70

The subsidiaries, interest in associates and joint ventures with reporting dates other than 31 March have been included based on

their actual results and balances as at 31 March and not the results and balances at their respective reporting dates. Hamilton

Riverview Hotel Limited has a balance date of 31 December to align with its other shareholders operations.

The country of incorporation for all subsidiaries, associates and joint ventures is New Zealand.

Forty hectares of land at Rotokauri, Hamilton, was sold from Tainui Development Limited to Rotokauri Development Limited

joint venture in 2013 for the purposes of residential sub‑division. The sale transaction resulted in a gain on sale of $7m of which

$2m or 30% was recognised in 2013, representing the external joint ventures partners proportion of the gain. The balance of

$5m of the gain on sale will be recognised in future financial years when the land is sub‑divided and sold to external parties and

will be based on the proportional share of the land (see notes 11 and 14). No such gains were recognised and no sales to external

parties were made in 2014.

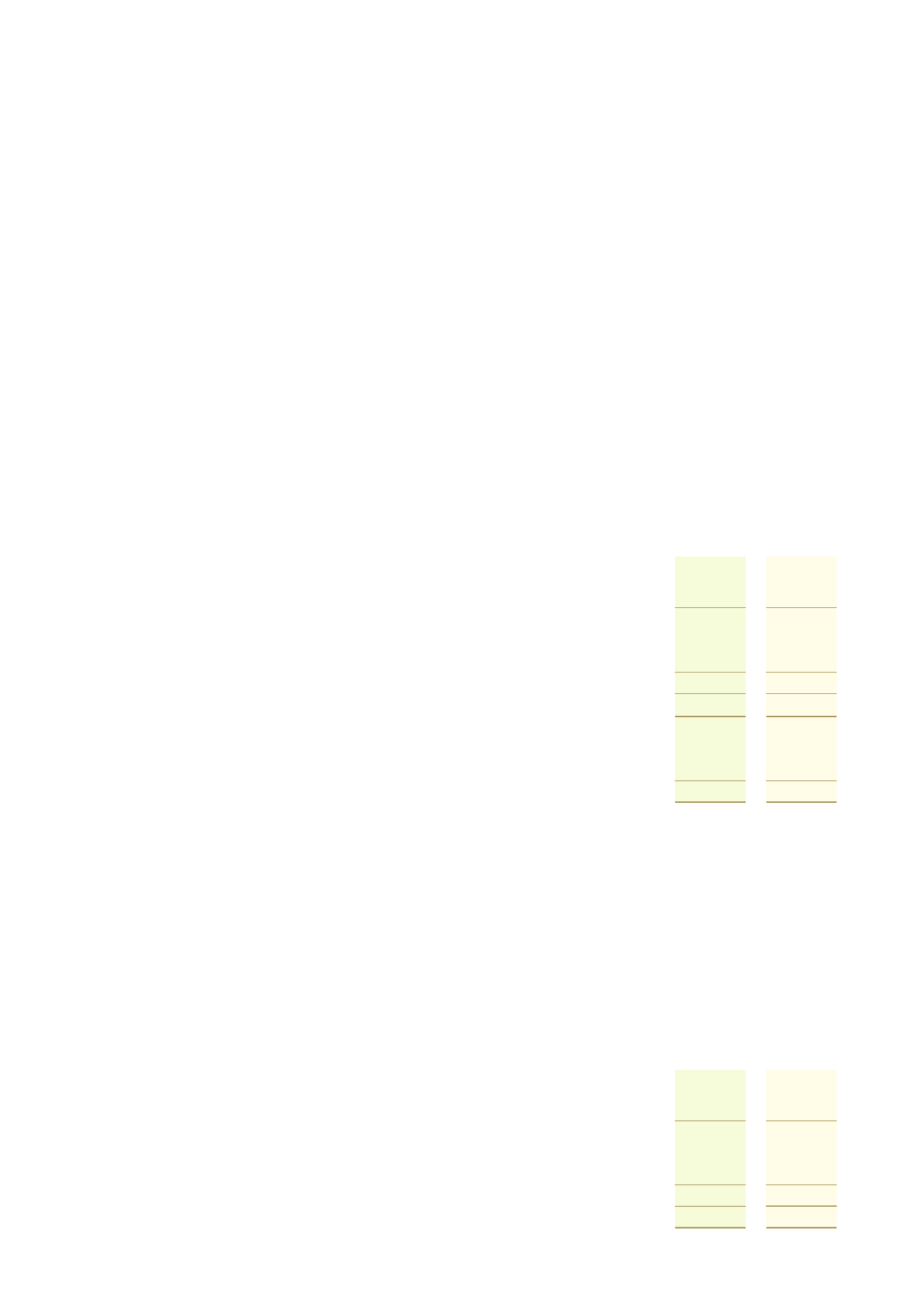

The Group’s interest in the joint ventures had the following effect on the financial statements:

2014

2013

$'000

$'000

Statement of financial position

Current assets

8,762

1,638

Non‑current assets

30,833

5,908

Total assets

39,595

7,546

Current liabilities

3,584

1,885

Non‑current liabilities

13,832

-

Total liabilities

17,416

1,885

Net assets

22,179

5,661

Statement of comprehensive income

Revenues

4,719

1,407

Expenses

(4,189)

