73

waikato-tainui

annual report 2014

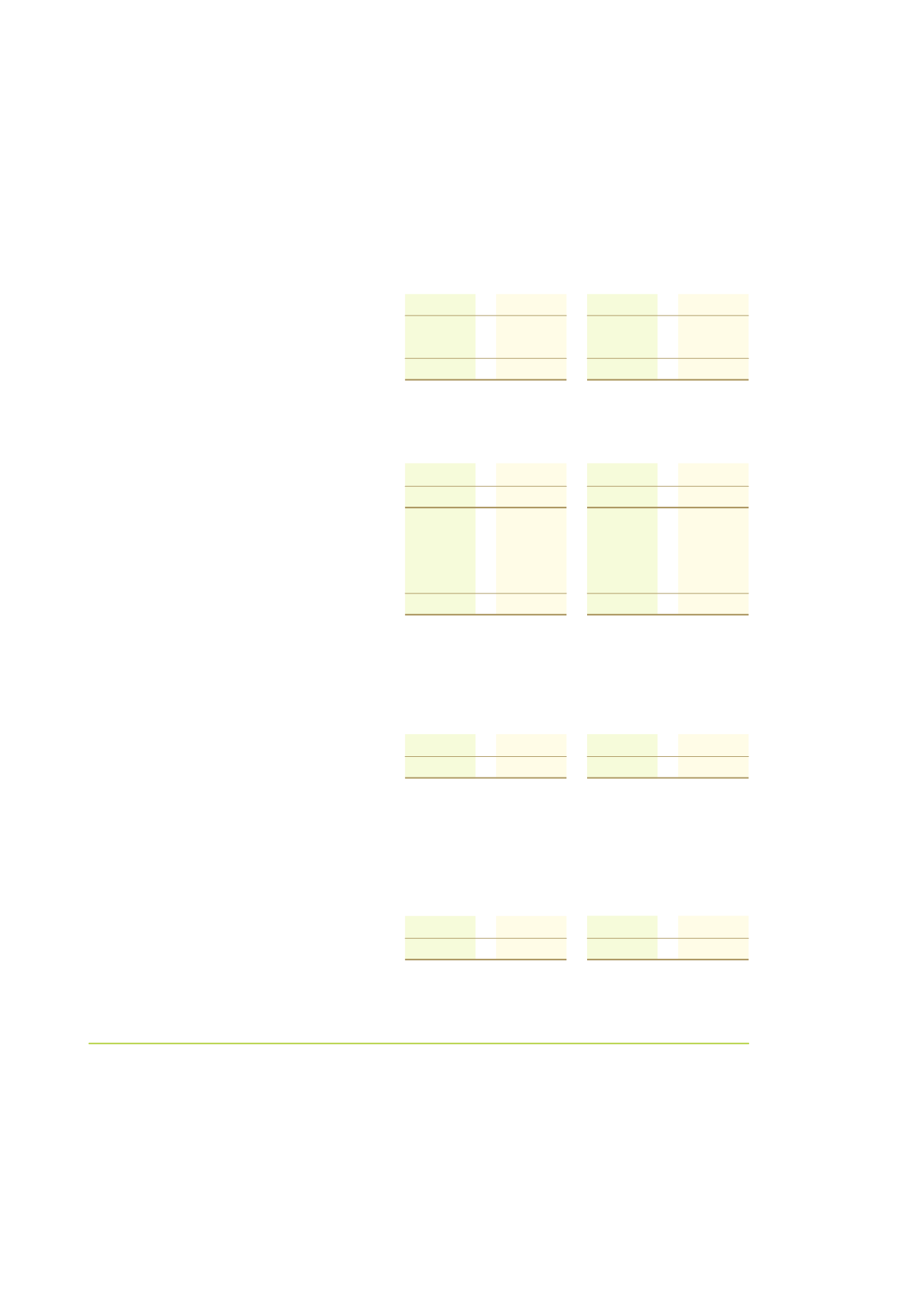

7. i n c ome ta x

Consolidated

Parent

2014

2013

2014

2013

$'000

$'000

$'000

$'000

Profit subject to income tax

1,221

-

-

-

Income tax at 28%

342

-

-

-

Tax refund on bonus issue

(1,924)

-

(1,924)

-

Income tax credit

(1,582)

-

(1,924)

-

The tax credit account represents the Waikato Raupatu Lands Trust consolidated income tax group. The Maori authority tax

credits were surrendered and cash was paid in 2014.

Unused tax losses

2,043

2,076

-

-

Unrecognised deferred tax balances

2,043

2,076

-

-

The taxable members of the Group have sufficient losses to carry forward to met any potential income tax liability. The taxable

losses are not recorded in the financial statements due to the lack of probability that the losses will be recovered.

