Tainui Group Holdings

Annual Report

2013

9

This is my first

report as Chairman

of Tainui Group

Holdings. I accepted

the position because

I am a firm believer

in the increasingly

important role

Maaoridom will play

in our economy. It’s

my hope that Waikato-

Tainui will take a

leadership role.

For iwi-owned companies, their first

responsibility is to pay dividends from

their profits. But as retained earnings

and debt are their only sources of

capital, theymust reinvest some of

their profit each year to increase the

value of their assets, which they can in

turn borrow against.

Over recent years TGH has created a

solid core of investment properties that

generate a reliable cash flow, among

them

,

and the

They are however, stages in amuch

longer journey. If we are tomake a real

difference for themore than 64,000

people ofWaikato-Tainui, TGHmust

have an asset base capable of delivering

much higher returns to its Shareholder.

Our dividend this year is equivalent

to only $180 per person. Our Ruakura

development is vital to get to that next

stage where we increase our returns,

but it will not be an overnight process.

2013 financial results

Taking into account subdued economic

growth, TGH andWTF performed

well in 2013. Their combined net

operating profit was steady at $20.8

million, a marginal increase on 2012.

The net profit for TGH andWTF

was $45.1million, up 13% from$39.9

million last year. This came on the back

of a 13% increase in revenue, principally

reflecting good trading conditions at

the

.

TGH andWTF together paid a

dividend to the Shareholder of $11.5

million, up $0.5 million from 2012.

The value of total assets at 31 March

increased by $44million, to $738

million.

Our Shareholder converted its $70

million loan, on the books since the

settlement assets first transferred

to TGH, to equity. This has given an

extra $70million of permanent capital,

which now stands at $490million. As a

result, the return on Shareholder funds

reduced from 10.3% to 9.2%.

Total bank debt (excluding

sits at $161 million,

with approved but unused facilities of

$89 million. Total debt represents 25%

of total assets, in line with our policy

that debt cannot represent more than

30% of total assets.

New investment strategy

TGHhas embarked on a diversification

strategy. While the majority of our

assets remain in property, and will

continue to do so, TGH’s strategy

will see us diversifying into other

investment sectors.

There is good reason for this. The

company is charged with achieving

a return on the commercial assets of

If we are to make

a real difference

for the more than

64,000 people of

Waikato-Tainui,

TGH must have an

asset base capable

of delivering much

higher returns to its

shareholder.

