24

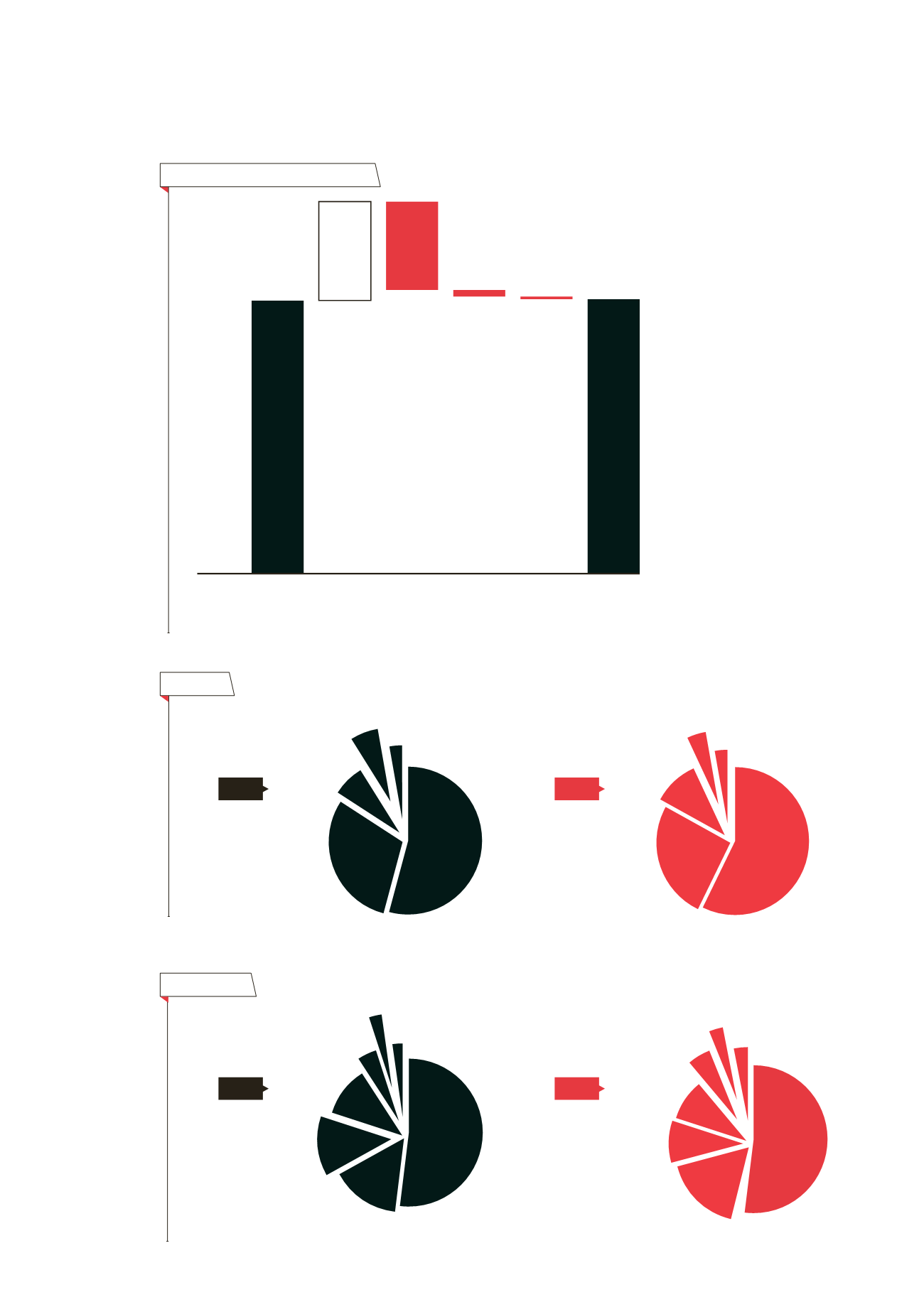

Net operating profit movement

Net

operating

profit

2012

Income

Expenses Net

finance

Share of

associates

profit

Net

operating

profit

2013

$M

20.7

(6.7)

(0.5)

(0.2)

