As at 31 March the value of combined total

assets was $876 million, up $53 million from the

same time last year. This reflects the diversified

investments in Genesis Energy and Go Bus.

The return on equity was 6%, down from 8% in

2014. This result was influenced by unrealised

investment property gains which were not

repeated at the prior year’s levels.

Total debt currently represents 31% of total assets,

which compared to 26% last year. However, total

bank debt excluding the hotels is $224 million

or 26% of total assets. TGH’s policy is that debt

(excluding the hotels) cannot exceed more

than 30%.

NGEETEHI ATU MAHI

Covering Other Bases

After 15 years of investing primarily in property,

this year saw a shift in focus towards investing in

medium-to-large private businesses that have a

strong local presence and potential for significant

growth.

TGH’s purchase of a 33% stake in Waikato Milking

Systems (WMS) in March 2014 in partnership with

Ngaai Tahu and Pioneer Capital was an early

example of this diversification strategy in action.

WMS is a proven, fast-growing business serving

the dairying sector with a range of technology

solutions bringing greater productivity to the

milking sheds of both New Zealand and

the world.

When the Government floated 49 per cent of

Genesis Energy in April 2014, TGH purchased

5.4 million shares and the share price performed

strongly through to financial year’s end. Genesis

Energy has long standing roots in the Waikato and

a close relationship with Waikato-Tainui through its

ground lease on the Huntly power station and the

former Meremere power station.

FREEING UP CAPITAL

FROM EXISTING BUILDING

DEVELOPMENTS

WILL

CONTINUE TO BE A FOCUS IN

THE YEAR AHEAD.

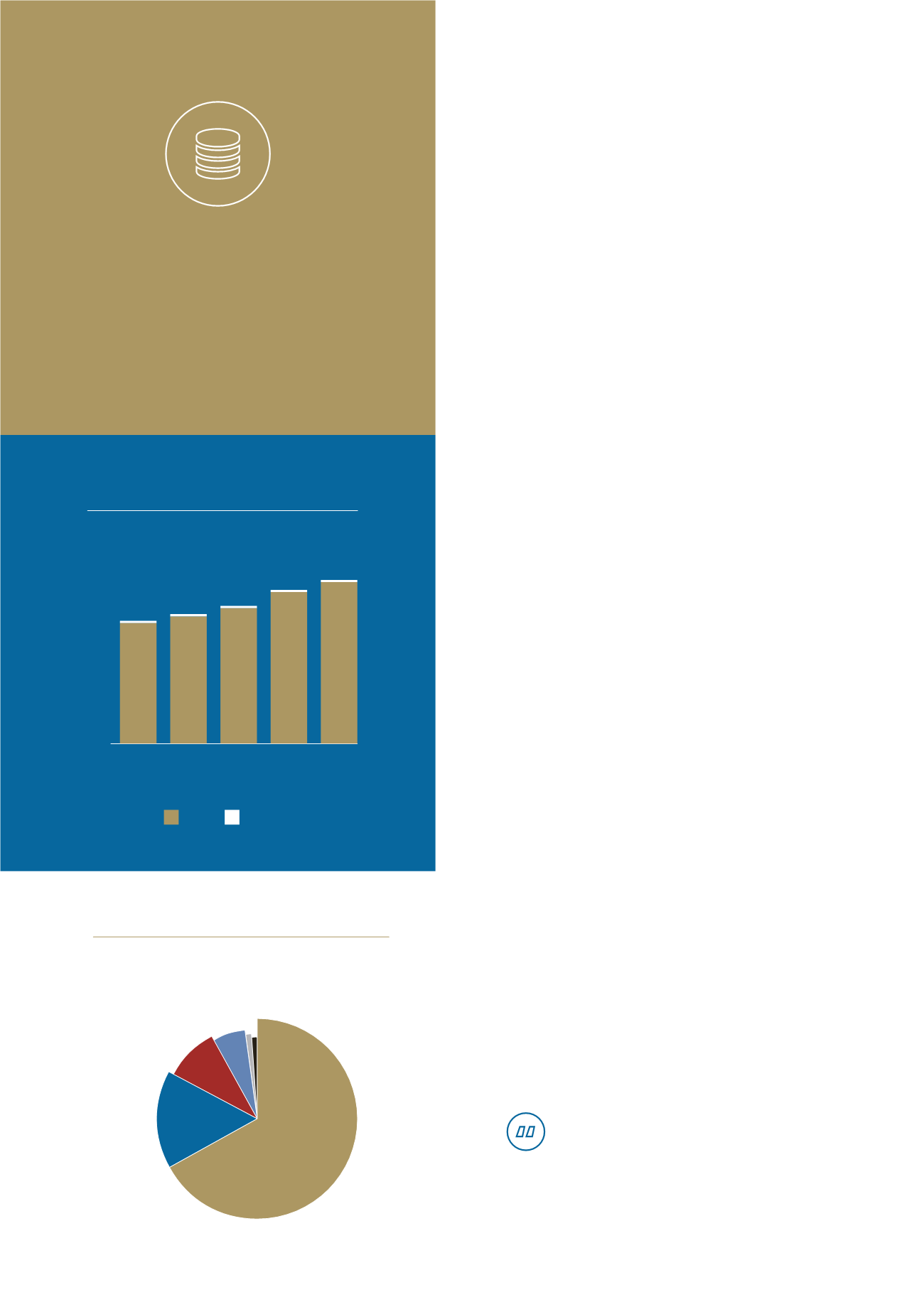

Property

67%

16%

Fixed Income

(Lease of Land

– Ground Leases)

9%

Primary Industries

(Farms and Fishing)

6%

Direct Investments

(WMS and Go Bus)

1%

Cash

1%

Equities

(Shares)

portfolio asset allocation - tgh and wtf

0

300

500

600

800

900

1,000

2011

total assets - tgh + wtf

400

2012 2013 2014 2015

TGH

WTF

14

20

700

200

100

812

865

725

680

645

13

14

13

11

11

$m

total assets 2015

As at 31 March the value of total assets was

$876 million, up $53 million from the same

time last year. This reflects the diversified

investments in Genesis Energy and GoBus.

16