95

waikato-tainui

annual report 2014

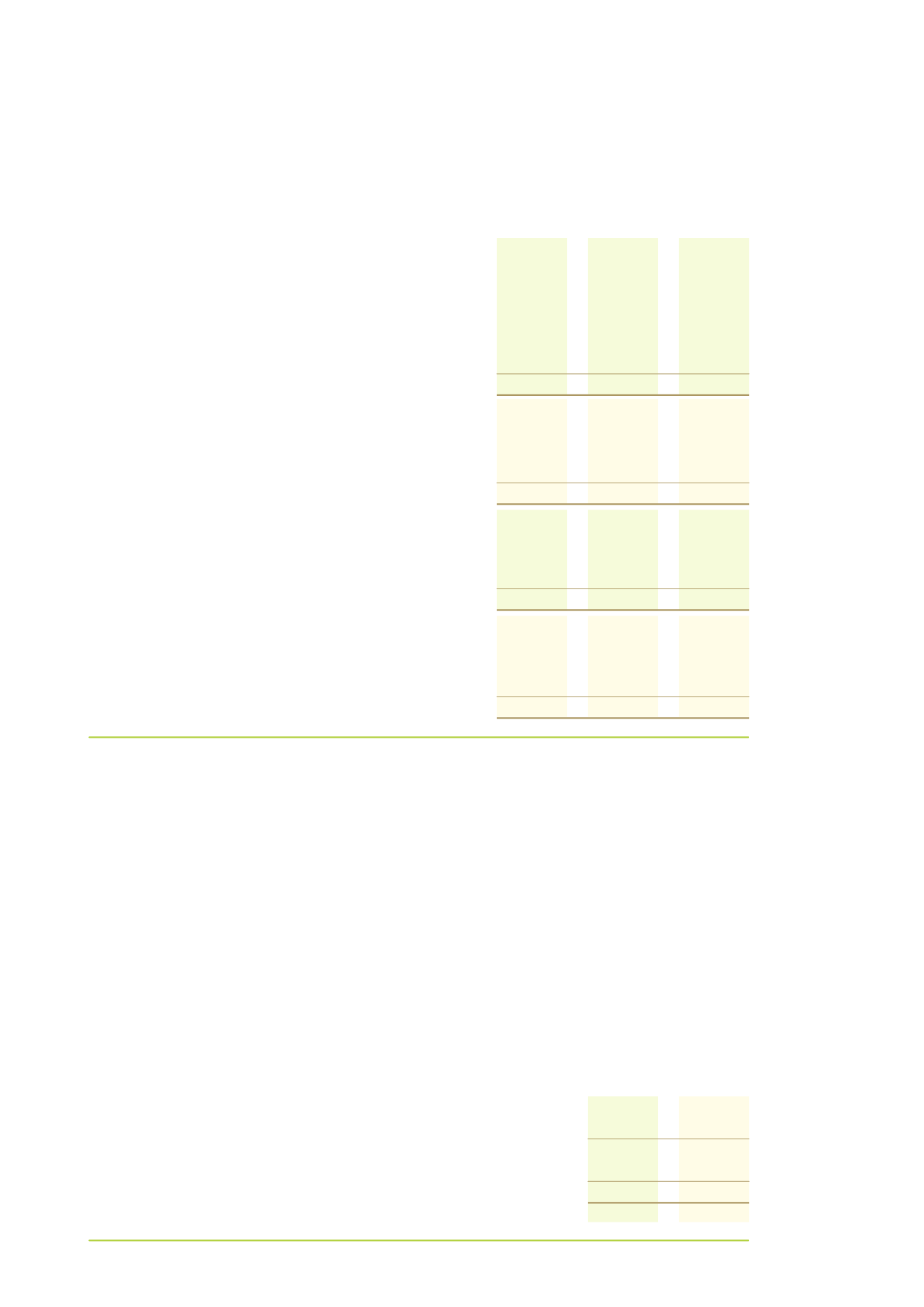

Liabilities at fair

Liabilities

value through

amoritised

profit or loss

cost

Total

$'000

$'000

$'000

FINANCIAL LIABILITIES AS PER STATEMENT OF FINANCIAL POSITION

CONSOLIDATED

At 31 March 2014

Borrowings

-

225,587

225,587

Derivative financial instruments

5,048

-

5,048

Trade and other payables

-

36,584

36,584

5,048

262,171

267,219

At 31 March 2013

Borrowings

-

187,163

187,163

Derivative financial instruments

12,902

-

12,902

Trade and other payables

-

16,680

16,680

12,902

203,843

216,745

PARENT

At 31 March 2014

Trade and other payables

-

3,821

3,821

Advances from subsidiaries

-

10,663

10,663

-

14,484

14,484

At 31 March 2013

Borrowings

-

12

12

Trade and other payables

-

3,324

3,324

Advances from subsidiaries

-

5,993

5,993

-

9,329

9,329

26.2 Capital risk management

The Group’s capital is its equity plus debt, which is comprised of retained earnings and other reserves. Equity is represented by

net assets. The Trust is subject to the financial management and accountability provisions of the Charities Act 2005, Waikato

Raupatu Claims Settlement Act 1995 and the Waikato‑Tainui Raupatu Claims (Waikato River) Settlement Act 2010. The Group

manages its revenues, expenses, assets, liabilities, investments and general financial dealings prudently. The Group’s equity is

largely managed as a by‑product of managing revenues, expenses, assets, liabilities, investments and general financial dealings.