20.8

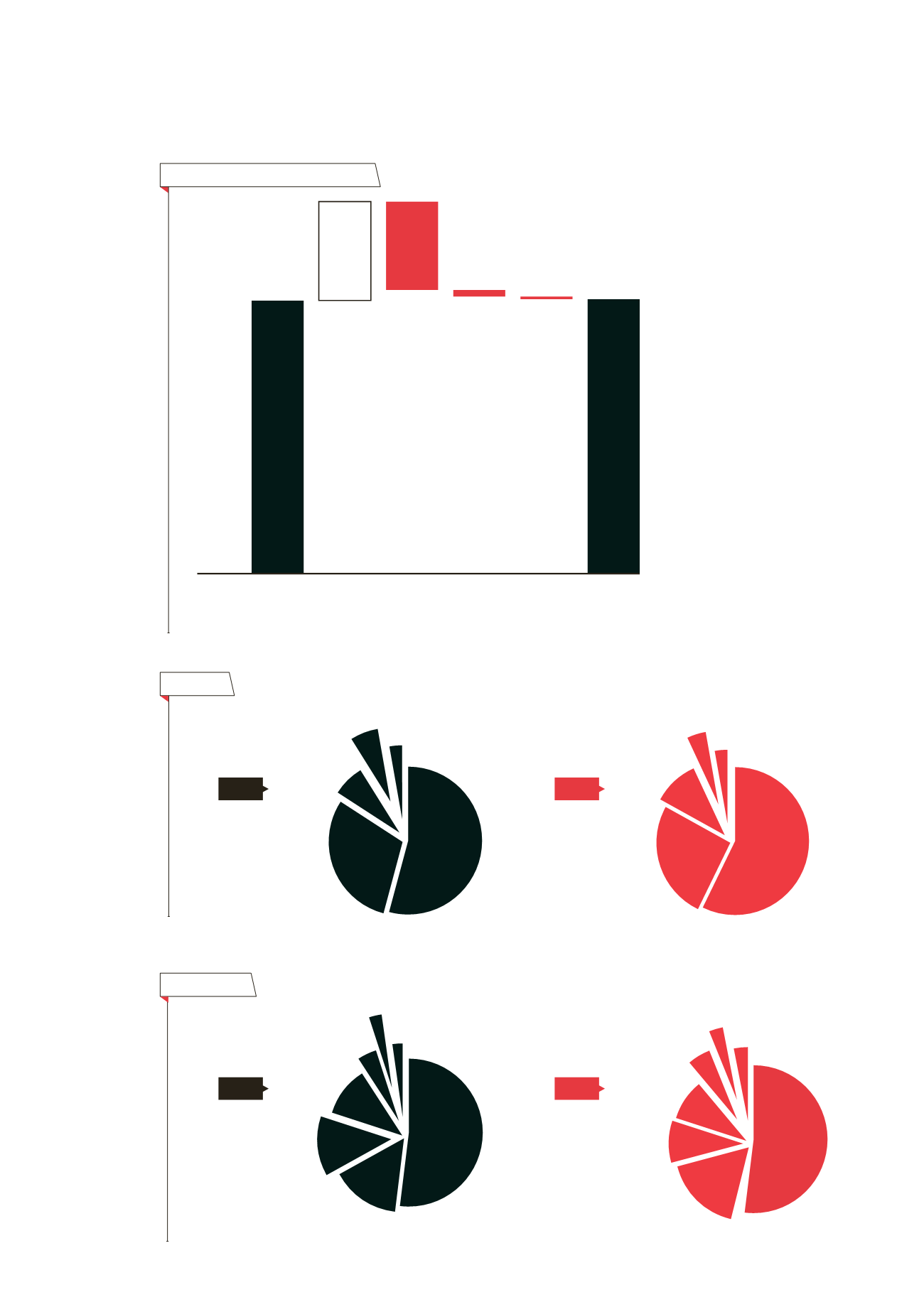

Revenue

Expenditure

3%

Quota leasing

54%

Rental

30%

Hotel

7%

Other

6%

Sale of sections

3%

Quota leasing

57%

Rental

26%

Hotel

10%

Other

4%

Sale of sections

2013

2013

2012

2012

Key:

The white bar represents

increases in income in 2013

which is offset by the red bars,

representing increases in costs.

The net result of the white

and red bars will provide the

movement between 2012 and

2013 net operating profit.

7.5

0

15%

Employee costs

13%

Other

11%

Rental

4%

Sale of sections

3%

Cost

of sales

2%

Depreciation and

amortisation

52%

Hotel

54%

Hotel

17%

Employee costs

9%

Other

9%

Rental

5%

Sale of sections

3%

Cost

of sales

3%

Depreciation and

amortisation

Total

$62.7m

Total

$28.8m

Total

$22.0m

Total

$55.3m

financial

Overview