10

Waikato-Tainui. These aremostly land

holdings, restored after the tribe’s 1995

settlement with the Crown. However,

it takesmany years to develop an

investment property before we earn any

revenue from it, and a large percentage

of the capital neededmust be borrowed.

At

, for example, we have

consents for the balance of the site

and we will carefully develop as

market demand and returns on

capital warrant further expansion.

Other potential property investments

are viewed similarly. Over the

medium termwe do not want to

affect our ability to pay an increasing

Shareholder dividend. We have

therefore decided to use the freed-

up cash to pursue a higher yielding

investment strategy.

There will be two parts to this new

approach.

The first is to identify property

development opportunities, selling

rather than retaining the investment

for the long term. We recognise

however that there could be lengthy

timeframes between development

concepts, locating the land, rezoning,

resource consenting, tenanting,

building and then exiting.

So the second is to invest in one ormore

medium to large private businesses

where the owner(s) are looking for fresh

equity, and where there is potential for

TGH to receive good cash flows after a

relatively short time. We will aim for

a few large stakes rather thanmany

smaller ones, and add value through our

governance andmanagement expertise.

This new investment strategy builds

on the fact that we still have capacity

as well as a strong, reliable earnings

stream. We also have the ability to

take onmore risk. We can accept a

maximumvolatility in earnings of

10% in any one year, and our current

rate is 7%. Together these factors

give us, our Shareholder, and the

investment community the confidence

that this new strategy is sound and

that we can continue to grow.

It also means we have now set a much

higher earnings threshold for all our

future property-based investments.

Tribal engagement

Ultimately what TGH does has to be

for the benefit of tribal members. To

achieve higher returns, without taking

undue risk, takes time, and for many

tribal members the wait is frustrating.

While in recent years the company has

reported regularly to its Shareholder,

it is fair to say that its main focus has

been on getting TGH operating well.

While the company has developed

its experience and expertise over the

last decade, it has beenmuch harder

on the Shareholder side to afford the

structures, training and resources

needed to execute tribal plans.

The result is that the combined people,

assets and resources of the tribe and its

commercial armhave been not been

consistently aligned.

If TGHwants to be a part ofWaikato-

Tainui, and reach the goal of delivering

amuch higher sustainable dividend, it

needs to engagemuchmore deeplywith

all the stakeholders ofWaikato-Tainui.

We need to take a holistic view and

have a much better understanding of

mutual expectations. We have made an

intensive effort over the last 12 months

to engage with the entire tribe, but this

is only the start of a process.

This new

investment

strategy builds on

the fact that we

still have capacity

as well as a strong,

reliable earnings

stream.

