During the year the Group (excluding the hotels) restructured its arrangements with all banks to align the debt facilities with

relevant subsidiary entities that have contributed towards the debt. This has resulted in a cost effective structure which has led to

a number of assets being released from unnecessary security (see also note 22).The Group debt reported is $268m (2014: 211m)

(see note 22). As at 31 March 2015 Tainui Group Holdings Limited’s debt was $224m (2014: $182m) or 26% of total assets held

by Tainui Group Holdings Limited. Tainui Group Holdings Limited’s policy is that debt cannot exceed more than 30% of total

assets. The Group has not breached any bank covenants as required by the ANZ, ASB Bank, Bank of New Zealand and Westpac

New Zealand Limited during the reporting period (see note 22) (2014: no breach). There are no externally imposed capital

requirements at balance date (2014: nil).

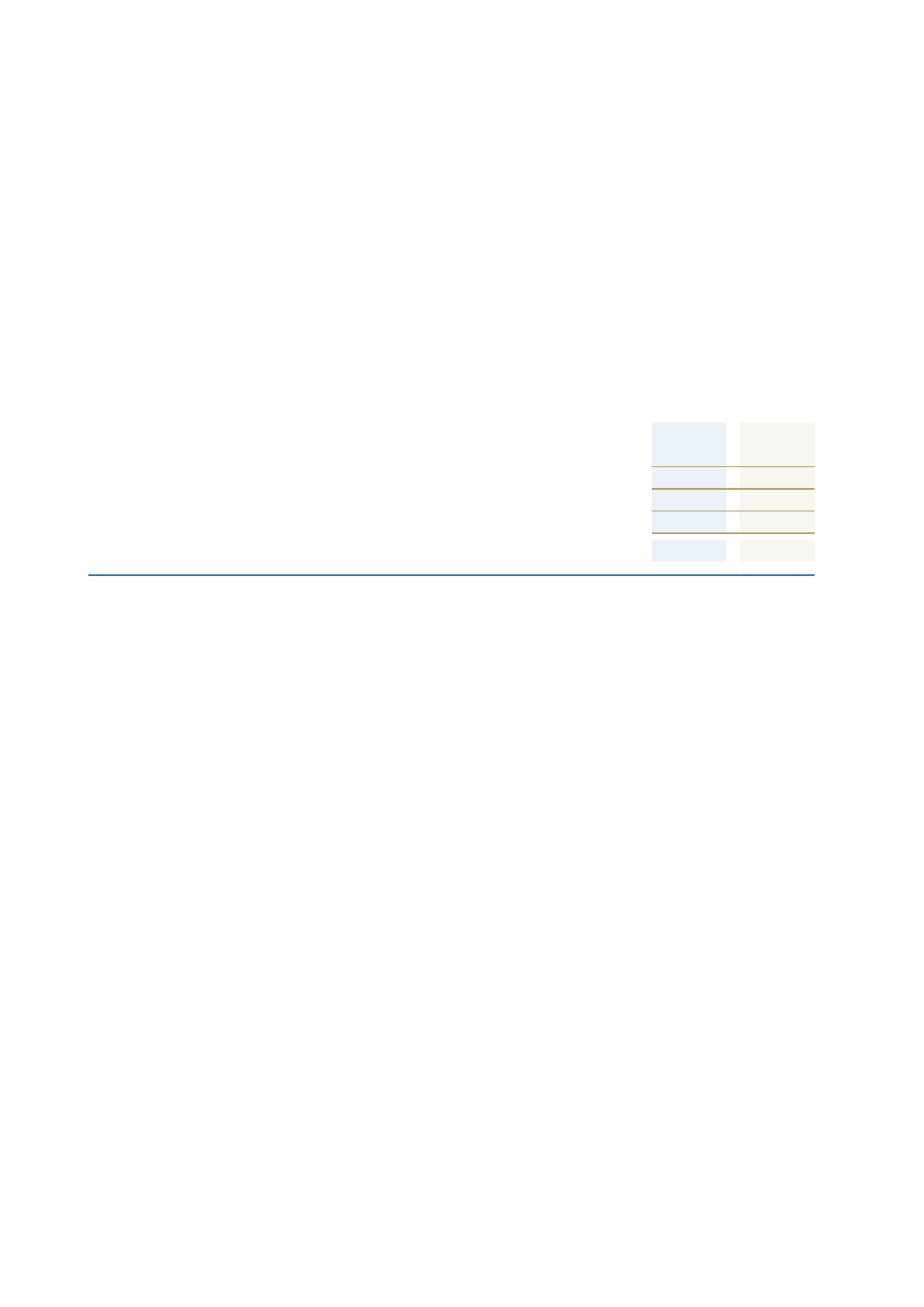

Consolidated

Notes

2015

$’000

2014

$’000

Total borrowings

22

268,094

211,422

Less: cash and cash equivalents

(176,959)

(171,470)

Net debt

91,135

39,952

Total equity

861,561

783,724

Total capital

952,696

823,676

Gearing ratio

10%

5%

2 5 B u s i n e s s c om b i n a t i on s

(a) Summary of acquisitions

On 16 October 2013, Tainui Development Limited acquired 41% of the share capital of Hamilton Riverview Hotel Limited

taking its total shareholding to 82%. Hamilton Riverview Hotel Limited owns and operates the Novotel Tainui and Ibis Tainui in

Hamilton. Details as at 31 March 2014 of the fair value of the assets and liabilities determined on a provisional basis are provided

in Note 25(b). There were no changes to provisional accounting in the year ended 31 March 2015.

In May 2014 the Group acquired the remaining 18% of the issued shares of Hamilton Riverview Hotel Limited for a purchase

consideration of $5m. The Group now holds 100% of the equity share capital of Hamilton Riverview Hotel Limited. The carrying

amount of the non-controlling interest in Hamilton Riverview Hotel Limited on the date of acquisition was $5.9m. The group de-

recognised the non-controlling interest and recorded the difference between the consideration paid and value of net assets as at

the acquisition date in retained earnings. Details as at 31 March 2015 of the purchase are provided in Note 25(c).

85

waikato-tainui

annual report 2015