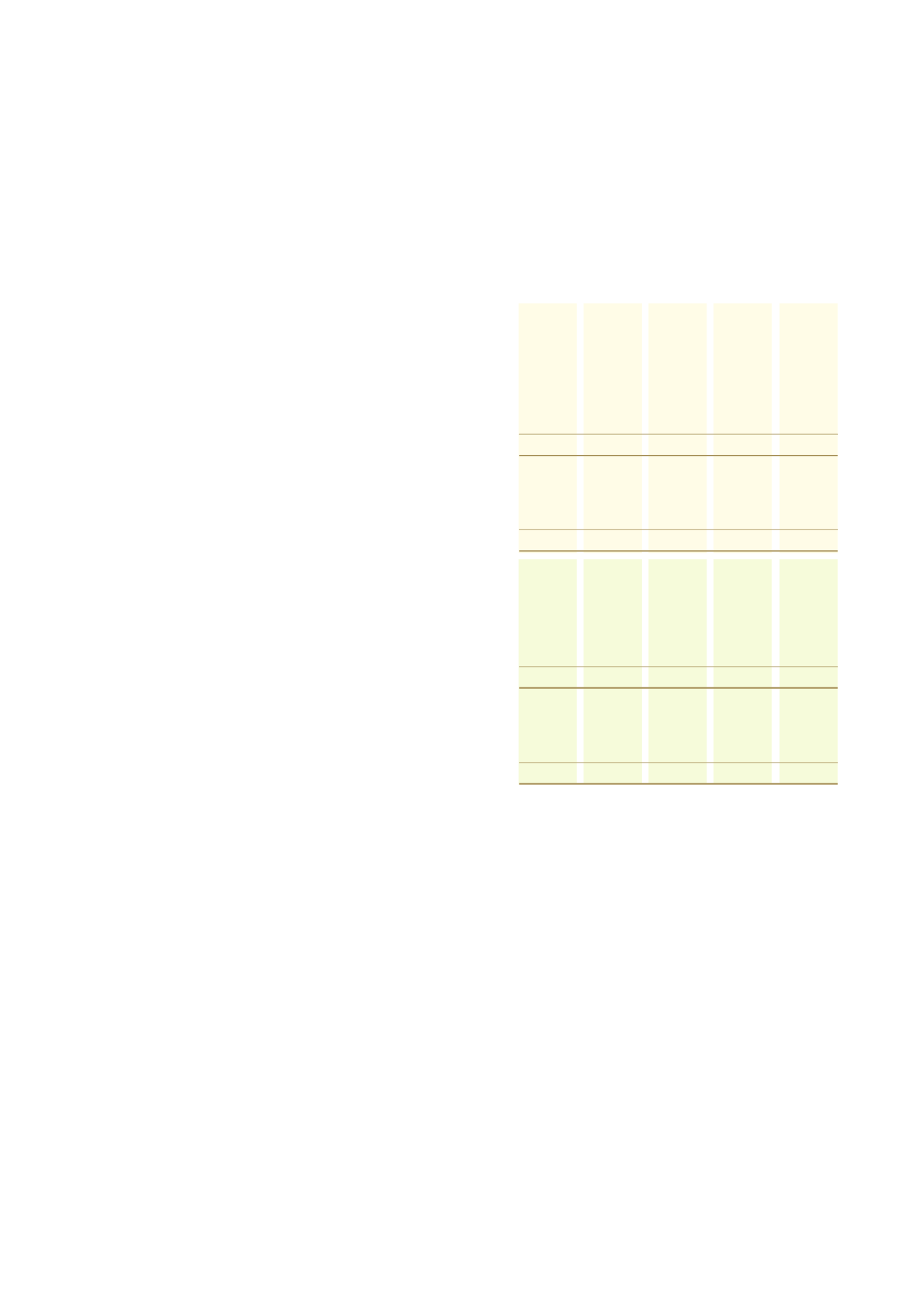

84

Computer,

office

Trust &

equipment,

other

Plant & Motor

furniture

properties equipment

Vehicles & fittings

Total

Notes

$'000

$'000

$'000

$'000

$'000

PARENT

Year ended 31 March 2013

Opening net book value

8,366

447

139

210

9,162

Additions

-

34

-

74

108

Disposals

(35)

(6)

-

(36)

(77)

Depreciation charge

5

(334)

(79)

(89)

(77)

(579)

Closing net book value

7,997

396

50

171

8,614

At 31 March 2013

Cost

15,121

939

684

753 17,497

Accumulated depreciation

(7,124)

(543)

(634)

(582)

(8,883)