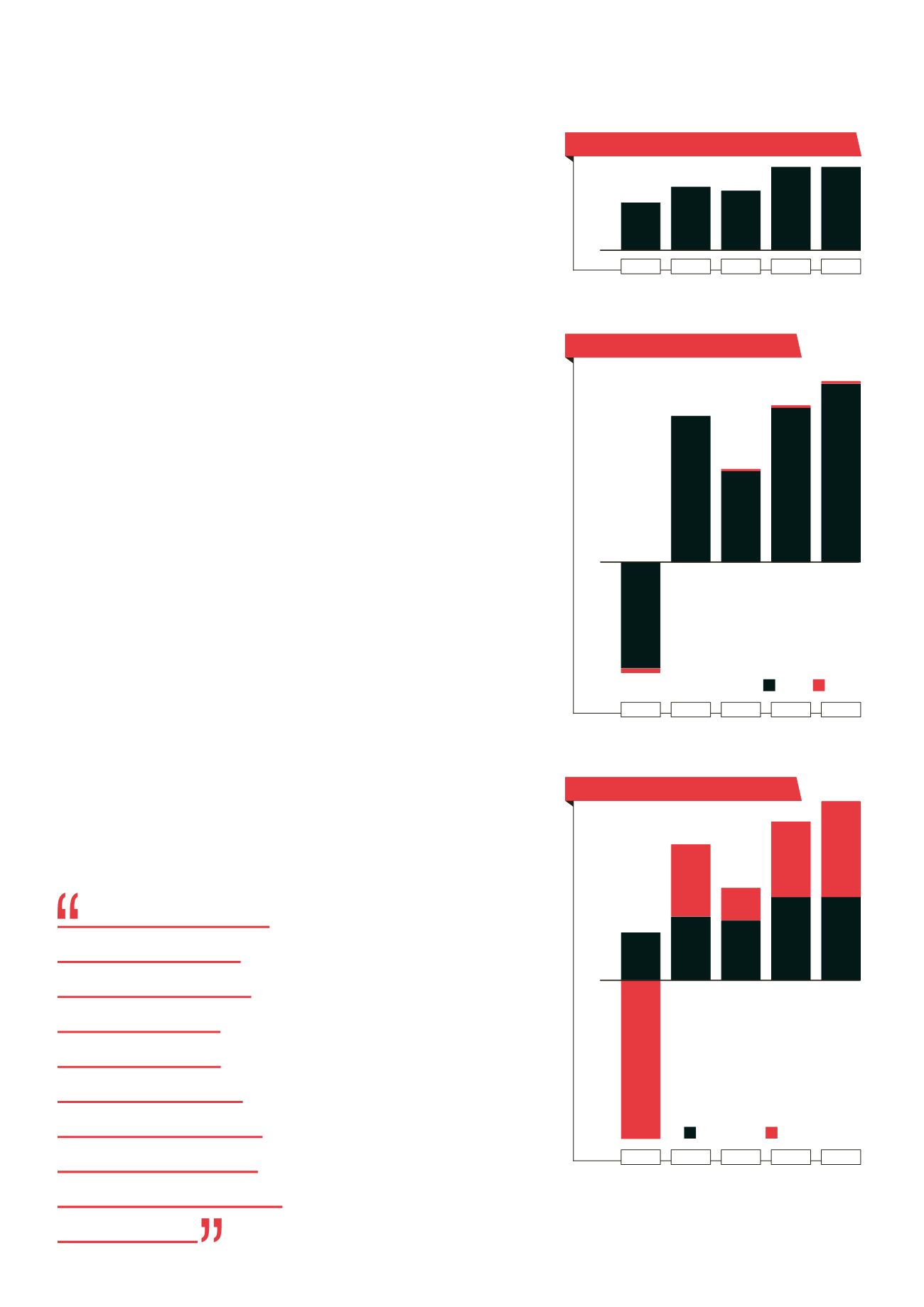

(27)

34

0.4

0.5

0.4

23

39

(1)

WTFL

TGH

2009 2010 2011 2012 2013

45

Net profit after minority interest

TGH & WTFL

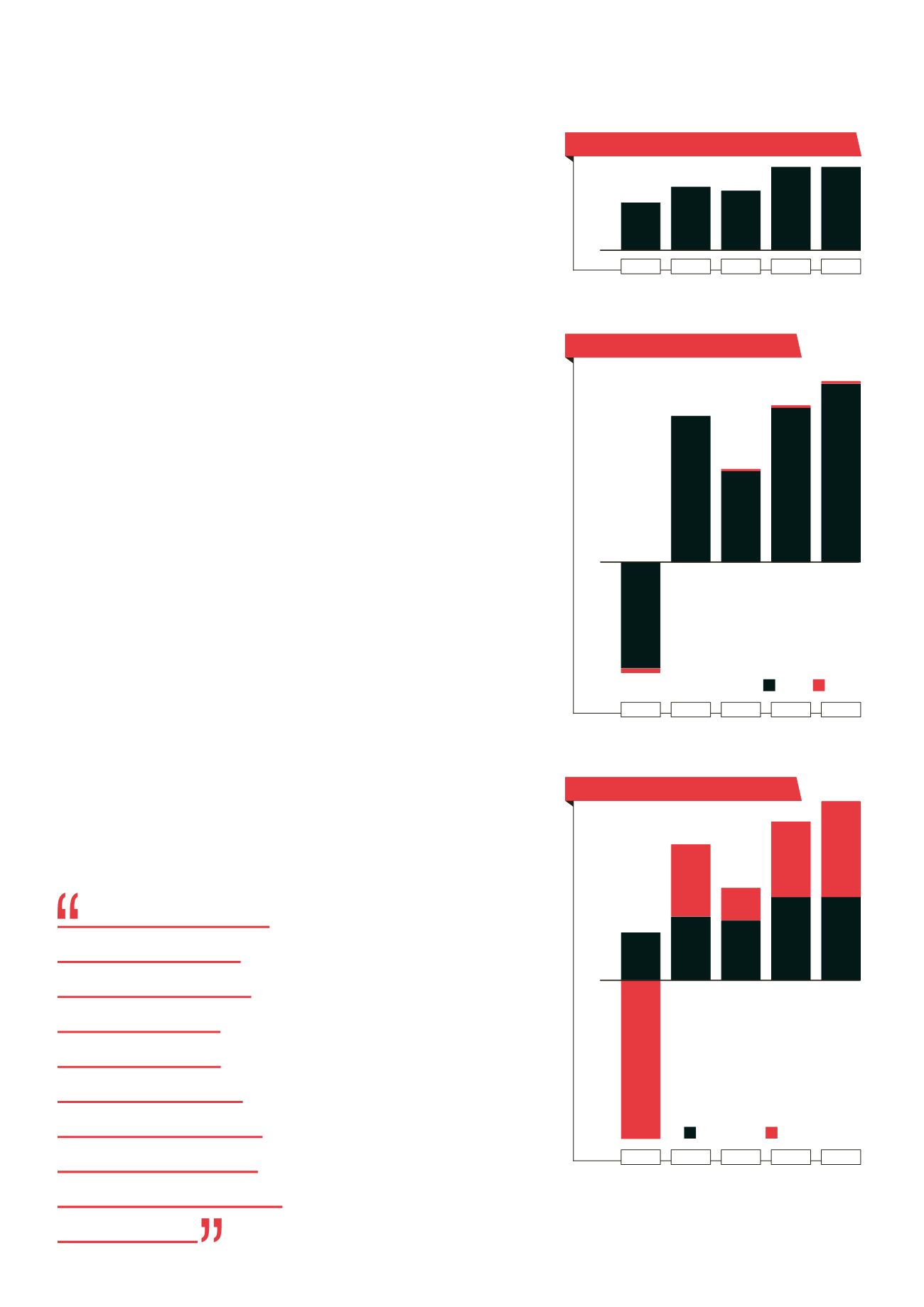

Net operating profit after minority interest

12

16 15

21 21

TGH & WTFL

2009 2010 2011 2012 2013

$M

0

$M

0

NON-TRADING

TRADING

2009 2010 2011 2012 2013

12

18

16 15

8

19

21 21

(40)

24

Net profit after minority interest

TGH & WTFL

$M

0