In the 20th year since the

Raupatu settlement agreement

between Waikato-Tainui and the

Crown, it is pleasing to report

another year of solid results from

the commercial assets of the

tribe. During the year TGH has

also taken early steps to build

on its foundations as a property

investor by moving into a broader

spread of active investments in

high-returning businesses.

TGH has also invested in its team

to support a more diversified

future and notched up the re-

zoning of our land holding at

Ruakura. This has resulted in

considerable gains in the value

of this strategic land holding.

The continuing push to diversify

investments over the year ahead

will support the objectives of

Waikato-Tainui Whakatupuranga

2050. It will enable TGH to

generate more cash, more

employment opportunities

and to grow the tribal estate by

investing in the primary sector.

Winning the Aotearoa New

Zealand Maori Business

Leadership Award for

outstanding business has

highlighted the pioneering

role of Waikato-Tainui as the

first major iwi to settle with

the Crown in 1995 and its

efforts since to grow the tribe’s

wealth. As we look ahead, our

diversification strategy is our

springboard for the future.

The steps now underway will

determine the success of TGH

as an inter-generational investor,

not just in the immediate term,

but right through to 2050.

TE RAARANGA TAHUNA

Financial performance

TGH and Waikato-Tainui

Fisheries (WTF) made sound

financial progress during the

2015 year. The two companies

achieved a combined net

operating profit of $35.6 million.

Revenue increased 19% to

$82.1 million. A key contributor

to this movement was the

consolidation of Hamilton

Riverview Hotel Limited’s full

year’s performance as we

purchased Accor Hotels’ shares

s i r henry van der he yden and chr i s jobl in

TE PUURONGO AA TAINUI

GROUP HOLDINGS

In the 2015 financial year Tainui Group Holdings (TGH)

achieved solid financial progress. It also took the next

steps as a kaitiaki of the economic wealth of the tribe’s

67,000 members - by moving towards a more diversified

basket of investments so the tribe does not have ‘all its

eggs in one kete’.

20

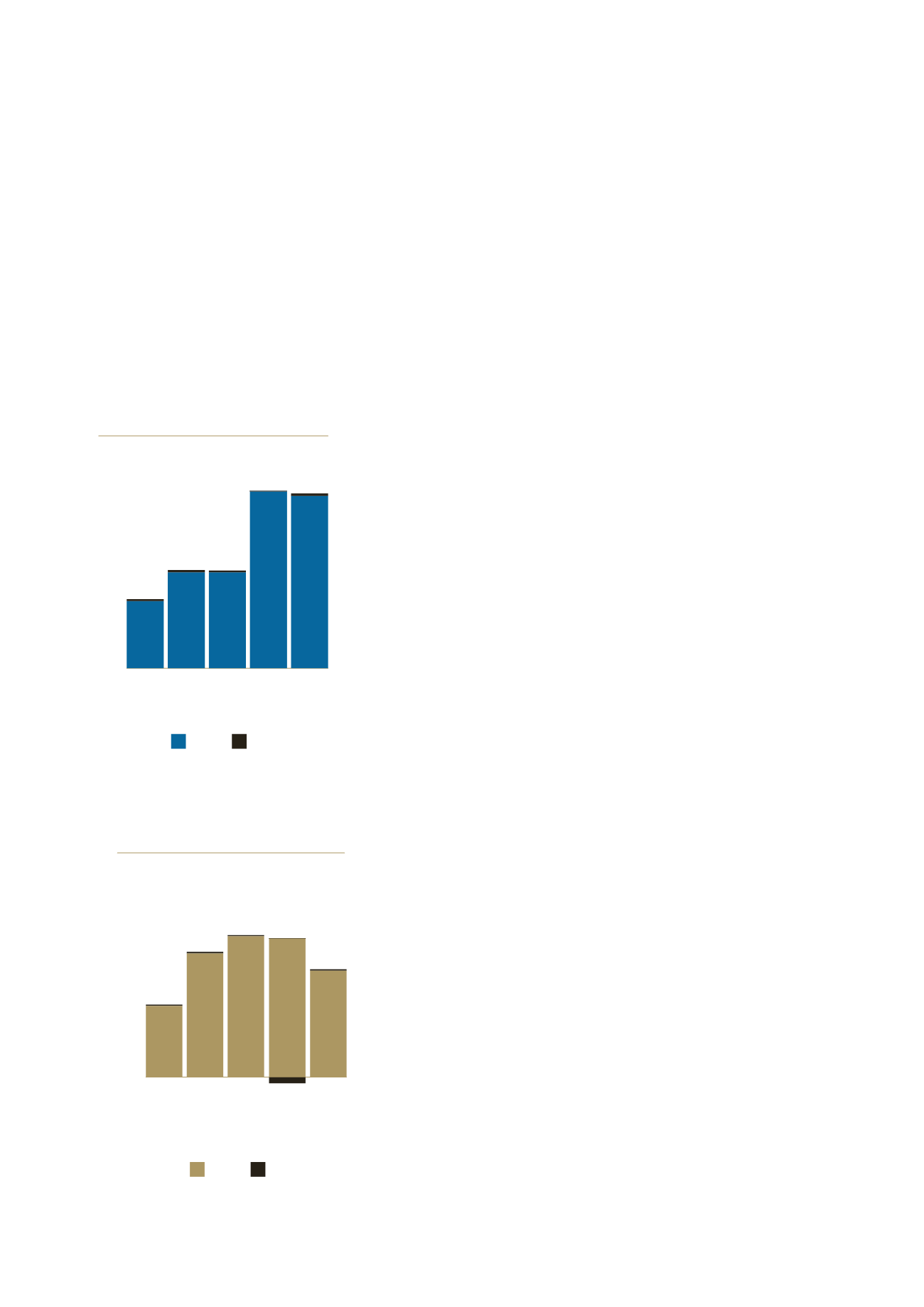

0.4

0

10

30

40

50

2011

$m net profit/(loss) - tgh + wtf

20

20

2012 2013 2014 2015

TGH WTF

-10

23

39

45

44

34

0.5

0.4

0.5

(2.4)

0

5

10

20

25

30

35

40

2011

$m net oper ating profit - tgh + wtf

15

2012 2013 2014 2015

TGH WTF

14

20

20

37

35

$m

0.4

0.5

0.4

0

0.5

14