93

waikato-tainui

annual report 2014

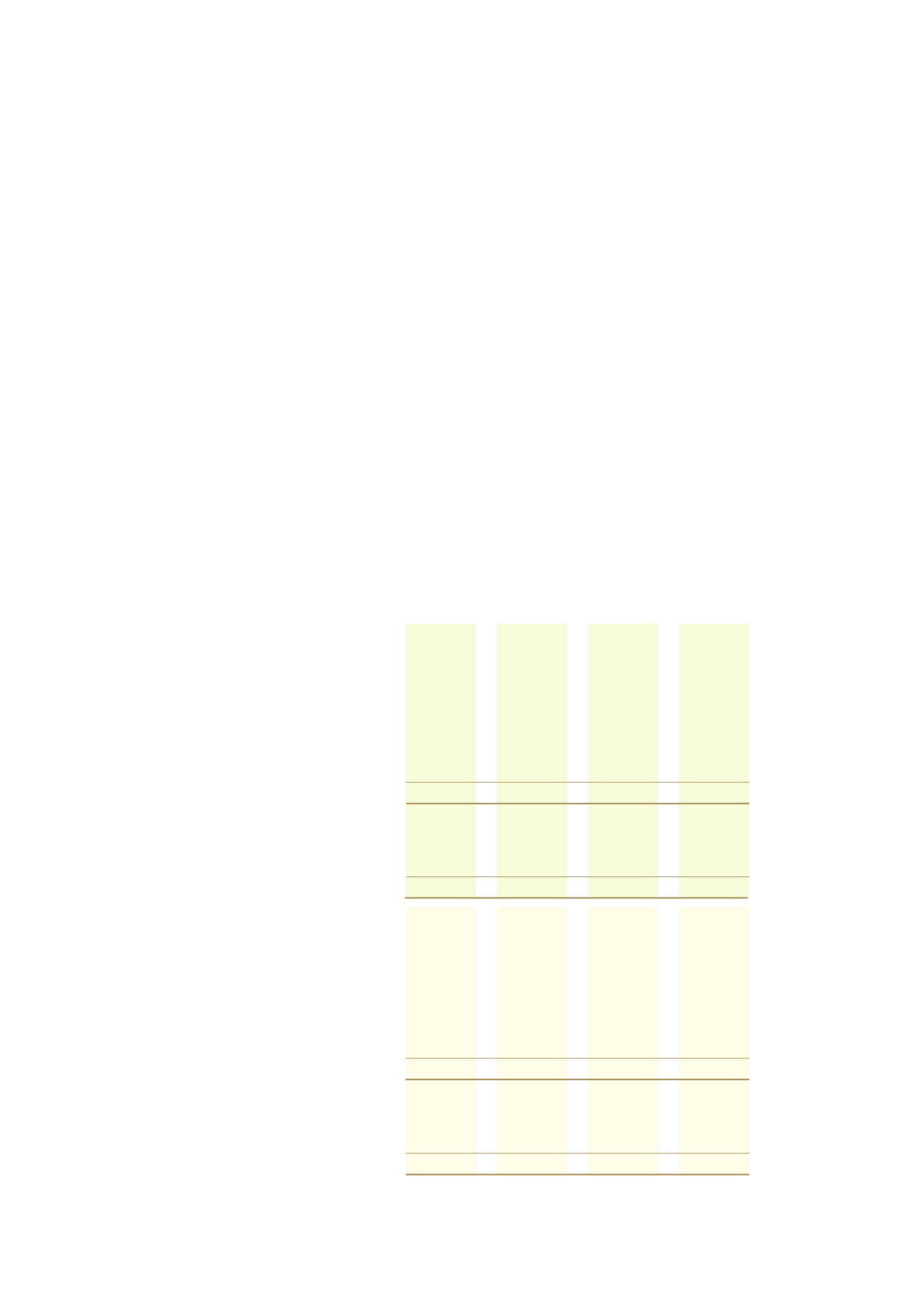

Level 1

Level 2

Level 3 Total balance

$'000

$'000

$'000

$'000

CONSOLIDATED ‑ as at 31 March 2014

Assets

Financial assets at fair value through profit or loss

– Investments in listed companies

1,957

-

-

1,957

– Investments in unlisted companies

-

10,883

-

10,883

– Investments in unlisted company (AFL income shares)

