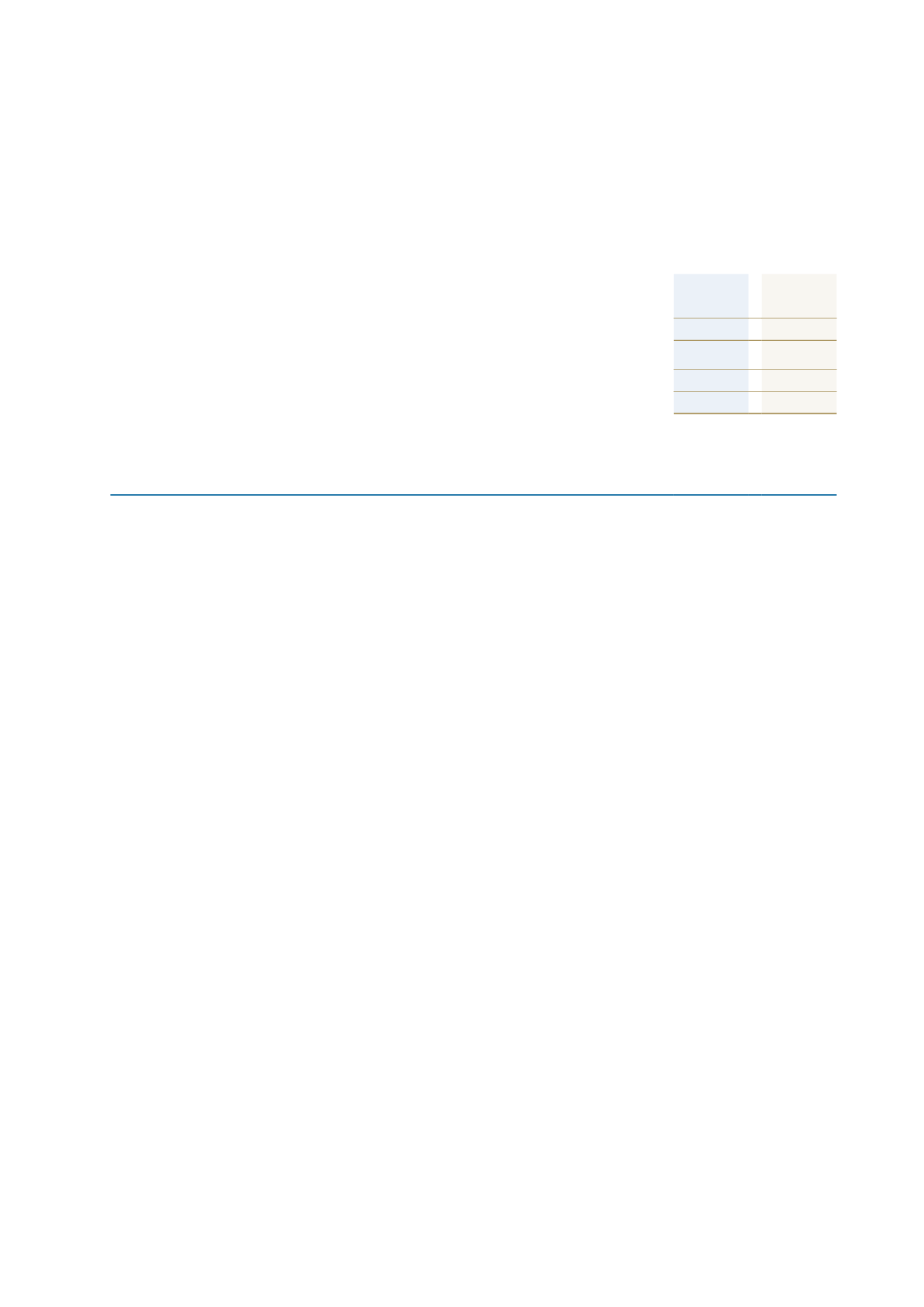

2 3 Ot h e r f i n a n c i a l l i a b i l i t i e s

Consolidated

2015

$’000

2014

$’000

Categorised as at fair value through profit or loss

Interest rate swaps

1,635

1,355

Total current other financial liabilities

1,635

1,355

Interest rate swaps

6,051

3,693

Total non-current other financial liabilities

6,051

3,693

7,686

5,048

The notional amount of interest rate swaps is $193m with maturity dates that range from 1-8 years (2014: $144m, maturing

between 1-8 years).

2 4 F i n a n c i a l r i s k m a n a g e m e n t

24.1 Financial risk factors

Exposure to credit, liquidity and market (currency, interest and price) risks arise in the normal course of the Group’s business. The

Group has various financial instruments with off-balance sheet risk.

Senior management are required to identify and report major risks affecting the business and develop strategies to mitigate these

risks. The board reviews and approves overall risk management strategies covering specific areas.

(a) Credit risk

Credit risk is the risk that a third party will default on its obligations to the Group, causing the Group to incur a loss. The Group

does not have any significant concentrations of credit risk, other than the relativity settlement receivable and the co-management

settlement receivable expected from the Crown (see also note 14). The maximum exposure to credit risk at reporting date is the

carrying amount of the financial assets as shown in the statement of financial position. The Group does not require any collateral

or security to support financial instruments as it only deposits with, or lends to, banks and other financial institutions with high

credit ratings except for funds lent to a related party and an external entity for which the Group has appropriate security and

guarantees. The Group further minimises credit exposure by limiting the amount of surplus funds placed with any one financial

institution. The cash and cash equivalents of $177m (2014: $171m) are held with bank and financial institution counterparties,

which are rated AA- to A+, based on Standards and Poors ratings. The Group does not expect non-performance of any obligations

at balance date. There are no material financial assets held by the Group at balance date which are past due but not impaired.

(b) Market risk

(i) Currency

The Group has no material exposure to currency risk at balance date.

There are no notional principal or forward foreign exchange contracts at 31 March 2015 (2014: nil).

(ii) Interest rate risk

The Group’s interest rate risk arises from long-term borrowings. Borrowings issued at variable rates expose the Group to cash flow

interest rate risk. Borrowings issued at fixed rate expose the Group to fair value interest rate risk.

The Group adopts a policy of ensuring that between 25 and 90 per cent of its exposure to changes in interest rates on borrowings

is on a fixed rate basis.

waikato raupatu lands trust

notes to the financial statements

f o r t h e y e a r e n d e d 3 1 m a r c h 2 0 1 5

80