18

Portfolio

management

Cash Flows

Managing cash flows is crucial to

TGH. They are reported on and

managed weekly. The ability to do this

successfully has a cascading effect on

the timing of debt draw downs, and

therefore interest rate exposure. As a

high proportion of income is derived

fromproperty rental, cash inflows

are regular with very little deviation.

Cash outflows may spike according

to the various development projects

requiring funding, but otherwise

operating outflows also remain at

consistent levels.

Sustainability and quality of cash

flows are essential components of

TGH’s business. Theymust withstand

market fluctuations, and service

not only operating costs but also the

dividend to our Shareholder and debt

requirements.

Through its tenancy profile, TGH

is provided with stable, long-term,

high quality tenants such as Genesis,

Waikato Institute of Technology,

University of Waikato, Kiwi Income

Property Trust and Crown agencies. In

2013, these tenants generated the bulk

of investment property cash inflow,

comprising 23% of total rental revenue,

down from 29% in 2012.

TGH’s rental cash flows are now

predominantly from retail tenants at

. TGH’s increased exposure

to the retail sector prompts a hands-

on approach to tenant relationship

managemesant and debt collection.

A careful and considered approach

is applied to property development.

Before any property development is

approved, its feasibility is analysed

to ensure that the project’s cash flows

meet internally developed risk-

adjusted hurdle rates.

The most significant development

undertaken in TGH’s history was

the construction of

at

. The development was broken

into multiple stages, so TGH received

rental revenue as each stage was

completed, allowing debt to be serviced

accordingly. Before commencing each

stage, a committed leasing threshold

also had to be met to provide surety of

cash inflows. The approach taken there

will also be applied to future property

developments. Another significant

development was the construction of

the

Built

during the global financial crisis,

with demand for construction at a low

point, the pricing was competitive.

Economic Value Added and

Sector Reporting

TGH’s market is as wide and varied as

the business TGH operates. However,

the nature of the core business placed

TGH in the investment property sector

in 2013 (This is set to change from

2014 as outlined in the Chairman

and CEO’s reports). Largely based in

Waikato, TGH owns a significant

footprint in the Hamilton area where

competitors are commercial landlords,

retail operators and residential and

commercial property developers.

TGH periodically compares its

performance to market benchmarks

to assess returns on investments.

The balance sheet consists mostly of

tangible assets that are reported at

market value, and so an Economic

Value Added (EVA) analysis is suited

to TGH’s business. Unlikemost

property companies however, TGH

is compelled to hold significant

parcels of strategic undeveloped land

that have considerable value. There

are also parcels of land that are of

significance toWaikato-Tainui which

cannot be sold and whose returns

would otherwise be considered low

by comparison to sector benchmarks.

This has the inevitable impact of

eroding traditional performance

metrics such as return on assets (ROA)

and return on equity (ROE).

