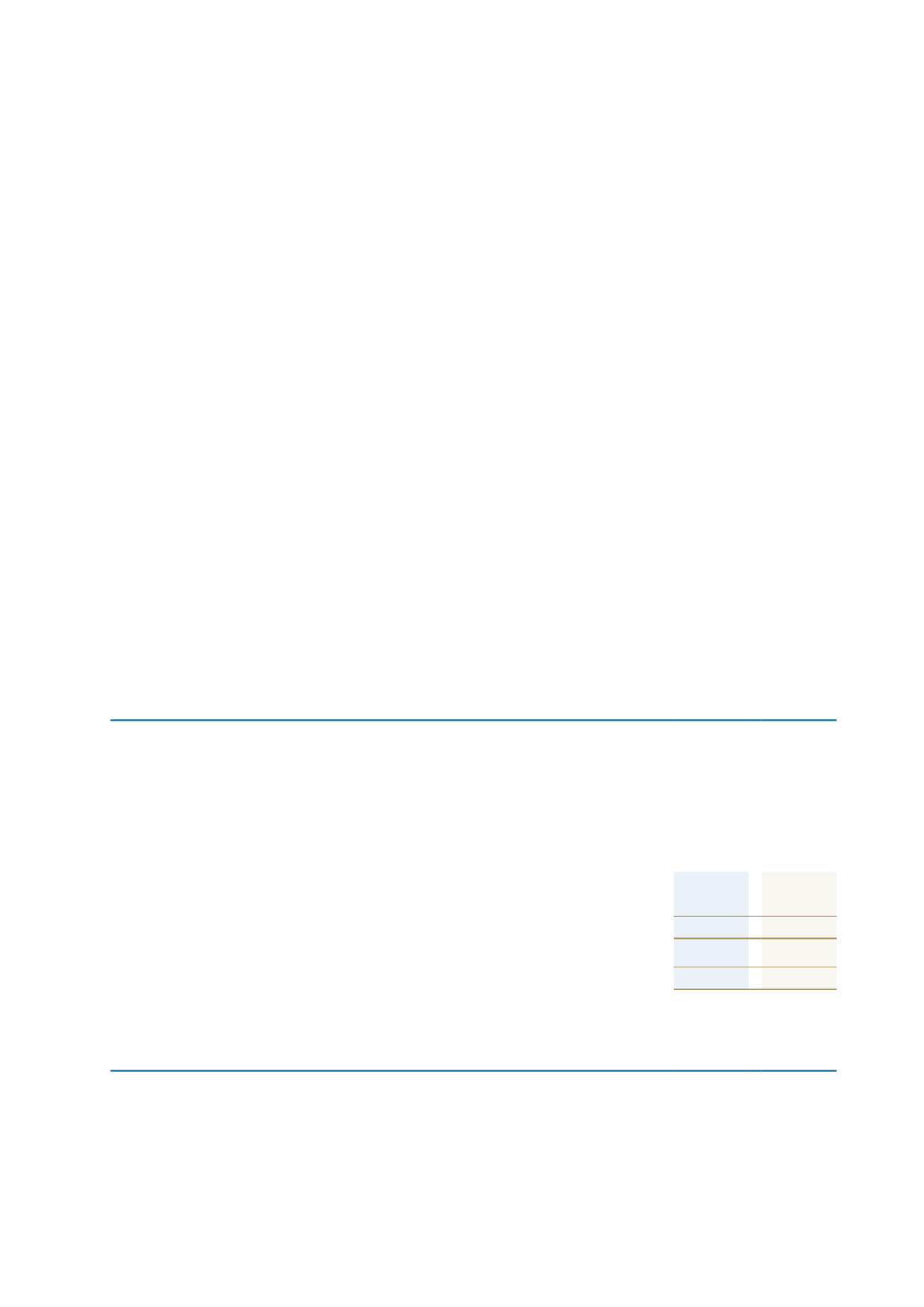

Expenditure contracted for at the reporting date but not recognised as liabilities is as follows:

Consolidated

2015

$’000

2014

$’000

Property, plant and equipment

-

894

Investment properties

-

1,742

-

2,636

Other

8,477

17,854

8,477

17,854

Other commitments are for Tainui Group Holdings Limited and include the capital call commitment for investment in Pioneer

Capital for $7.4m, and livestock purchased for $1.1m (2014: Pioneer $8.2m, Genesis Energy shares $8.3m and livestock $1.4m).

2 9 E v e n t s s u b s e q u e n t t o t h e r e p o r t i n g p e r i o d

At a special general meeting of AFL on 4 June 2015, it was resolved that Iwi will hold all voting and income shares in AFL. The

Group currently owns 5.48% of the AFL income shares. Once the legislative changes are made to the Mâori Fisheries Act, 2004,

the Group will own 6.85% of both AFL voting and income shares. This is expected to have positive impact on fair value of AFL.

waikato raupatu lands trust

notes to the financial statements

f o r t h e y e a r e n d e d 3 1 m a r c h 2 0 1 5

88