85

waikato-tainui

annual report 2014

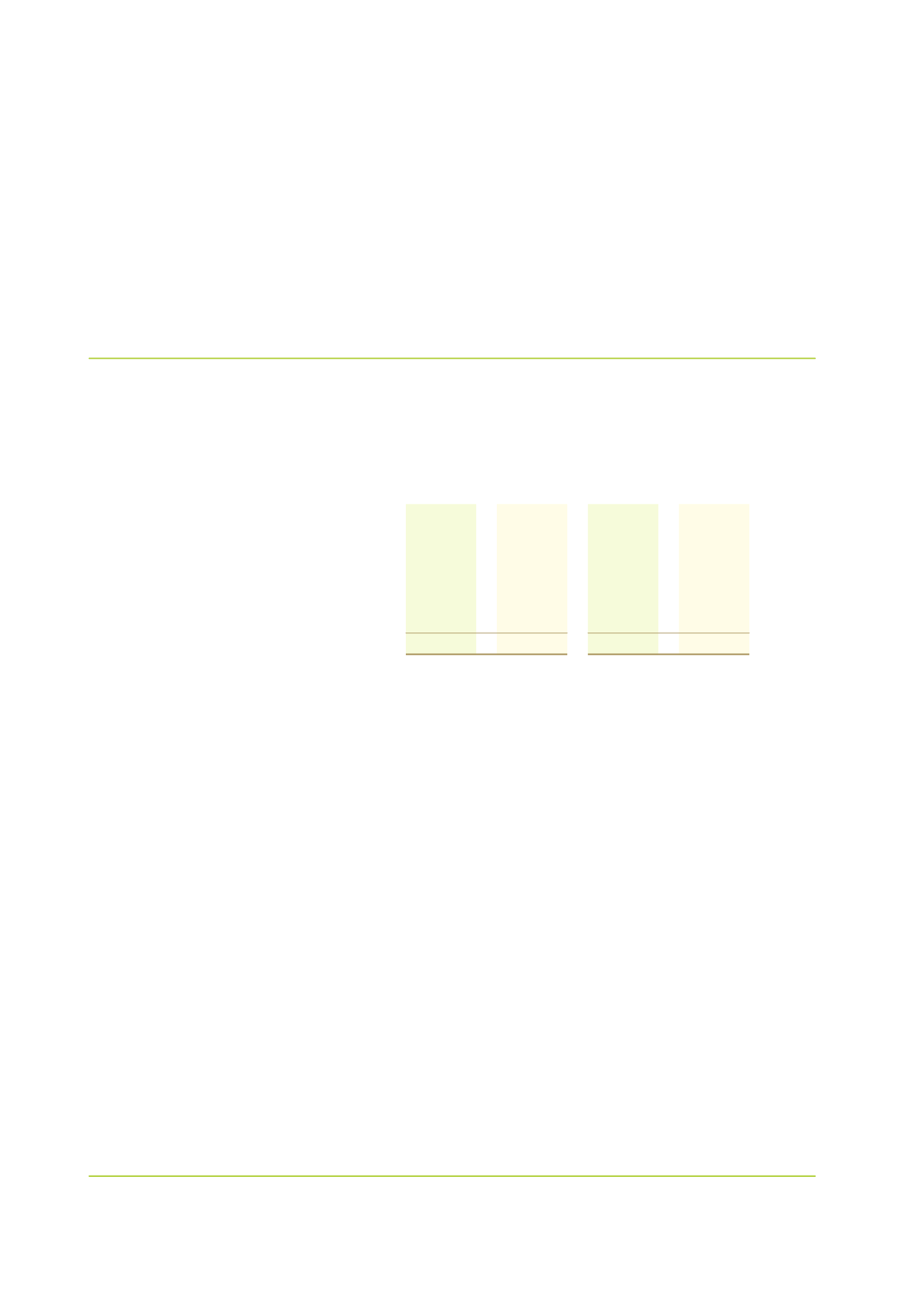

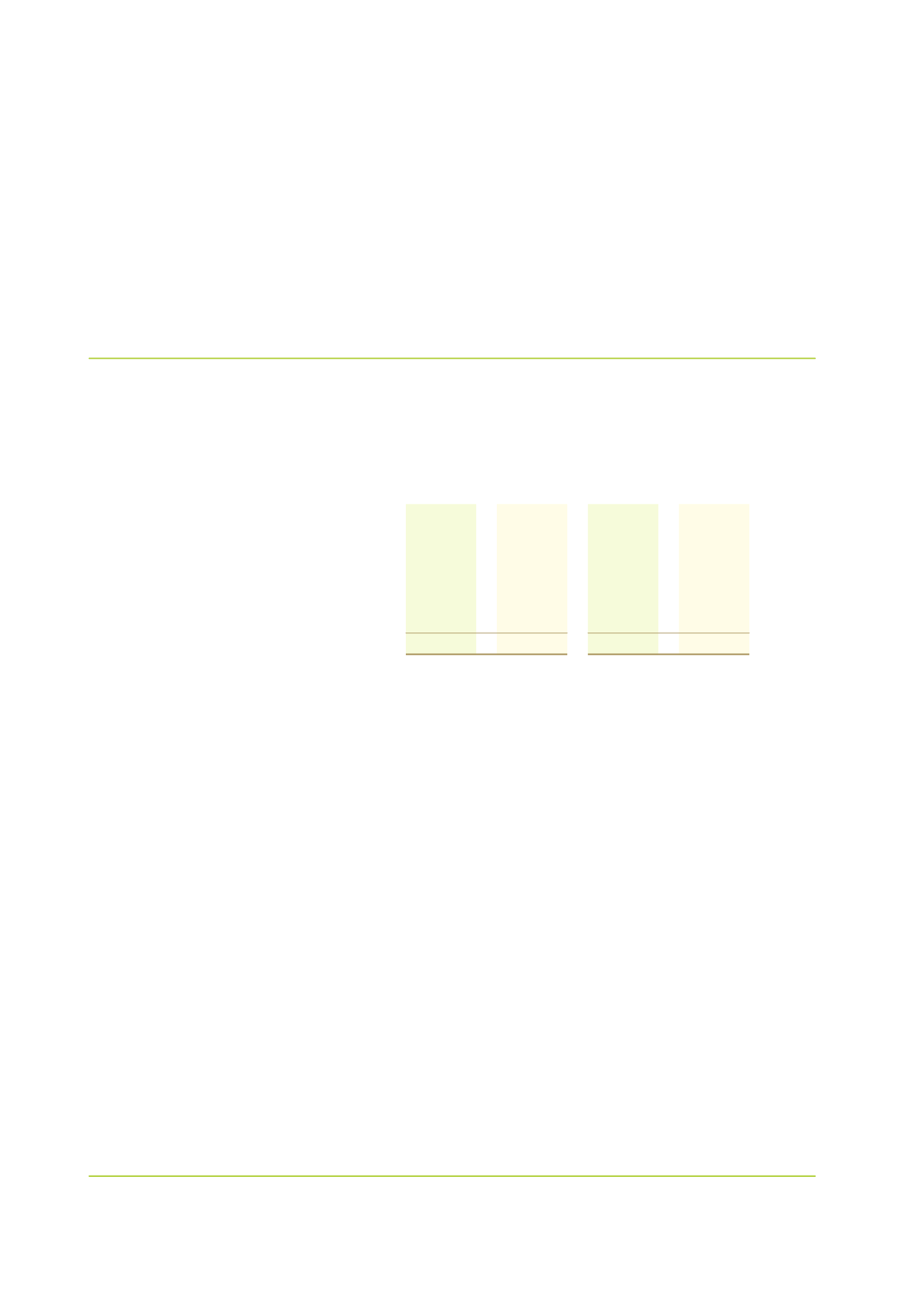

1 9 . i n v e s t men t p r o p e r t i e s

Consolidated

Parent

Notes

2014

2013

2014

2013

$'000

$'000

$'000

$'000

Balance at beginning of year

545,288

504,437

4,177

4,305

Development

11,709

16,785

-

-

Net gain/(loss) from fair value adjustment

8

12,706

21,828

551

(128)

Acquisition from subsidiary

-

-

4,380

-

Transfer (to)/from property, plant and equipment

18 (1,675)

4,862

-

-

Disposals

(3,114)

(2,624)

-

-

Balance at end of year

564,914

545,288

9,108

4,177

Valuation basis of investment properties

Investment property valuations were completed as follows:

D.J. Saunders from Telfer Young (Waikato) Limited valued properties at fair value of $72m and Parent $5.8m on 31 March 2014

(31 March 2013: $69m and Parent: $0.9m) using a mixture of market evidence of transaction prices for similar properties, direct

comparison, capitalisation and discounted cash flow approaches.

T. Arnott from CB Richard Ellis Limited valued properties at fair value of $298m on 31 March 2014 (31 March 2013: $286m)

using a mixture of market evidence of transaction prices for similar properties, capitalisation and discounted cash flow

approaches.

K. Sweetman from Colliers International NZ Limited valued properties at fair value of $80m on 31 March 2014 (31 March 2013:

$75m) using a mixture of market evidence of transaction prices for similar properties, direct comparison, capitalisation and

discounted cash flows approaches.

P.A. Curnow from Curnow Tizard Limited valued properties at fair value of $112m and Parent $3.3m on 31 March 2014 (31

March 2013: $112m and Parent: $3.3m) using a mixture of market evidence of transaction prices for similar properties, direct

comparison, capitalisation and discounted cash flow approaches.

All valuers are independent registered valuers not related to the Parent or Group. All valuers hold recognised and relevant

professional qualifications and have recent experience in the locations and categories of the investment property they

have valued.

Tainui Group Holdings Limited also incurred work in progress, which is held at cost, as at 31 March 2014 of $3m (2013: $3m) in

relation to the property located at The Base.

$9.3m). The total value of other properties valued by Curnow Tizard Limited at 31 March 2014 is $4.7m (2013: $4.6m). The

carrying amount that would have been reported for other properties under the historical cost method is $4.5m (2013: $4.5m).

All valuers are independent registered valuers not related to the Parent or Group. All valuers hold recognised and relevant professional

qualifications and have recent experience in the locations and categories of farm and other properties they have valued.

Hotel assets pledged as security

The ASB Bank and the Bank of New Zealand have security agreements over the assets owned by the Novotel Auckland Airport

hotel and the Hamilton Riverview Hotel Limited respectively, refer to note 23.