78

1 4 . r e l at e d pa r t y t r a n s a c t i on s

Transactions between related entities include loans and advances to and from the Parent, certain subsidiaries and associates.

All amounts owing by and to the Trust and Group are repayable on demand and are interest free, other than the advance owing

by the Trust to Waikato‑Tainui Distributions Limited for which interest is charged daily based on the 90 day bank bill rate. There

is no impairment of any related party balances. The amount owing by Tainui Group Holdings Limited and subsidiaries to the

Parent is subordinated to the Westpac and BNZ bank loans (see note 23).

Tainui Group Holdings Limited charged the Trust and Waikato Raupatu River Trust $0.6m and $0.3m respectively (2013: the

Trust and Waikato Raupatu River Trust $0.5m and $0.3m respectively) for administration services and financial charges, which is

classified as other income (see note 4). There were no purchases of goods or services from the Group’s subsidiaries.

Tainui Group Holdings Limited and Waikato‑Tainui Fisheries Limited declared a dividend of $11.1m (8.5c per share) and

$0.4m ($3,700 per share) respectively during the year for the year ended 31 March 2014 to Waikato‑Tainui Te Kauhanganui

Incorporated (2013: Tainui Group Holdings Limited $10.0m (7.7c per share) and Waikato‑Tainui Fisheries Limited $0.9m ($9,000

per share)). A dividend of $12m (9.2c per share) from Tainui Group Holdings Limited was declared on 20 June 2014 in relation to

the year ended 31 March 2014, of which $8.4m was prepaid at balance date (see note 31).

On 21 February 2013, Tainui Group Holdings Limited issued 70,000,000 shares at $1 per share to the Trust. No cash was paid for

the shares, however payment of the shares were offset by the advance that Tainui Group Holdings Limited owed the Trust.

There are operating leases in place between the Trust and Tainui Group Holdings Limited for land owned by the Trust where the

Tainui Group Holdings Limited has developed and leased properties at The Base and the University of Waikato respectively.

In 2014 the Parent moved into the premises located at 4 Bryce Street, Hamilton. This property is classified as property plant and

equipment (see note 18). No rent is charged. The Waikato Raupatu River Trust occupy the premises at 20 Alma Street, Hamilton.

The property is classified as investment property. Rental of $0.1m was charged during the year (2013: $0.1m).

During the course of the year, Rotokauri Development Limited sold a property in Rotokauri, Hamilton to an employee of Tainui

Group Holdings Limited. The property was sold at auction for $0.5m and was on an arms length basis.

(a) Parent entity

The Waikato Raupatu Lands Trust is the Parent entity of the Group. Waikato‑Tainui Te Kauhanganui Incorporated is the ultimate

controlling party. All members of the Group are considered to be related parties of the Trust.

Amounts outstanding between the Parent and the Group are:

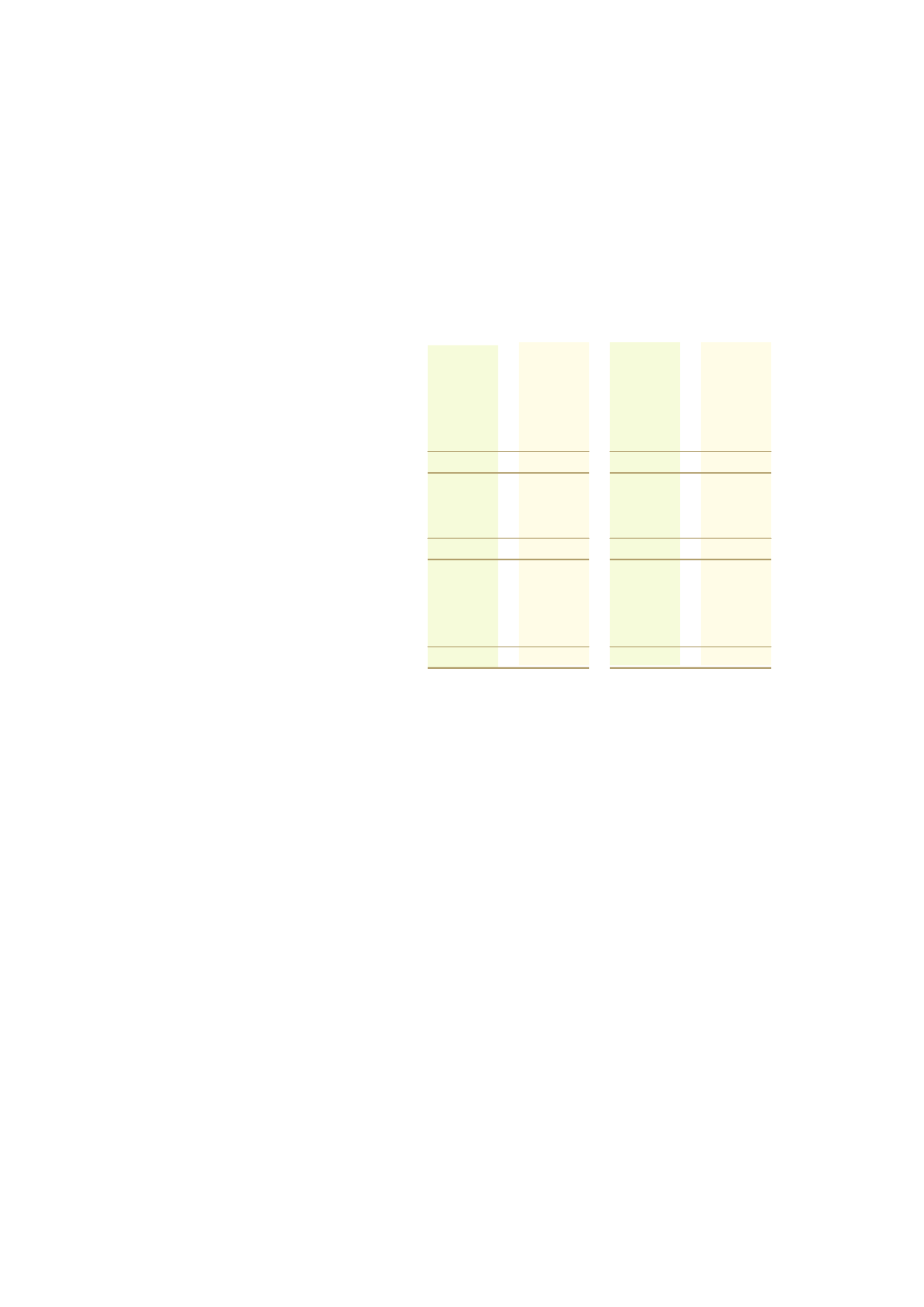

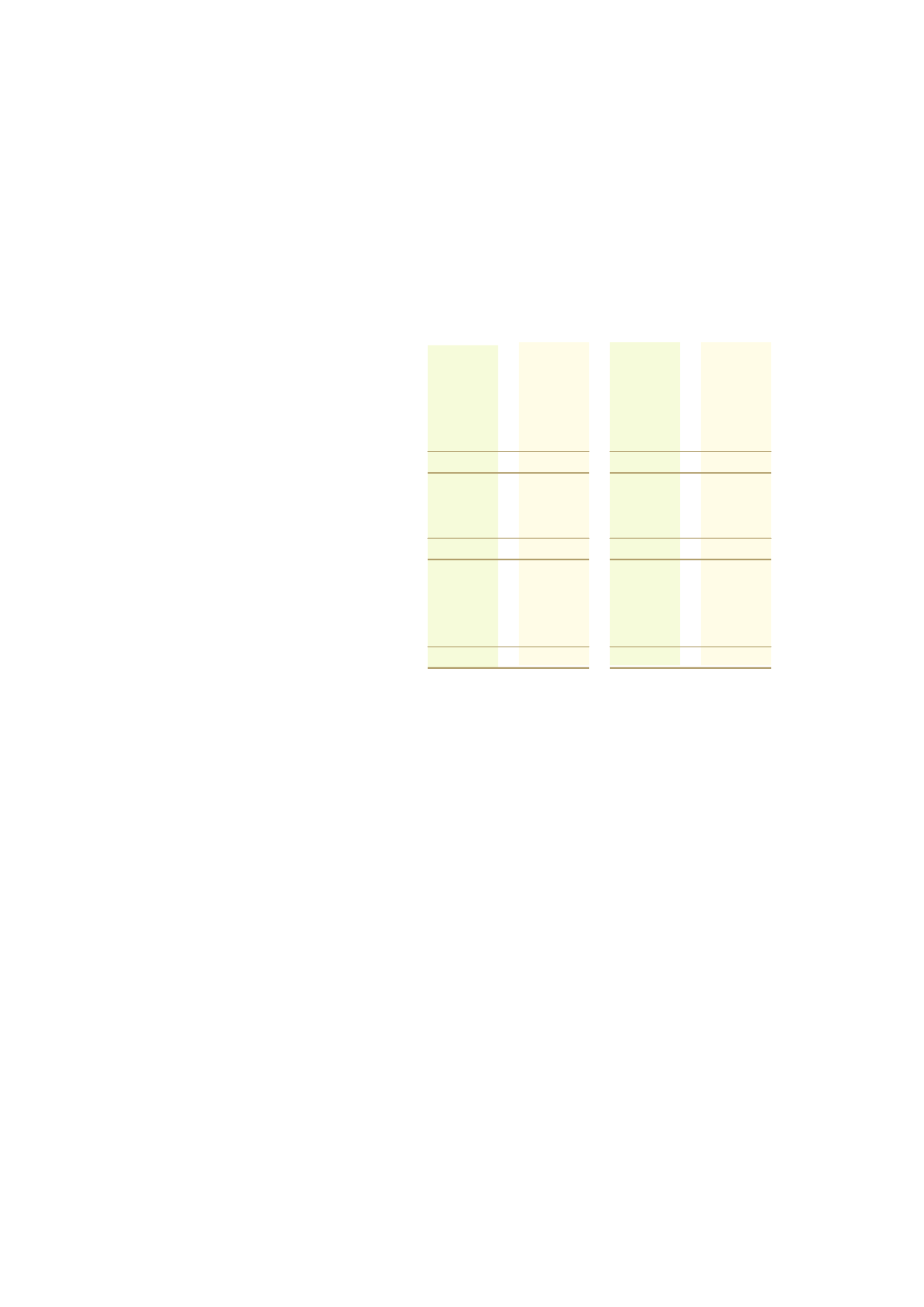

Consolidated

Parent

Notes

2014

2013

2014

2013

$'000

$'000

$'000

$'000

Advances owing (to)/from related parties:

Tainui Group Holdings Limited and subsidiaries

-

-

5,044

4,377

Waikato Raupatu River Trust

-

-

(218)

1

Waikato‑Tainui Distributions Limited

-

-

1,200

1,200

Waikato‑Tainui Koiora Limited Collective LP

-

-

257

415

-

-

6,283

5,993

Trade and other recievable owing from related parties:

Tainui Group Holdings Limited

11

-

-

8

158

Rotokauri Development Limited

11

-

1,185

-

-

-

1,185

8

158

Trade and other payables owing to related parties:

Tainui Group Holdings Limited and subsidiaries

21

-

-

4,380

125

Waikato‑Tainui Distributions Limited

21

-

16

34

16

Waikato Raupatu Lands Trust

21

-

26

-

26

-

42

4,414

167

waikato raupatu lands trust

notes to the financial statements

f o r t h e y e a r e n d e d 3 1 m a r c h 2 0 1 4