88

Waikato Milkings Systems Limited Partnership holds a multi‑currency term loan with the ANZ Bank of New Zealand for $41.1m

(2013: nil) which matures on 24 February 2017 and a revolving cash advance facility of $7.0m for a term of 90 days for which

the Groups share of the available facilities are $13.6m and $2.3m respectively, of which $13.6m and $0.1m had been drawn at

balance date (2013: nil). The ANZ Bank of New Zealand holds a first and preferential security interest over all property owned by

Waikato Milking Sytems Limited.

Tainui Group Holdings Limited and guaranteeing subsidiaries (Tainui Corporation Limited, Tainui Development Limited, TGH No.1

Limited, Raukura Moana Seafoods Limited and The Base Limited) have granted to Westpac New Zealand Limited and Bank of

New Zealand a charge in and over all present and future assets and present and future rights and interest in any asset as security

for the finance facilities.

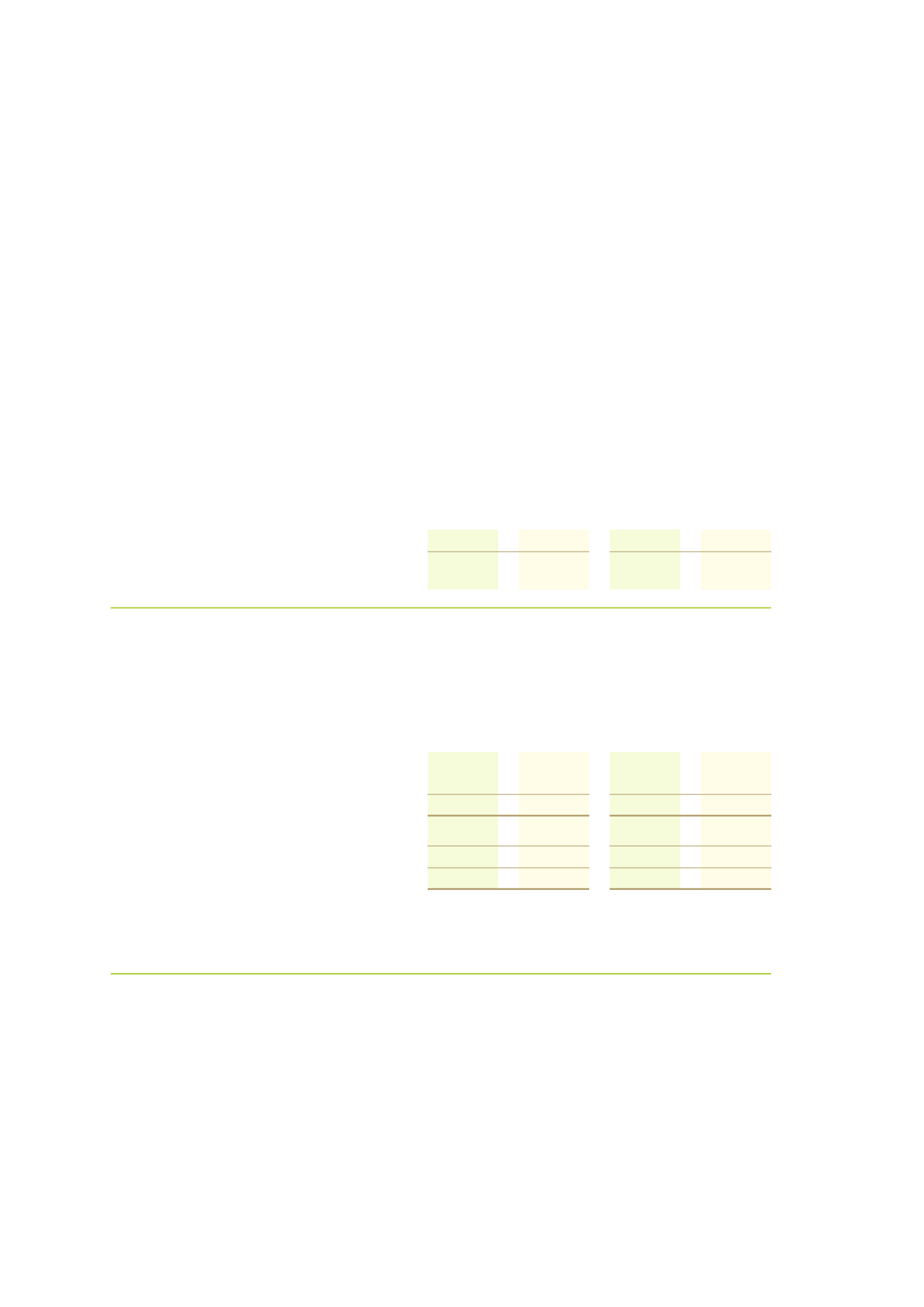

The following borrowing costs were capitalised as components of investment properties:

Consolidated

Parent

2014

2013

2014

2013

$'000

$'000

$'000

$'000

Investment properties

927

722

-

-

Weighted average capitalisation rate on funds

borrowed generally

7.64%

8.20%

-

-

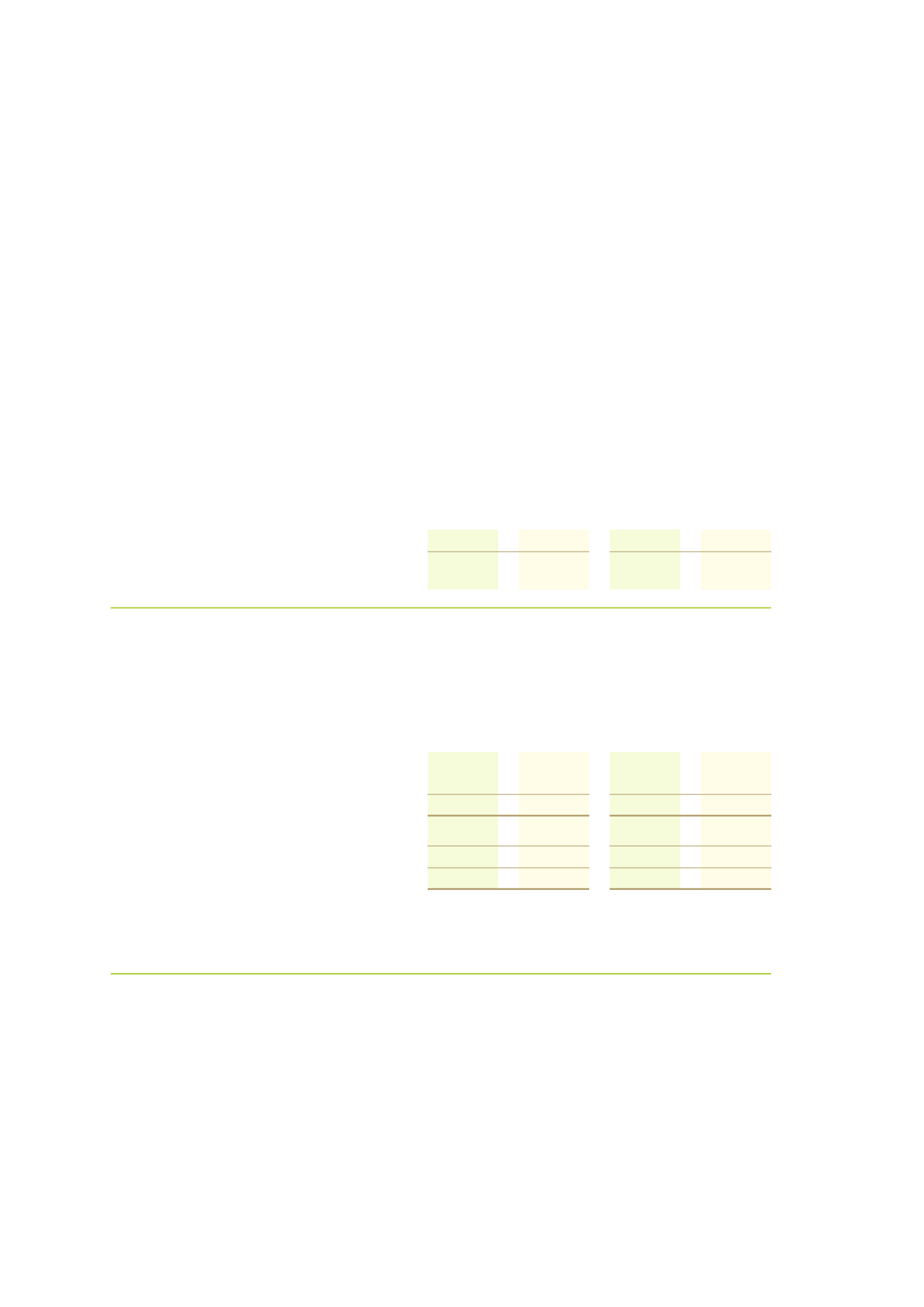

2 4 . o t h e r f i n a n c i a l l i a b i l i t i e s

Consolidated

Parent

2014

2013

2014

2013

$'000

$'000

$'000

$'000

At fair value through profit or loss

Interest rate swaps

1,355

162

-

-

Total current other financial liabilities

1,355

162

-

-

Interest rate swaps

3,693

12,740

-

-

Total non‑current other financial liabilities

3,693

12,740

-

-

5,048

12,902

-

-

The notional amount of interest rate swaps is $144m with maturity dates that range from 1‑8 years (2013: $150m, maturing

between 1‑9 years).

23. Interest bearing liabilites (continued)

waikato raupatu lands trust

notes to the financial statements

f o r t h e y e a r e n d e d 3 1 m a r c h 2 0 1 4