Maori authority tax credits

32

1,956

-

-

32

1,956

-

-

Movements

Balance at 1 April

1,956

221

-

-

Tax payments net of refunds

-

1,735

-

-

Bonus issue distribution

(1,924)

-

-

-

Balance at 31 March

32

1,956

-

-

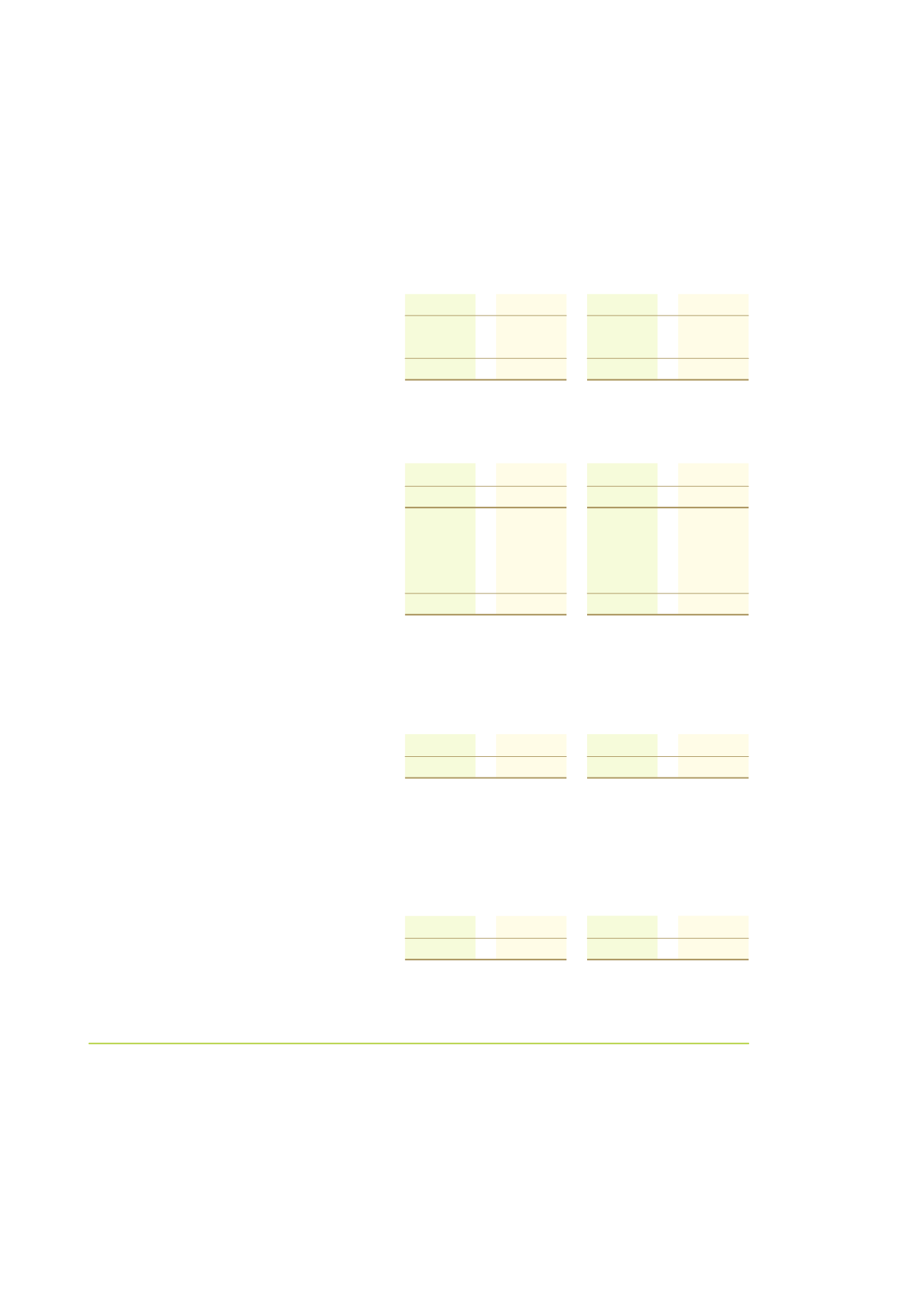

Property, plant and equipment

3,183

-

-

-

Net deferred tax liability

3,183

-

-

-

Deferred tax in respect of property, plant and equipment has been assessed on the basis of the asset value being realised

through sale.

(a) Income tax expense

(b) Tax credits available for use in subsequent reporting periods

(c) Unrecognised deferred tax balances

(d) Deferred tax liabilities

The balance comprises temporary difference attributable to: