4

Tena koutou katoa –

Greetings to you all.

Trust Waikato has a vision of resilient and vibrant

communities throughout the region it serves. In

contributing to that vision, the Trust aims to invest wisely

the capital fund with which it is entrusted and to donate

effectively the proceeds of those investments to benefit

communities.

Chair’s Report

Investing Wisely

Trustees see their role as guardians of the capital fund.

We aim to grow the fund to keep pace with both inflation

and population growth in the region, without taking on

undue risk. Established in perpetuity, the Trust strives to

ensure that the fund will be worth just as much for future

generations as it is for our communities today.

The Trust regularly reviews its investment objectives

and strategic asset allocations, and monitors fund

performance closely. Investments are diversified across

a range of asset classes: global equities, Australasian

equities, private equity, unlisted property, infrastructure,

global credit, global fixed interest, New Zealand fixed

interest and cash.

As an asset owner, the Trust takes its investment role

seriously, and wants to ensure its investment returns

are sustainable and beneficial for communities and our

environment. The Trust continues to be a signatory to

the Principles for Responsible Investment (PRI). The PRI

provide an aspirational set of guidelines for ensuring that

environmental, social and governance issues are taken

into account by investors.

I am pleased to report that, despite market volatility, the

Trust’s investments have continued to experience steady

growth, returning 7.6% in the financial year. This is well

above the benchmark return of 5.0% for the portfolio.

As at 31 March 2016, Trust funds were valued at over

$343 million, with healthy reserves enabling us to make

consistent levels of donations. The Trust set a record

$11.2 million donations budget in 2015. Due to the level

of reserves, we have set another strong budget for 2016.

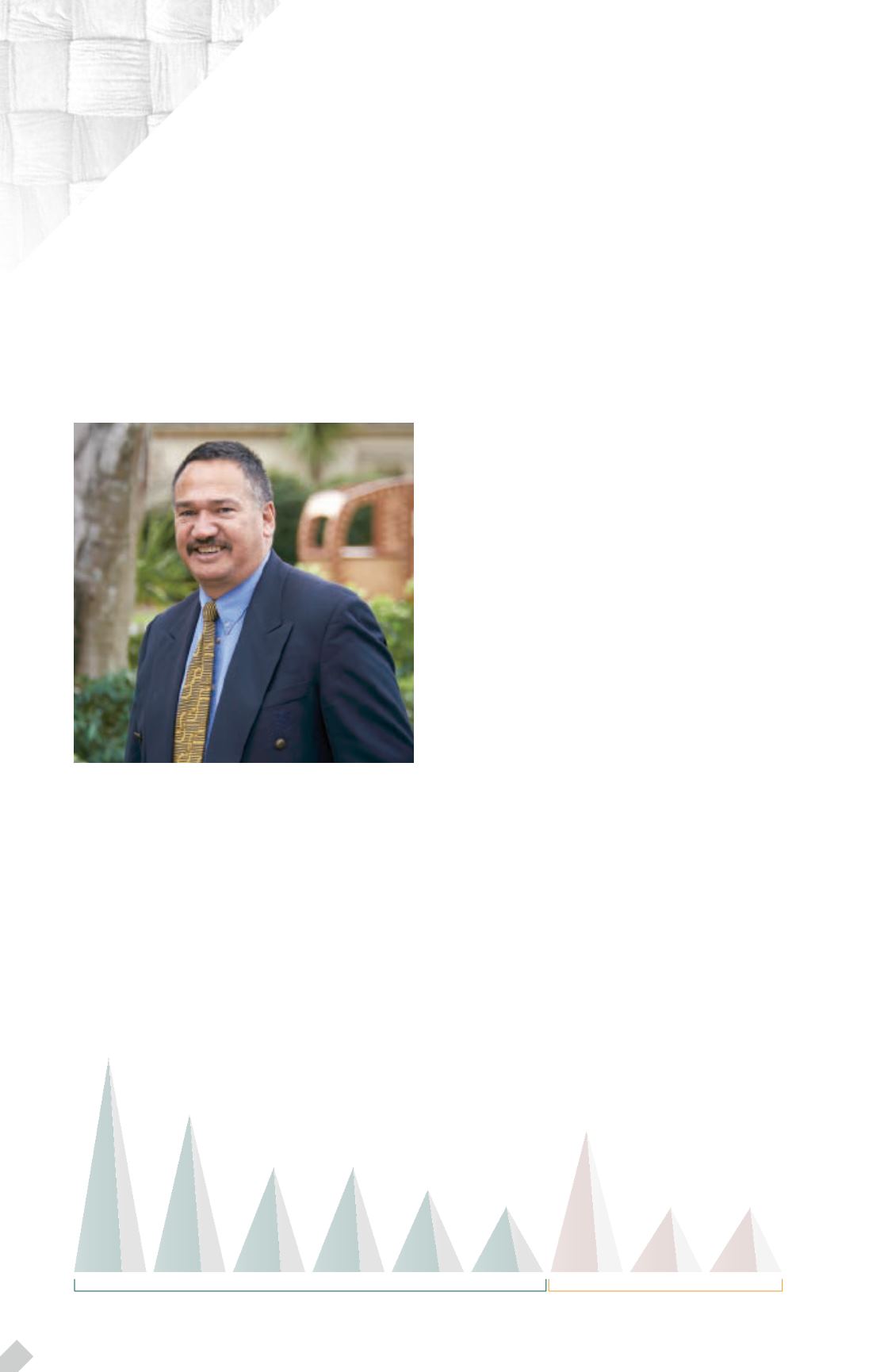

Total Income Assets 25%

Total Growth Assets 75%

STRATEGIC ALLOCATION OF FINANCIAL ASSETS

5

%

CASH

5

%

NZ FIXED

INTEREST

15

%

GLOBAL FIXED

INTEREST

5

%

NZ PRIVATE

EQUITY

7.5

%

GLOBAL

CREDIT

10

%

AUSTRALASIAN

EQUITIES

17.5

%

UNLISTED

PROPERTY

25

%

GLOBAL

EQUITIES

10

%

INFRASTRUCTURE

"To the many groups and volunteers within our

region, I thank you for making a real difference

in our communities. It is a privilege to serve

you and to help make our communities more

resilient and vibrant."