20

Investment Properties

TGH’s investment properties comprise

79% (2012

:

78%) of the company’s total

assets. In 2013, they out-performed the

listed property sector average in terms of

growth in both value and cash, despite a

relatively flatmarket over the past year.

Ahigh proportion of Crown tenants

with good quality covenants, long term

leases provide a significant contribution

to both rental revenue and capital

growth. Ground leases provide further

stability as tenants have a shared

interest in retaining their tenancies

and renewing beyond the initial lease

expiry date. Our property values

have been boosted by the statutory

planning progress at Ruakura. The

retail sector also contributed to growth

due to tenant mix improvements,

retail sales increases, infrastructural

improvements made to support the

existing retail and planned expansion.

The values of all other property sectors

have remained relatively static.

Acquisitions and Disposals

TGH continually reviews its property

portfolio to ensure that all its

investments are providing appropriate

returns. While a number of acquisition

opportunities were presented in

2013, there were only two properties

that were purchased. Both were at

Rotokauri, and were acquired for

added residential development. Three

properties were disposed of during

the year. Two properties in Hamilton,

located in Hill Street and Queens

Avenue, were considered uneconomic

to retain or develop. The third

property sold was part of the former

Hort Research block at Pukekohe,

which also proved difficult to develop

and low yielding. In total, 7.43 hectares

were purchased and 5.94 hectares sold

during 2013.

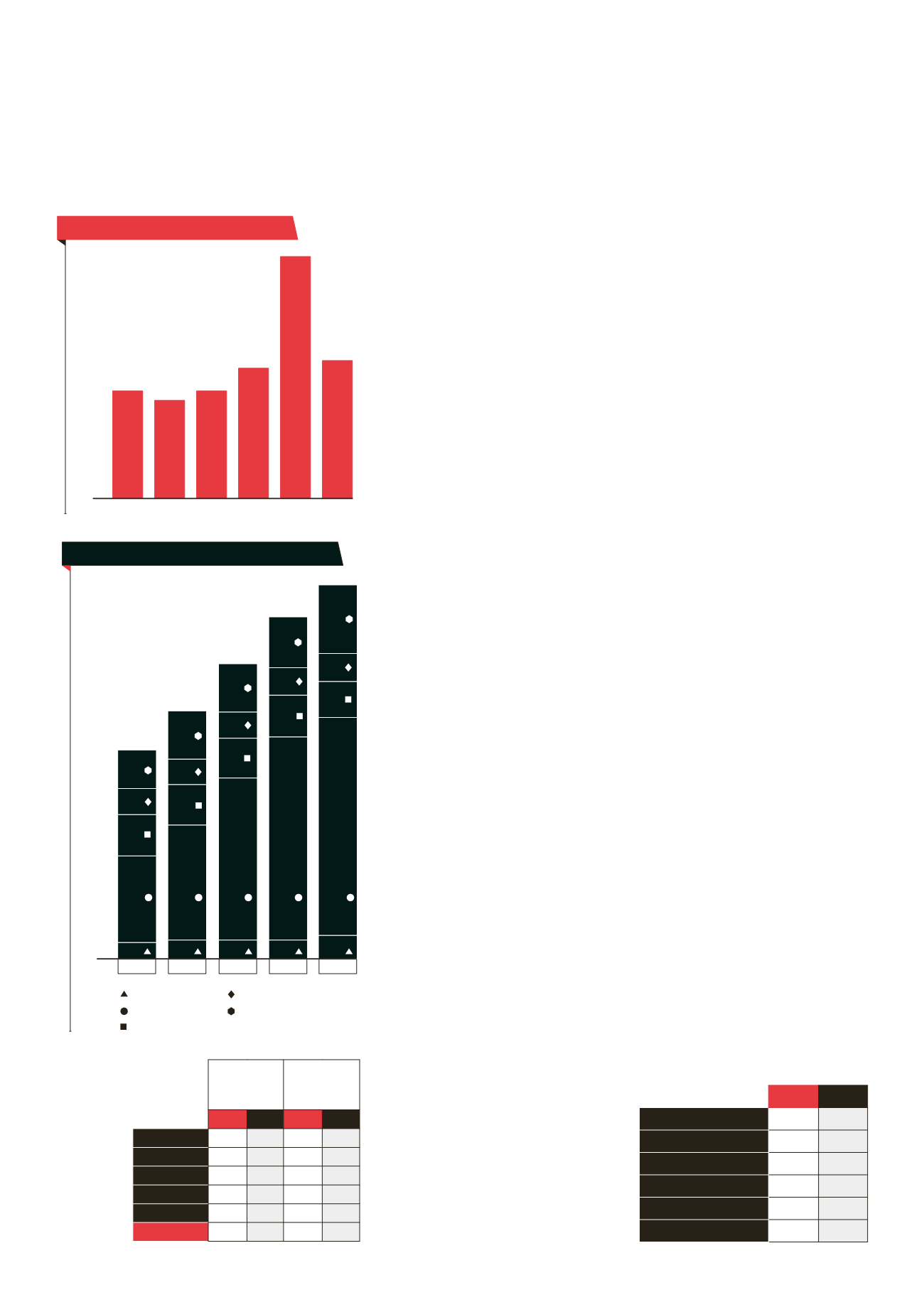

Weighted average lease term - tgh

Years

0

5.7 5.2 5.7

6.9

12.8

7.3

Rural

Office Retail Industrial Public Portfolio

2009 2010 2011 2012 2013

Investment property porfolio value - tgh

$M

0

133 176 248 311 334

63

62

61

64

55

25 29 29 29 36

40

39

40

42

43

59

74

74

78

105

Office/comercial

Retail

Public sector

Industrial

Rural/industry

Investment and

Management

135 rent reviews were completed during

the financial year which resulted in

additional revenue of $1.2 million,

providing an uplift of 4.4% over prior

rentals. Total occupancy for 2013 was

99% (2012

:

98%) at year end. Occupancy

was maintained at high levels

throughout the year as industrial and

retail vacancies were filled.

Profile

is New Zealand’s first super

regional shopping centre due to its

scale, the diversity of its retail offering

and high number of anchor tenants.

Consequently it draws a significant

proportion of its patronage from

regional areas, in addition to Hamilton

City, enhanced by excellent customer

access with the network of major

arterial roads connecting to

continues to be the country’s

largest retail development comprising

large format retail (LFR), food and

hospitality, a large DIY offer, an outlet

centre and an enclosed specialty

retail shopping mall which includes a

cinema complex.

During the year a further 18

tenants signed lease agreements and

commenced trading at

including 12 new tenants in

,

3 new LFR tenants and 2 tenants that

were relocated. In total

has

190 tenants, 109 in

and 31

outlet tenants (such as DressSmart) and

50 LFR tenants.

Akey strength of

continues to

be customer car parking, roading layout

and car-parkingmanagement system.

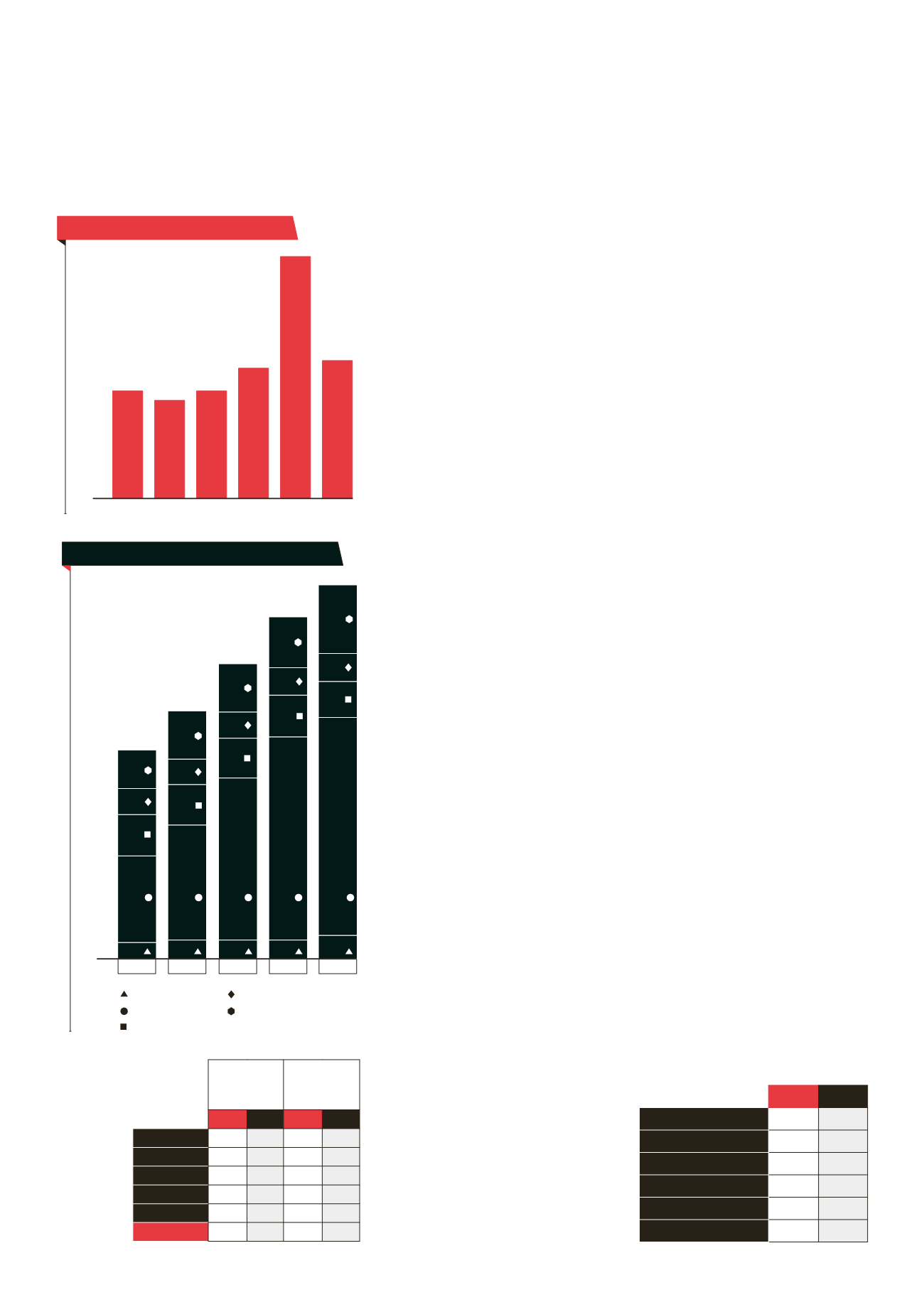

Investment

property

portfolio

summary

Property

asset value

($million)

Occupancy

(%)

2013 2012 2013 2012

Retail

334 311 99 100

Rural

105 78 100 100

Public

55 64 98 95

Industrial

43 42 100 100

Office

36 34 96 94

Total

573 528 99 98

2013 2012

Net lettable area (sqm)

82,622 81,171

Number of tenancies

190

180

Occupancy

99% 99%

Carparks

3,479 2,860

Pedestrian count

7.5m 7.1m

Vehicle count

3.9m 3.6m

Key statistics

The Base