TGH has evolved its EVA reporting to

187

2013

Key

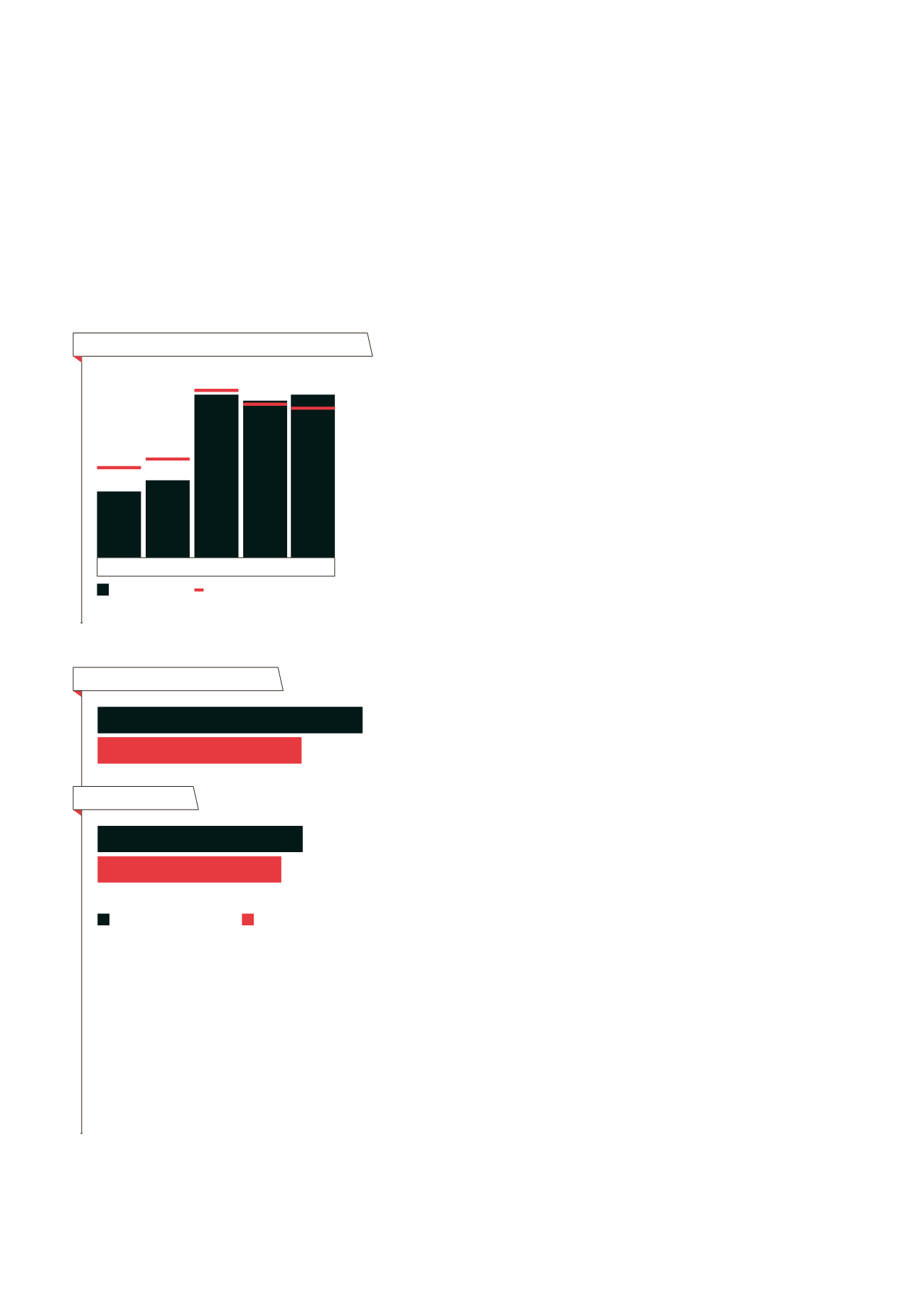

Covenant:

Covenants are the financial measures

which TGH must abide by under the terms of the

bank debt facilities and only apply to the entities

within the Group that have provided guarantees.

Interest cover ratio covenant:

Interest cover

ratio calculates the number of times the profit

(before interest cost) exceeds interest costs.

The ratio must be more than two times.

Gearing percentage covenant:

The gearing

percentage covenant is the equity as a

percentage of the total tangible assets.

2.0

67%

60%

Minimum Covenant

March 2013 Covenant

Quasi equity as a % of total tangible assets

Operational

review

Interest cover position (ratio)

Gearing position

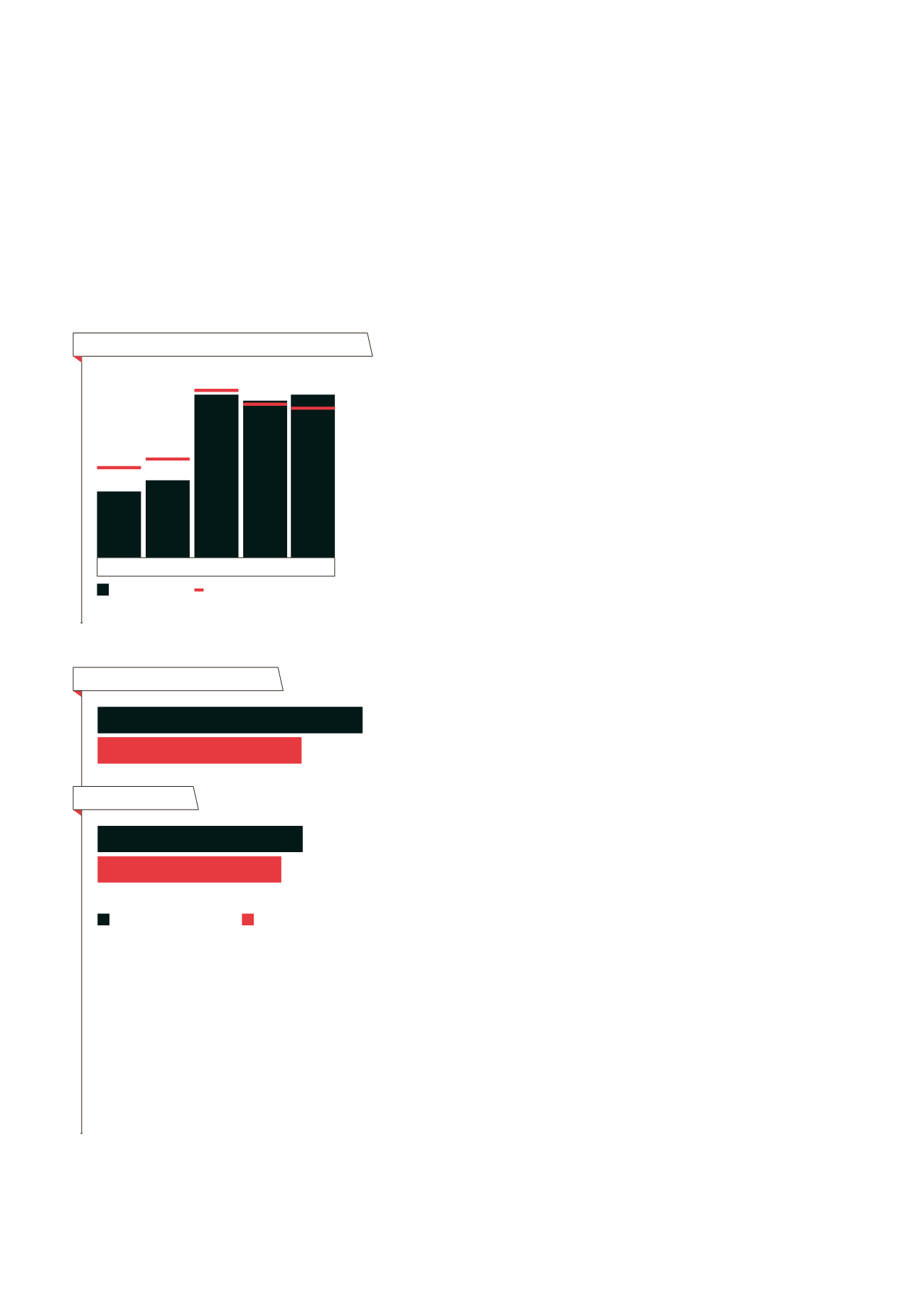

Interest bearing liabilities (bank debt) - tgh

75

2009

88

2010

187

2011

180

2012

Bank debt

Debt to total assets gearing

15.5% 17.0%

28.9%

26.5% 25.8%

Maximum gearing = 30% debt: total assets

2.6

2013

187