The objective of managing the Group’s equity is to ensure the Group effectively achieves its objectives and purpose, whilst

remaining a going concern in order to provide returns for the Parent and to maintain an optimal capital structure to reduce

the cost of capital. The Group has not breached any bank covenants as required by the Bank of New Zealand and Westpac

New Zealand Limited during the reporting period (see note 23) (2013: no breach). There are no externally imposed capital

requirements at balance date (2013: nil).

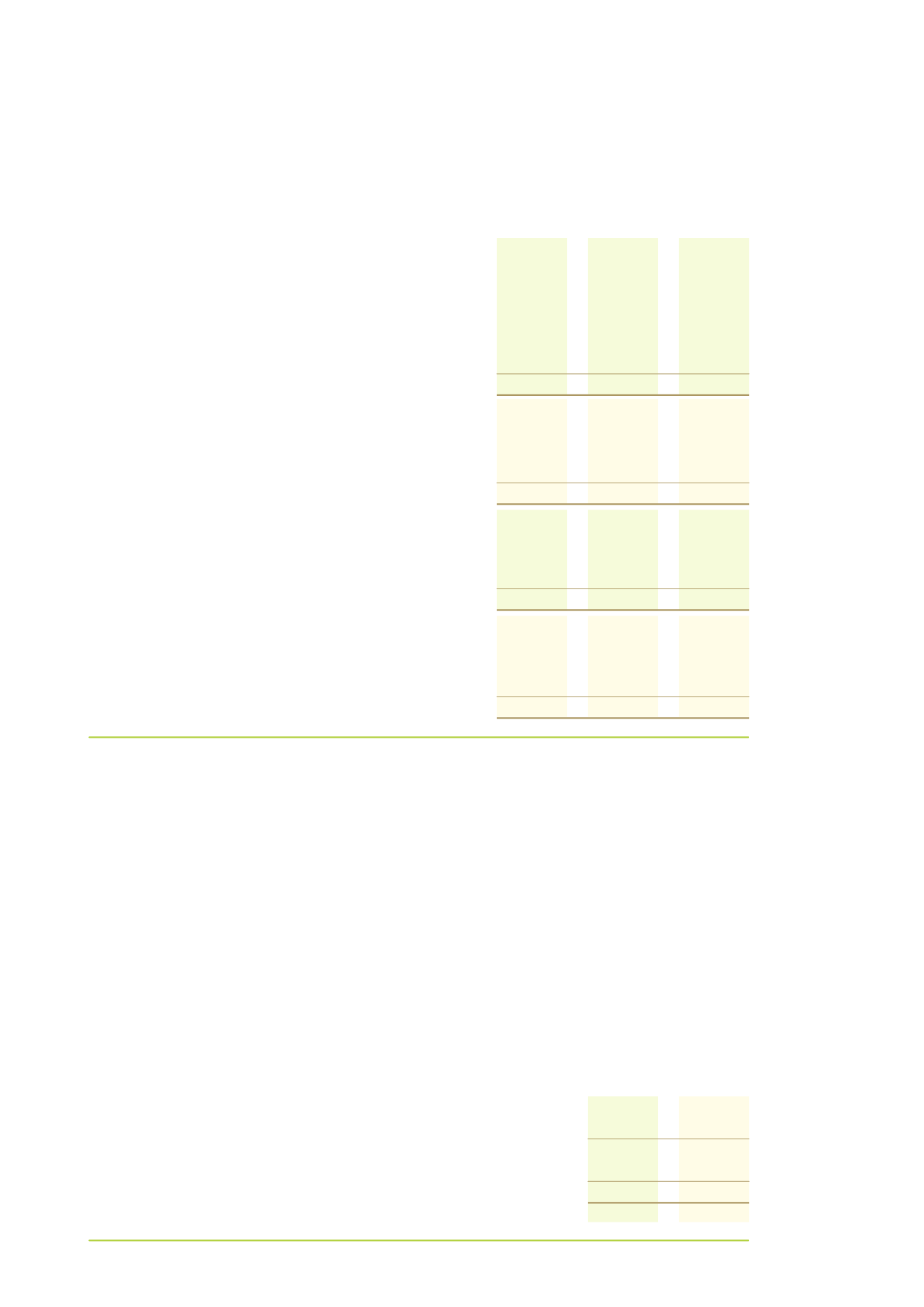

Consolidated

2014

2013

Notes

$'000

$'000

Total borrowings

23

225,254

186,683

Less: cash and cash equivalents

(172,099)

(156,858)

Net debt

53,155

29,825

Total equity

783,724

704,687

Total capital

836,879

734,512

Gearing ratio

6%

4%