(1,111)

Profit before income tax

530

296

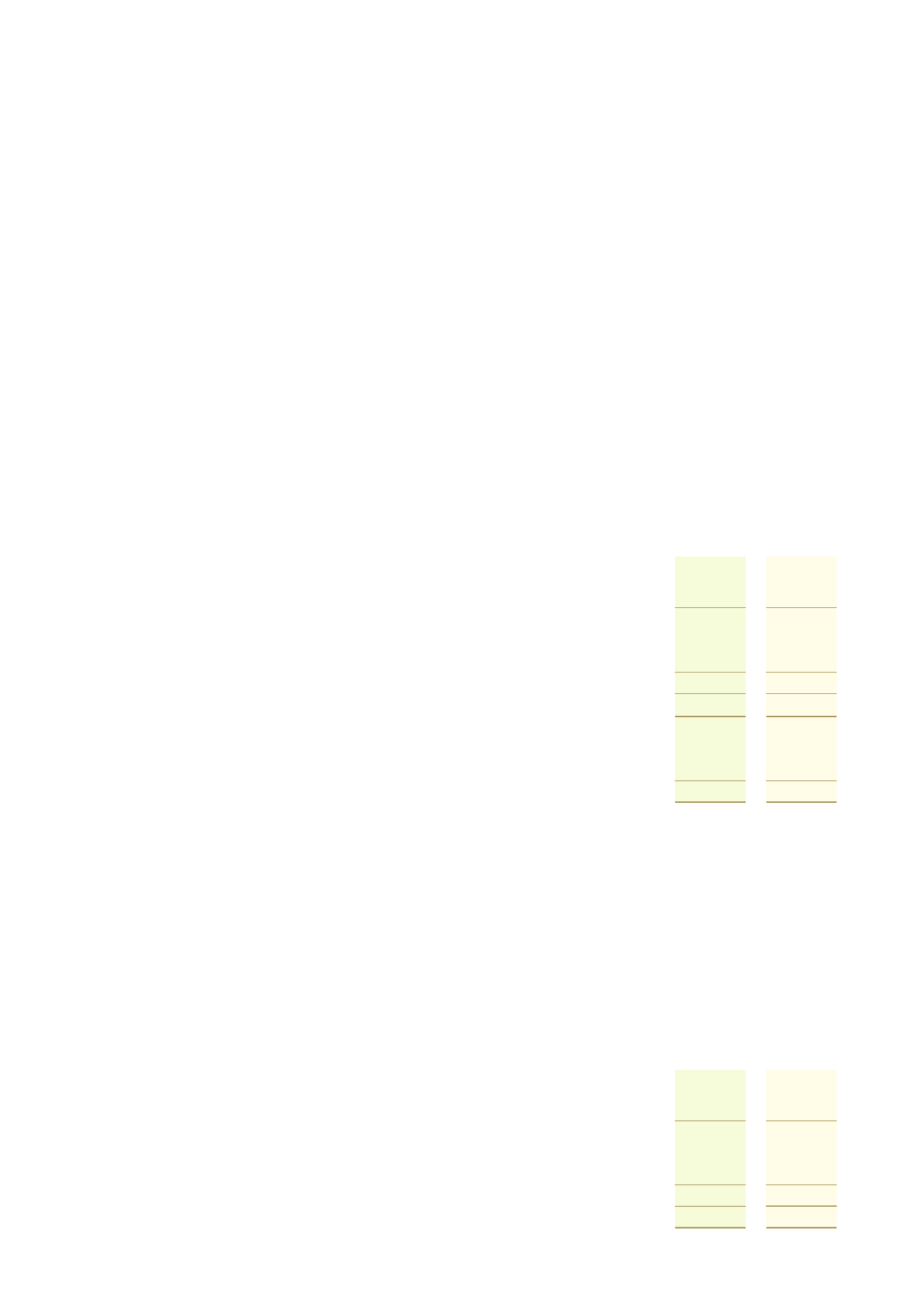

Consolidated

Acquisition of Waikato Milking Systems Limited Partnership

On 31 March 2014, Tainui Development Limited invested $13.38m for a 33% equity share of WMS GP Limited. WMS GP Limited

acquired 100% of the shares in Waikato Milking Systems Limited. The acquisition has been classified as a joint venture and

has been proportionally consolidated. The following assets and liabilities were recognised at balance date based on the Groups

proportional share. Acquisition costs of $0.2m were incurred. Included in non‑current assets is goodwill of $24.4m (see note 17).

2014

2013

$'000

$'000

Statement of financial position

Current assets

6,100

-

Non‑current assets

25,095

-

Total assets

31,195

-

Current liabilities

4,297

-

Non‑current liabilities

13,708

-

Total liabilities

18,005

-

Net assets

13,190

-

Consolidated

The following amounts have been recognised on a provisional basis subject to determination of the fair value of the assets and

liabilities of WMS GP Limited:

3. Consolidation (continued)

waikato raupatu lands trust

notes to the financial statements

f o r t h e y e a r e n d e d 3 1 m a r c h 2 0 1 4