3 1 I m p a c t s o f c h a n g e s i n a c c o u n t i n g p o l i c y

Due to the voluntary change in accounting policy (see note 2.2), the Group has accounted for its investments in joint ventures

using equity method.

The Group recognised its investments in the joint ventures at the beginning of the earliest period presented (1 April 2013), as the

total of the carrying amounts of the assets and liabilities that were previously proportionally consolidated by the Group. This is

deemed cost of the Group’s investment in the joint ventures for applying equity accounting.

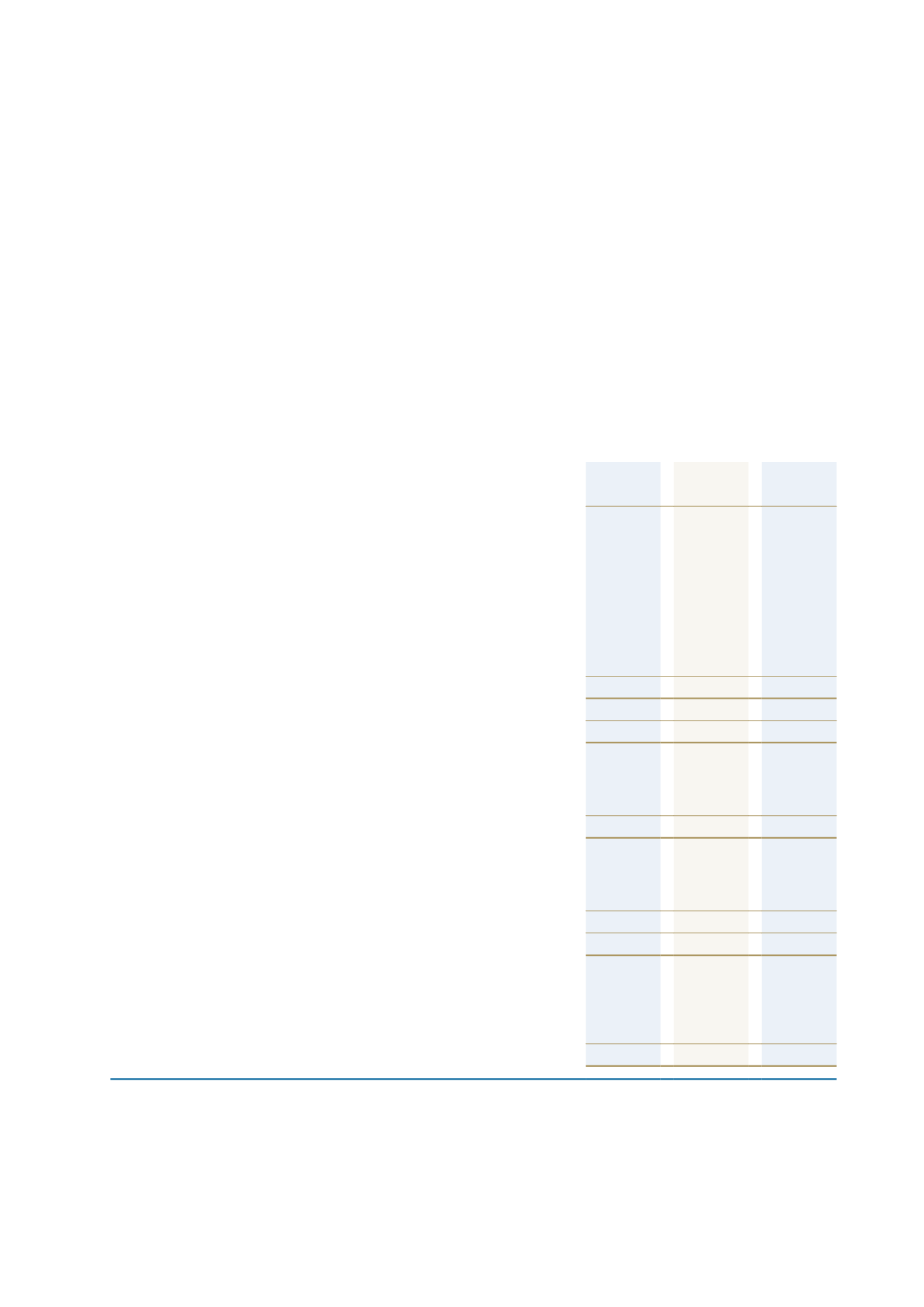

Impact of change in accounting policy on statement of comprehensive income

For year

ended 31

March 2014

(previously

reported)

$’000

Equity

accounting

for joint

ventures

$’000

For year

ended 31

March 2014

(restated)

$’000

Income

78,158

(4,699)

73,459

Expenses

(48,996)

4,180

(44,816)

Net operating profit

29,162

(519)

28,643

Finance costs – bank loans

(13,594)

-

(13,594)

Finance income – short term deposits

6,581

(53)

6,528

Shares of net profits of associates and joint venture partnership accounted for using the equity

method

474

586

1,060

Other gains – net

31,862

(14)

31,848

Settlement

20,943

-

20,943

Grant expense

(6,136)

-

(6,136)

Net profit before tax

69,292

-

69,292

Tax credit

1,582

-

1,582

Net profit for the year

70,874

-

70,874

Profit is attributable to:

Equity holders of Tainui Group Holdings Limited

69,453

-

69,453

Non-controlling interest

1,421

-

1,421

70,874

-

70,874

Other comprehensive income:

Items that will not be reclassified to profit or loss:

Gain on revaluation of farm and owner occupied properties

3,070

-

3,070

Other comprehensive income for the year

3,070

-

3,070

Total comprehensive income for the year, net of tax

73,944

-

73,944

Total comprehensive income for the year is attributable to:

Equity holders of Tainui Group Holdings Limited

72,523

-

72,523

Non-controlling interest

1,421

-

1,421

73,944

-

73,944

waikato raupatu lands trust

notes to the financial statements

f o r t h e y e a r e n d e d 3 1 m a r c h 2 0 1 5

92