While the

majority of our

assets remain in

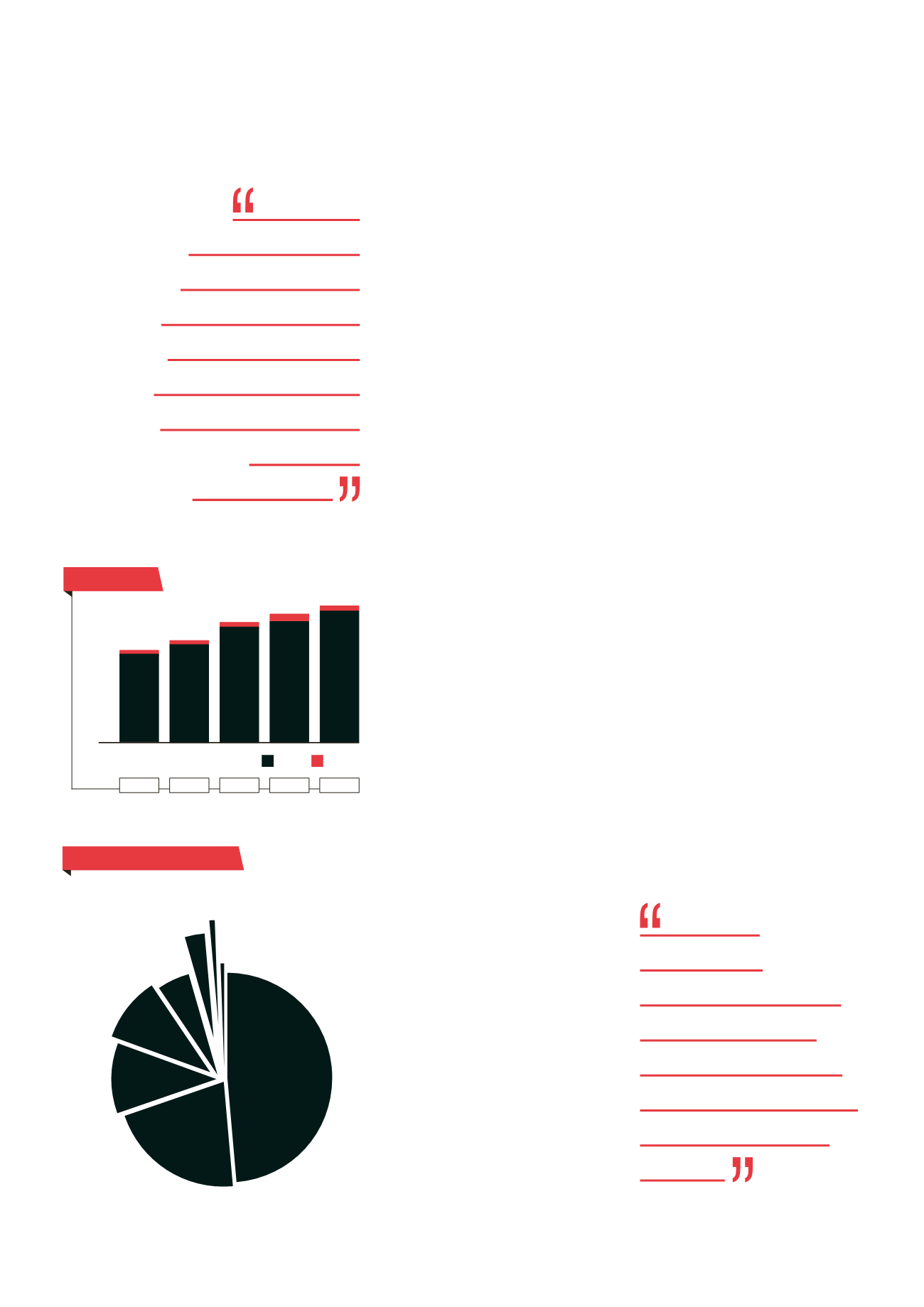

property, and will

continue to do so,

TGH’s strategy will

see us diversifying

into other

investments.

49%

Commercial

properties

21%

Crown

properties

11%

Rural

properties

10%

Hotels

5%

Fishing

2.7%

Agriculture

1%

Private equity

0.3%

Development properties

portfolio value by sector

TGH & WTFL

WTFL

TGH

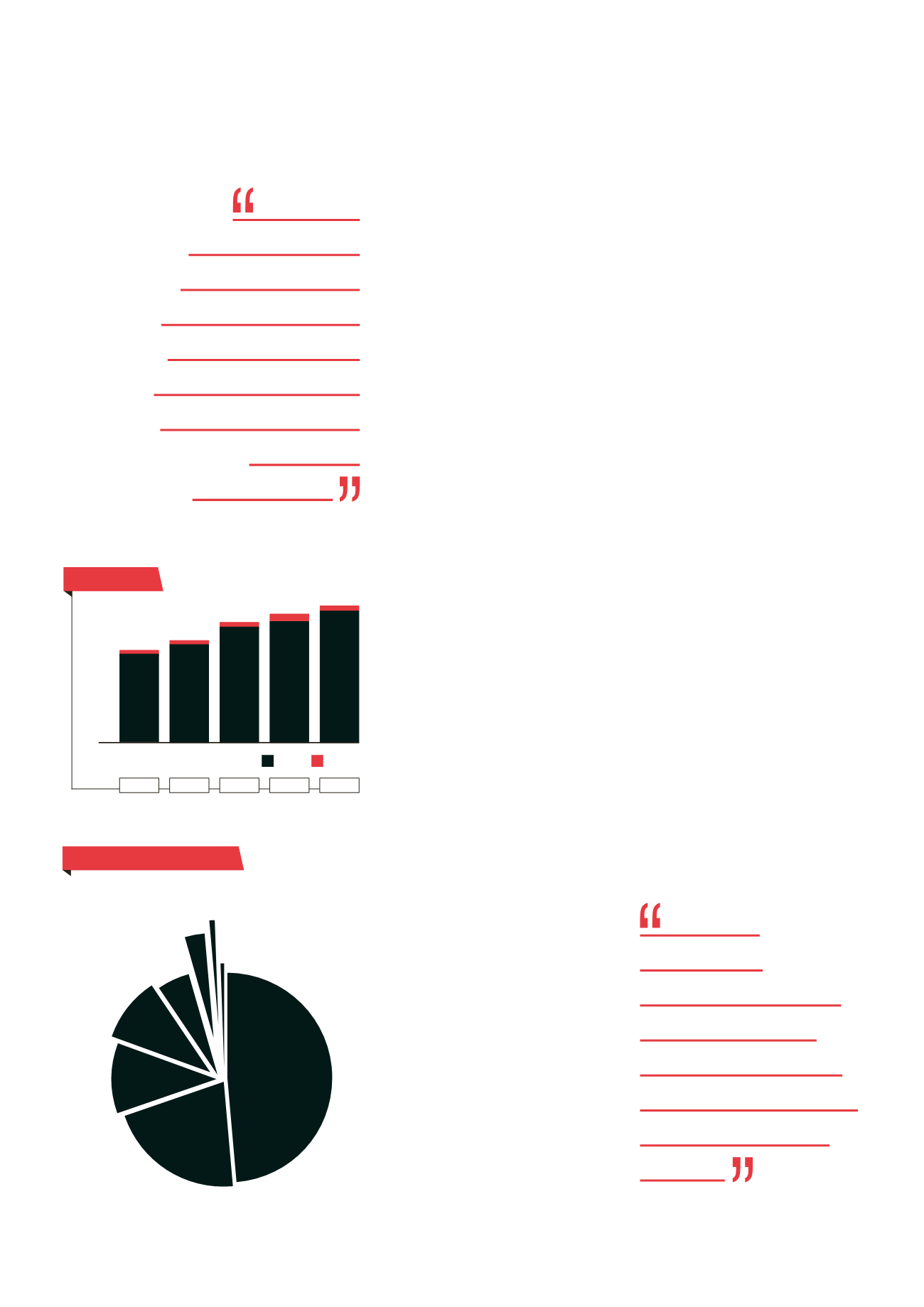

2009 2010 2011 2012 2013

total assets

TGH & WTFL

484 516

645 680 725

14 13

13

13

13

$M

0