-

-

10,521

10,521

Derivatives ‑ call option agreement for property

-

647

-

647

Total assets

1,957

11,530

10,521

24,008

Liabilities

Financial liabilities at fair value through profit or loss

– Interest rate swaps

-

5,048

-

5,048

Total liabilities

-

5,048

-

5,048

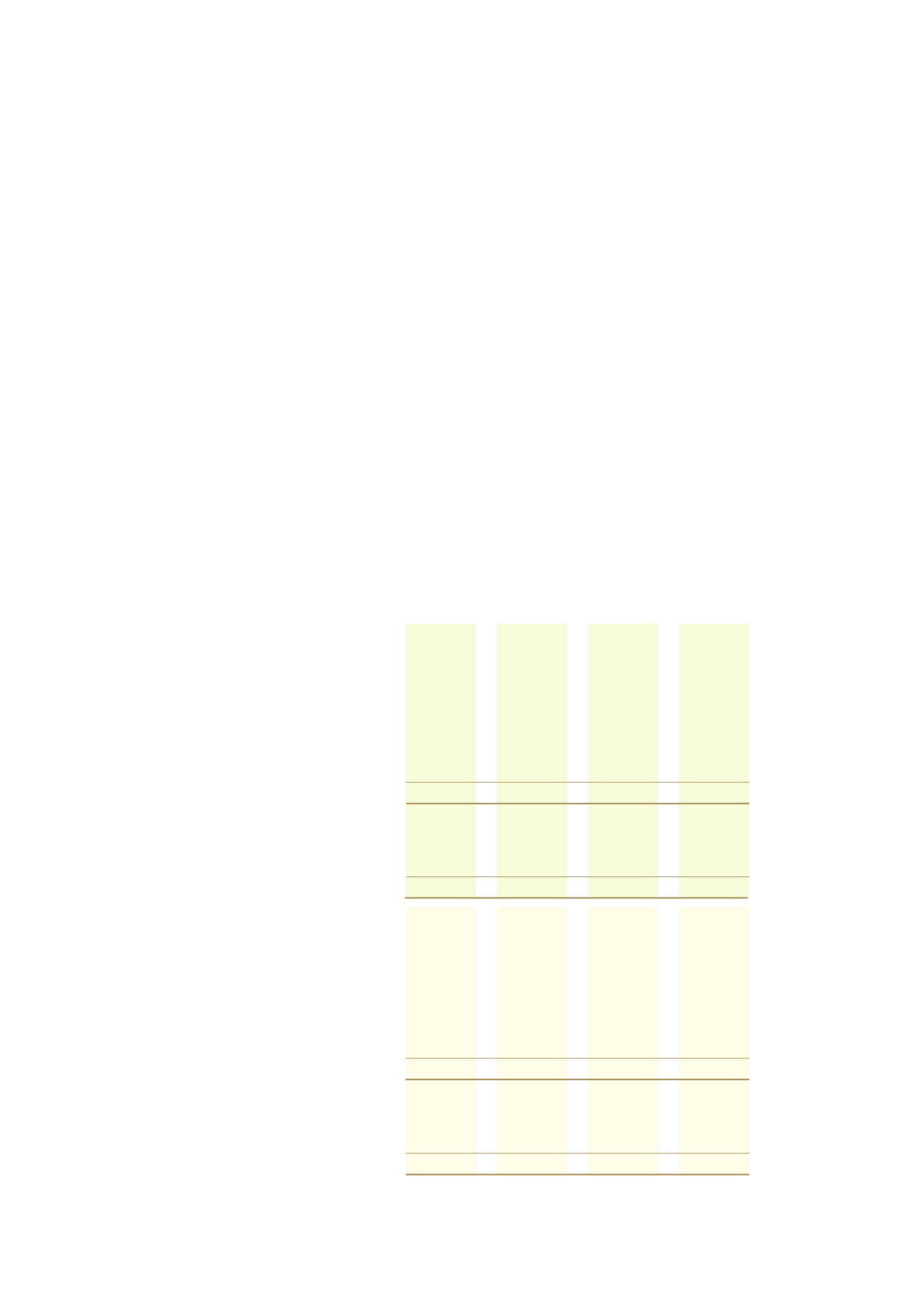

CONSOLIDATED ‑ as at 31 March 2013

Assets

Financial assets at fair value through profit or loss

– Investments in listed companies

2,426

-

-

2,426

– Investments in unlisted companies

-

7,579

-

7,579

– Investments in unlisted company (AFL income shares)

-

-

12,935

12,935

Total assets

2,426

7,579

12,935

22,940

Liabilities

Financial liabilities at fair value through profit or loss

– Interest rate swaps

-

12,902

-

12,902

Total liabilities

-

12,902

-

12,902

(e) Fair value estimation

The fair value of financial instruments traded in active markets is based on quoted market prices at balance date. The quoted

market price used for financial assets held by the Group is the current bid price, with the exception of investment in subsidiaries,

joint ventures and associates.

Investment in subsidiaries, joint ventures and associates do not have a quoted market price in an active market and the fair value

cannot be reliably measured.

The carrying value less impairment provision of trade receivables and payables are assumed to approximate their fair values due

to their short term nature. The fair value of financial liabilities for disclosure purposes is estimated by discounting the future

contractual cash flows at the current market interest rate that is available to the Group for similar financial instruments.

There are no financial liabilities with a carrying value different to their fair value.

Disclosure of fair value measurements is made by the level of the following fair value measurement hierarchy:

• Quoted prices (unadjusted) in active markets for identical assets or liabilities (level 1).

• Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly (that is,

as prices) or indirectly (that is, derived from prices) (level 2).

• Inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs) (level 3).