80

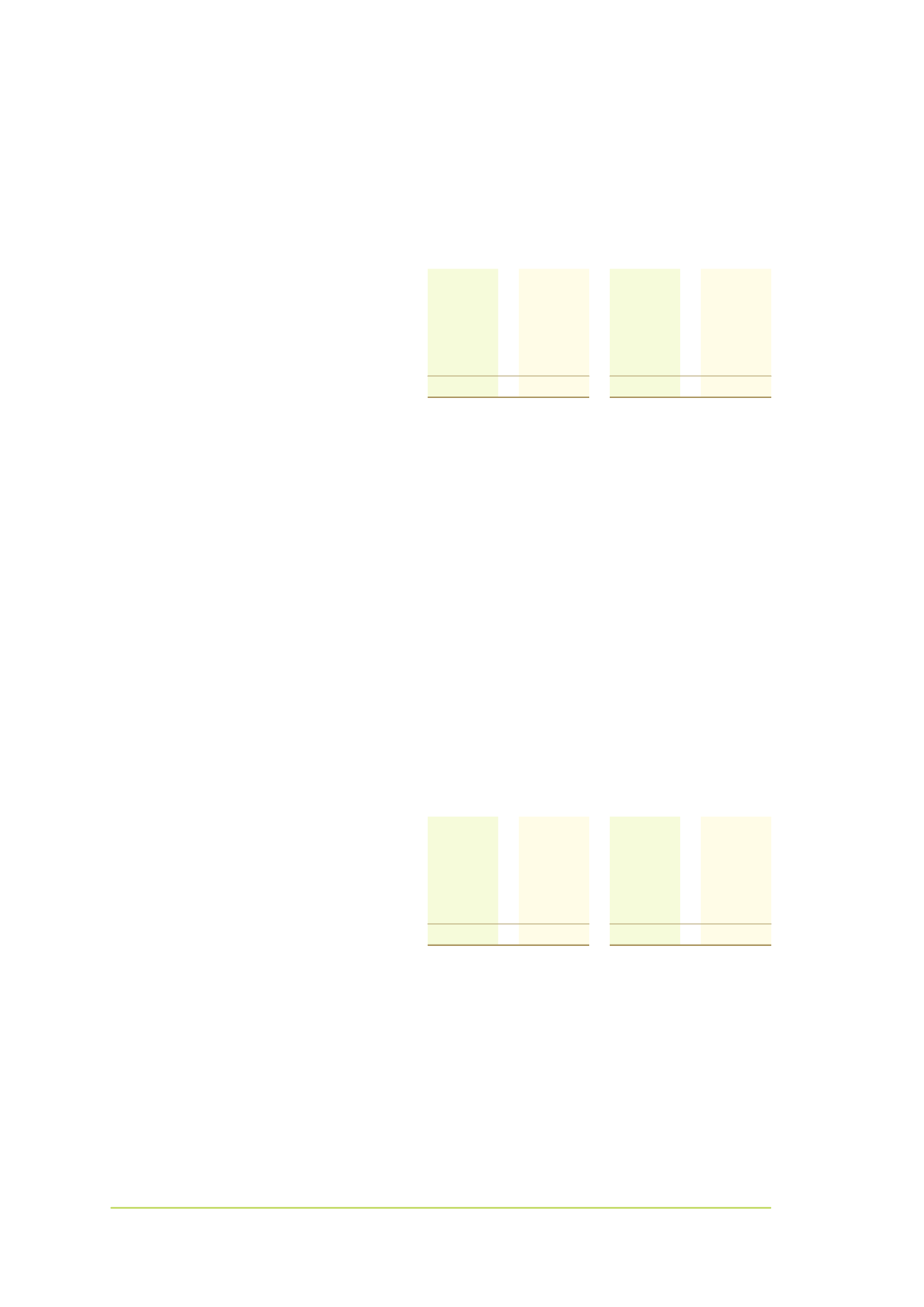

15 . t r a d e a nd o t h e r r e c i e va b l e s (non c u r r en t )

Consolidated

Parent

2014

2013

2014

2013

$'000

$'000

$'000

$'000

Co‑Management Settlement receivable

9,455

16,647

-

-

Relativity settlement receivable

19,000

-

19,000

-

Other receivables

708

927

468

469

Provision for doubtful receivable

(450)

(450)

(450)

(450)

Lease fitout contribution

1,158

1,159

-

-

29,871

18,283

19,018

19

Other receivables is comprised of the Waikato Raupatu River Trust Co‑management settlement receivable. The Co‑Management

funding has been valued based on a discounted cash flow method using the annual swap rates for the relative term. The swap

rates applied range from 3.63% to 5.08% (2013: 3.16%). The Co‑Management funding settlement provided that an annuity of

$1m be provided for 27 years. During the 2014 year, $11m was received for the Co‑management debtor, which included the

annuity of $1m plus an advance of $10m, reducing the settlement period by 10 years.

The Crown treaty settlement allows for a special mechanism ‑ a ‘relativity settlement’ as set out in note 1 and note 29. A

relativity settlement receivable of $19m has been recognised at 31 March 2014 based on the value of Treaty settlements

confirmed by the Government on 30 June 2013. The Relatiity settlement receivable calculates an amount receivable from the

Government in 1995 dollars of $12.7m, based on the Government confirmed settlements, adjusted for inflation to present value

in accordance with the Deed of Settlement mechanism.

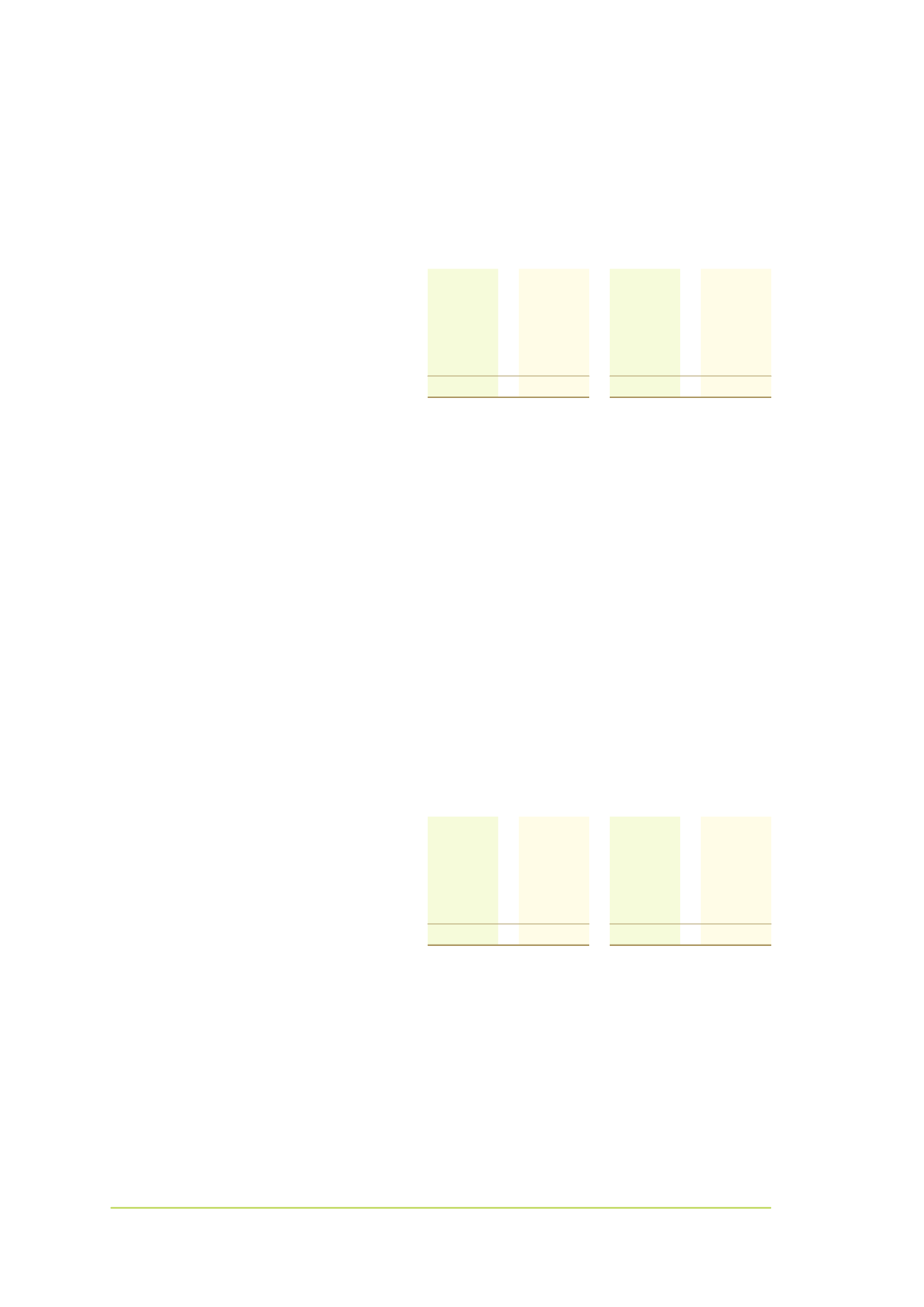

1 6 . o t h e r f i n a n c i a l a s s e t s

Consolidated

Parent

2014

2013

2014

2013

$'000

$'000

$'000

$'000

At fair value through profit or loss:

Call option agreement ‑ property

647

-

-

-

Listed companies

1,957

2,426

-

-

Unlisted companies

10,883

7,579

-

-

Unlisted company ‑ AFL income shares

10,521

12,935

-

-

24,008

22,940

-

-

(a) Listed companies

The fair value of shares in listed companies is the investment in Fonterra Co‑operative Group Limited.

(b) Unlisted companies

The fair value of shares in unlisted companies is represented by the investment in Pioneer Capital Partners LP.

(c) Unlisted companies ‑ Aotearoa Fisheries Limited (AFL) income shares

The fair value of the AFL income shares is based a valuation undertaken by Toroa Strategy Limited. The valuation methodology

uses a mixture of historical performance, multiple earnings over a three year period, dividend streams and liquidity. Toroa

Strategy Limited is not related to the Trust or Group and holds recognised and relevant professional qualifications having had

recent experience and knowledge in the assets they have valued.

waikato raupatu lands trust

notes to the financial statements

f o r t h e y e a r e n d e d 3 1 m a r c h 2 0 1 4