Closing net book value

7,997

396

50

171

8,614

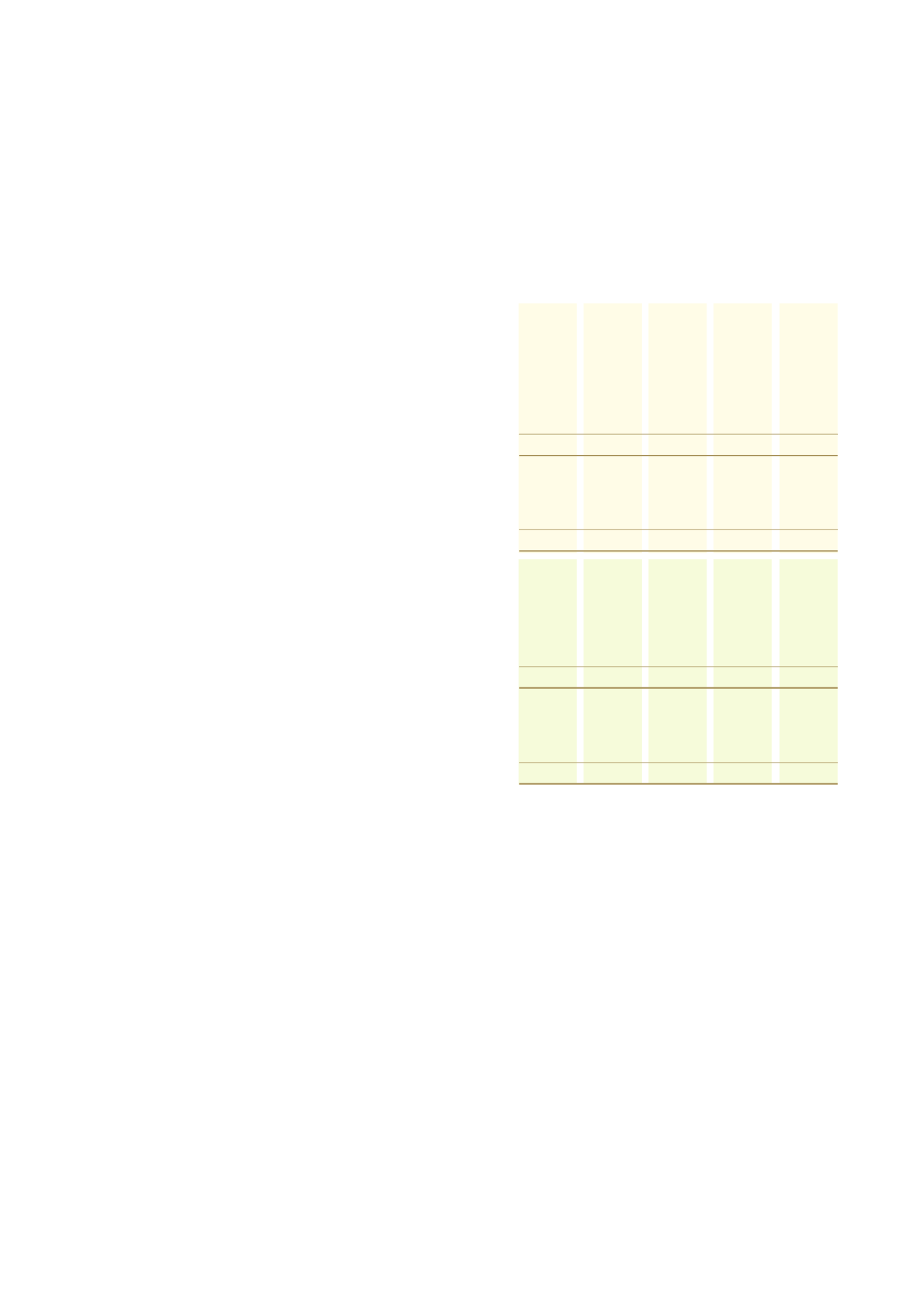

Year ended 31 March 2014

Opening net book value

7,997

396

50

171

8,614

Additions

203

32

-

85

320

Disposals

-

-

-

(45)

(45)

Depreciation charge

5

(303)

(40)

(24)

(94)

(461)

Closing net book value

7,897

388

26

117

8,428

At 31 March 2014

Cost

15,280

971

683

779 17,713

Accumulated depreciation

(7,383)

(583)

(657)

(662)

(9,285)

Closing net book value

7,897

388

26

117

8,428

Development properties and land at cost

In 2013, Tainui Group Holdings Limited developed new offices which had been reclassified from development to farm and other

properties. The prior office property occupied by Tainui Group Holdings Limited is now occupied by the Waikato Raupatu Lands

Trust and has been transferred from investment properties to farm and other properties.

Valuation of farm and other properties

Telfer Young (Waikato) Limited and Curnow Tizard were contracted as independent valuers to value farm and other properties.

Fair value has been assessed as the amount for which an asset could be exchanged or a liability settled between knowledgeable

willing parties in an arms length transaction.

The significant methods and assumptions applied in estimating the fair value were:

• the direct comparison approach (based on analysis of sales of vacant property. This analysis includes determination of land

value, other improvements and residual value for principal improvements);

• the traditional capitalisation approach (focusing on the net maintainable income and the level of investment return);

• the discounted cash flow approach (based on establishing a cash flow budget for the property having particular regard to the

length of lease term and nature of the leasehold interest and the following factors; discount rate, land inflation and rental

rates); and

• comparing market evidence of transaction prices for similar properties.

The total value of farm properties valued by Telfer Young (Waikato) Limited at 31 March 2014 is $22.4m (2013: $19.3m).

The carrying amount that would have been reported for farm properties under the historical cost method is $9.3m (2013:

18. Property, plant and equipment (continued)

waikato raupatu lands trust

notes to the financial statements

f o r t h e y e a r e n d e d 3 1 m a r c h 2 0 1 4